Form 8606: The Essential Guide to Reporting IRA Contributions and Conversions in 2025

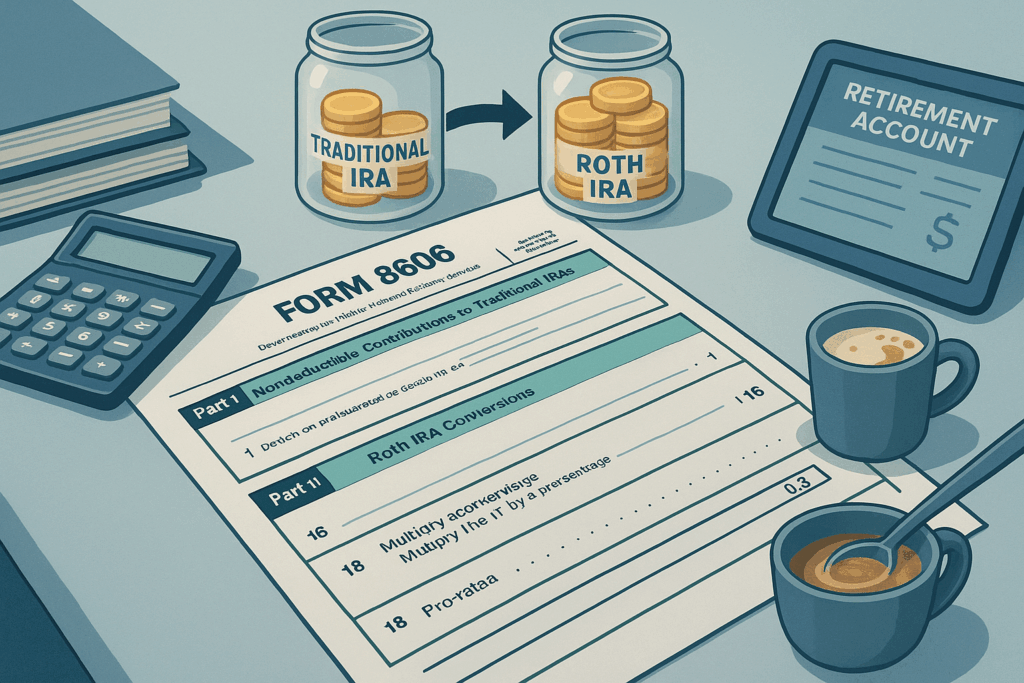

Form 8606 stands as a crucial document in the complex landscape of retirement tax planning, particularly for taxpayers managing nondeductible IRA contributions and Roth conversions. As we move into 2025, understanding this form has become increasingly important with the rising popularity of backdoor Roth conversions and the intricacies of the pro-rata rule. Whether you’re a seasoned investor or new to retirement planning, properly documenting your IRA transactions is essential for tax compliance and avoiding costly penalties. This comprehensive guide explores the purpose of Form 8606, breaks down the reporting requirements for nondeductible contributions, walks through the process of Roth conversions, and provides strategic insights to help you navigate distribution rules while maintaining accurate records for your retirement accounts.

The Purpose and Filing Requirements of Form 8606

Form 8606 serves as the critical documentation for tracking nondeductible contributions and distributions related to IRAs. This often-overlooked form plays a vital role in preventing double taxation and ensuring proper reporting of retirement account transactions to the IRS.

Form 8606 fulfills three essential functions in IRA reporting. First, it documents nondeductible contributions to traditional IRAs, particularly important when your income exceeds deduction limits. Second, it calculates the taxable portion of distributions from traditional, SEP, or SIMPLE IRAs that contain nondeductible contributions. Third, it tracks Roth IRA conversions and distributions, establishing the basis for future tax-free withdrawals [Source: Wolters Kluwer].

You must file Form 8606 in several specific circumstances. The most common is when making nondeductible contributions to a traditional IRA. For 2025, contribution limits are $7,000 for those under 50 and $8,000 for those 50 and older. The form is also required when taking distributions from IRAs with nondeductible contributions, when converting traditional IRAs to Roth IRAs, and when receiving certain distributions from Roth IRAs [Source: TurboTax].

For the 2025 tax year (filed in 2026), Form 8606 has expanded to address recent tax law changes related to special distribution types. These include qualified birth/adoption distributions, domestic abuse distributions, emergency personal expense distributions, and terminal illness distributions [Source: ASPPA]. These updates ensure proper tracking of these specialized withdrawals that may have different tax treatments.

The consequences of failing to file Form 8606 can be serious. The IRS imposes a $50 penalty for each instance of non-filing unless you can demonstrate reasonable cause [Source: Investopedia]. More significantly, without this form, you risk losing track of your basis (nondeductible contributions), potentially leading to double taxation when you withdraw funds. Additionally, overstating nondeductible contributions can result in a $100 penalty if deemed non-accidental.

Form 8606 must be filed with your annual tax return (Form 1040) by the standard tax filing deadline—typically April 15th of the following year. For the 2025 tax year, this would be April 15, 2026, unless extensions apply [Source: IRS].

Consider a practical example: You contribute $7,500 (nondeductible) to a Traditional IRA in 2025 and immediately convert it to a Roth IRA. On Form 8606, you would report the total contribution on Line 1 ($7,500) and track the basis to ensure tax-free growth [Source: WealthKeel]. Without this documentation, you might face double taxation when eventually withdrawing these funds.

Another scenario: You have $30,000 in Traditional IRAs, with $5,000 being nondeductible contributions reported on previous Form 8606 filings. If you take a $10,000 distribution in 2025, Form 8606 calculates the tax-free portion using the pro-rata rule and reports the taxable and non-taxable amounts appropriately [Source: Teach Me Personal Finance].

Form 8606 creates a permanent record that the IRS uses to verify the nontaxable portions of your future IRA distributions. This documentation is particularly valuable when switching tax preparers or dealing with inherited IRAs that have basis from nondeductible contributions. Even when accountants suggest otherwise, submitting Form 8606 with proper documentation remains a best practice to protect yourself from future tax complications.

Mastering Nondeductible Contributions and the Pro-Rata Rule

Understanding nondeductible IRA contributions and navigating the pro-rata rule are essential skills for maximizing retirement tax strategies, especially for higher-income earners who face contribution restrictions elsewhere. This chapter dives deep into these concepts, providing the knowledge you need to make informed decisions and properly report them on Form 8606.

What Are Nondeductible IRA Contributions?

Nondeductible IRA contributions are after-tax dollars placed into a traditional IRA when you’re unable to claim a tax deduction for those contributions. Unlike their deductible counterparts, these contributions don’t reduce your current-year taxable income, but they do create a valuable “basis” in your IRA that can be withdrawn tax-free in the future [Source: SoFi].

The primary benefits of nondeductible contributions include:

- Tax-deferred growth on all earnings until withdrawal

- No income limits for eligibility to contribute

- Partial tax-free withdrawals in retirement (the contributed principal)

- Backdoor Roth IRA potential for high-income earners

For 2025, you can contribute up to $7,000 if you’re under 50 years old or $8,000 if you’re 50 or older [Source: Fidelity].

When Nondeductible Contributions Make Sense

Nondeductible contributions become particularly relevant when:

- Your income exceeds deduction thresholds for traditional IRAs (for 2025, that’s above $89,000 for single filers with a workplace plan, or above $146,000 for joint filers with a workplace plan)

- You’re already maximizing contributions to workplace retirement plans

- You earn too much to contribute directly to a Roth IRA but want the eventual benefits of Roth-style tax-free withdrawals [Source: NerdWallet]

The Pro-Rata Rule Explained

When you have both pre-tax (deductible) and after-tax (nondeductible) money in your traditional IRAs, the pro-rata rule comes into play. As the IRS explains it, you cannot cherry-pick which funds to withdraw or convert first.

The famous “cream in coffee” analogy illustrates this concept perfectly: imagine your total IRA funds as a cup of coffee mixed with cream. The cream represents your after-tax contributions, while the coffee represents your pre-tax funds. When you take a sip (withdrawal or conversion), you get a proportional mix of both cream and coffee—you can’t selectively drink just the cream [Source: FI Tax Guy].

The rule applies across all your traditional, SEP, and SIMPLE IRAs collectively, not just individual accounts. The IRS treats them as one big pot for calculation purposes.

Pro-Rata Rule Calculations

The formula for calculating the nontaxable portion is:

Nontaxable % = (Nondeductible Contributions ÷ Total IRA Balance) × 100

Let’s see this in action with a real-world example:

- Nondeductible contributions (basis): $20,000

- Total IRA balance across all accounts: $200,000

- Conversion amount: $50,000

1. Calculate the nontaxable percentage: $20,000 ÷ $200,000 = 10%

2. Determine the tax-free amount: 10% × $50,000 = $5,000

3. The taxable amount is therefore: $50,000 – $5,000 = $45,000 [Source: Smart Asset]

This means you’ll owe income tax on $45,000 of your conversion, not just the earnings portion as many mistakenly believe.

Reporting with Form 8606

Form 8606 is your essential tracking tool for nondeductible contributions and pro-rata calculations. Filing it correctly ensures you don’t pay taxes twice on the same money.

To report nondeductible contributions for 2025:

- Part I (Lines 1-14): Record your nondeductible contribution amount for the year (Line 1) and your existing basis from prior years (Line 2).

- Line 6: Enter the December 31, 2025 value of ALL your traditional, SEP, and SIMPLE IRAs.

- Line 8: Calculate your total IRA value (including any distributions taken during the year).

- Lines 13-14: Determine the nontaxable portion of any distributions using the pro-rata formula [Source: Teach Me Personal Finance].

If you’re converting to a Roth IRA, you’ll also complete Part II, which calculates the taxable portion of your conversion using the same pro-rata principles.

Strategic Planning to Minimize Pro-Rata Impacts

For those with significant pre-tax IRA balances, the pro-rata rule can complicate nondeductible contribution strategies. Here are effective ways to mitigate its impact:

- Roll Pre-Tax IRAs to Employer Plans: If your employer’s 401(k) accepts incoming rollovers, move your pre-tax IRA balances there. This removes those funds from the pro-rata calculation, potentially leaving only nondeductible contributions in your IRA [Source: Thrivent].

- Time Your Contributions and Conversions: Consider making nondeductible contributions and converting them to Roth IRAs in the same tax year before they generate significant earnings.

- Zero Out Pre-Tax IRAs First: Before implementing a backdoor Roth strategy, convert all existing pre-tax IRA balances to Roth IRAs (paying the taxes due) or roll them into an employer plan to clear the way for cleaner nondeductible conversions [Source: RG Wealth].

- Keep Excellent Records: Maintain detailed documentation of all nondeductible contributions and file Form 8606 even in years when you don’t take distributions. This establishes your basis for future reference.

Real-World Application

Consider Jane, who has $100,000 in traditional IRAs, including $15,000 from nondeductible contributions. She wants to convert $20,000 to a Roth IRA. The pro-rata rule means 15% ($15,000 ÷ $100,000) of her conversion will be tax-free. For her $20,000 conversion, only $3,000 is tax-free, and she’ll pay taxes on the remaining $17,000.

However, if Jane rolls her $85,000 of pre-tax money into her employer’s 401(k), leaving only the $15,000 nondeductible amount in her IRA, she could then convert that $15,000 to a Roth IRA with no tax consequences. This illustrates the power of strategic pre-tax fund isolation in retirement planning [Source: TaxSlayer].

By understanding nondeductible contributions and mastering the pro-rata rule, you can make more informed decisions about your retirement accounts, potentially saving thousands in unnecessary taxes while maximizing your tax-advantaged growth opportunities.

Navigating Roth IRA Conversions and Backdoor Strategies

Building on our understanding of nondeductible contributions and the pro-rata rule, let’s explore how to leverage these concepts for Roth IRA conversions and the popular backdoor Roth strategy. These powerful techniques allow you to enjoy tax-free growth and distributions regardless of your income level.

A Roth IRA conversion involves transferring funds from traditional IRAs, 401(k)s, or other eligible accounts into a Roth IRA. Unlike direct Roth contributions, conversions aren’t subject to income limits, making them available to high-income earners. The primary benefit is that after conversion (and paying applicable taxes), your investments grow completely tax-free, with no required minimum distributions during your lifetime [Source: Vision Retirement].

When converting, remember that the transferred amount is treated as taxable income for the year. This could potentially push you into a higher tax bracket, affecting deductions or credits [Source: Investopedia]. Plan strategically to minimize this impact – some investors convert during market downturns when account values are lower, or during years with temporarily reduced income.

For high-income earners above the Roth contribution limits ($150,000–$165,000 for singles and $236,000–$246,000 for married couples filing jointly in 2025), the backdoor Roth strategy offers a legitimate workaround [Source: Physician on FIRE]. This two-step process begins with a nondeductible contribution to a traditional IRA, followed by a prompt conversion to a Roth IRA.

To execute a backdoor Roth conversion in 2025:

- Open a traditional IRA if you don’t already have one.

- Contribute after-tax money to your traditional IRA ($7,000 if under 50, $8,000 if 50+ by year-end).

- Convert the funds to a Roth IRA as soon as possible to minimize taxable earnings.

On platforms like Vanguard, navigate to “Traditional IRA > Contribute to IRA,” select “2025,” and confirm the contribution as “non-rollover.” For Fidelity, open a traditional IRA, select “Contribution for 2025,” and specify the amount as “non-deductible” [Source: Fidelity].

The critical part comes with Form 8606 reporting. This form documents your nondeductible contributions and conversions to ensure proper tax treatment. Part I tracks your nondeductible contributions, establishing your basis for tax-free conversions. On Line 1, enter your nondeductible contributions for the year. On Line 2, report the amount converted to a Roth IRA [Source: SDT Planning].

Part II of Form 8606 calculates the taxable portion of your conversion. Line 4 should match Line 2 from Part I (the converted amount). The taxable amount (Line 6) equals Line 4 minus your basis from Part I. For a clean backdoor Roth with immediate conversion of nondeductible funds, this should be zero or minimal [Source: White Coat Investor].

The pro-rata rule significantly complicates backdoor Roth conversions if you have existing pre-tax IRA balances. The IRS requires you to calculate the taxable portion based on the ratio of all your IRA funds (pre-tax and after-tax). For example, if you have $40,000 in pre-tax IRAs and make a $7,000 nondeductible contribution, your total IRA balance becomes $47,000. When converting that $7,000, approximately $5,958 would be taxable ([$40,000 ÷ $47,000] × $7,000) [Source: SmartAsset].

To avoid the pro-rata rule, consider consolidating existing pre-tax IRA balances into an employer retirement plan like a 401(k), if your plan allows it. This removes those funds from the pro-rata calculation, creating a “clean” backdoor conversion [Source: RG Wealth].

Common misconceptions about backdoor Roth conversions include ignoring the pro-rata rule, failing to file Form 8606, and delaying conversions unnecessarily. Remember that Form 8606 isn’t optional—it’s crucial for tracking your basis and validating tax-free withdrawals later [Source: IRA Help].

Unlike direct Roth contributions, converted Roth IRA funds cannot be “recharacterized” back to traditional IRAs under current tax laws. This means your conversion decision is permanent, so timing and planning are essential [Source: Investopedia].

For 2025 specifically, income thresholds for direct Roth contributions have increased, but the backdoor strategy remains valuable for those above these limits. When properly executed and documented, this strategy creates a pathway to tax-free growth that might otherwise be unavailable.

Avoiding Common Mistakes and Building a Foolproof Record-Keeping System

Even the most careful taxpayers can stumble when navigating the complexities of Form 8606. Without proper documentation and attention to detail, years of careful retirement planning can unravel quickly. The consequences extend beyond immediate tax implications, potentially affecting your retirement security for decades.

The most common Form 8606 error is completely omitting the form when making nondeductible IRA contributions. This oversight prevents the IRS from verifying your post-tax “basis,” resulting in double taxation when you eventually withdraw or convert those funds [Source: Martin Starnes & Associates]. Another frequent mistake is miscalculating the taxable portion during conversions by ignoring the pro-rata rule, which can lead to significant tax underpayment or overpayment.

Many taxpayers also make computational errors when tracking their basis over time. As one tax professional notes, “Errors often stem from incomplete tracking or reliance on professionals without scrutiny” [Source: WealthKeel]. These mistakes compound yearly, creating a cascading effect that becomes increasingly difficult to correct.

The consequences of Form 8606 errors are substantial. Failing to file the form when required triggers a $50 penalty per occurrence [Source: Wolters Kluwer]. More severely, overreporting nondeductible contributions incurs a $100 penalty unless you can demonstrate “reasonable cause” for the error. Beyond penalties, improper documentation leads to double taxation during distributions and creates complications during IRS audits.

Creating a robust record-keeping system is your best defense. The IRS recommends retaining retirement plan records for at least six years after plan termination, though many financial advisors suggest extending this to seven years or more [Source: USI]. Essential documents include all Forms 8606, contribution receipts, Forms 5498 from custodians, distribution Forms 1099-R, and conversion documentation.

For effective organization, implement both digital and physical storage solutions. “Use a designated repository for easy retrieval during audits or disputes,” advises First American Bank [Source: First American Bank]. Secure cloud storage with encrypted backups provides protection against physical damage to documents, while labeled physical folders offer quick access during tax preparation.

If you discover past Form 8606 errors, don’t panic—they can be corrected. File Form 1040-X with revised Form 8606 for each affected tax year [Source: White Coat Investor Forum]. Remember that corrections to early years may require amendments to subsequent returns to maintain consistency in basis tracking. For complex situations spanning multiple years, professional guidance becomes crucial.

Moving forward, implement best practices to prevent future errors. Maintain a detailed spreadsheet tracking all IRA contributions, conversions, and distributions by date, amount, and tax treatment. Cross-verify your records against custodian statements before filing taxes. For backdoor Roth strategies, consider using dedicated traditional IRA accounts solely for nondeductible contributions to simplify tracking.

While specific IRS audit cases aren’t publicly disclosed, taxpayers face increased scrutiny when Form 8606 reporting patterns change or when distributions appear inconsistently reported [Source: TurboTax]. Your comprehensive records become your strongest defense during questioning.

Remember that custodians are not obligated to track your nondeductible contributions—this responsibility falls entirely on you. By maintaining meticulous records and understanding Form 8606 requirements, you can confidently navigate the complexities of IRA taxation while maximizing your retirement savings potential.

Conclusion

Navigating Form 8606 is an essential skill for anyone utilizing nondeductible IRA contributions or Roth conversions as part of their retirement strategy. The form serves as both a tracking mechanism and a tax compliance tool that prevents double taxation while ensuring you properly report your retirement transactions. As we’ve explored, understanding the pro-rata rule, maintaining meticulous records, and following the correct filing procedures can save you from significant penalties and tax complications. With the increasing popularity of backdoor Roth IRAs and the ever-changing tax landscape, staying informed about Form 8606 requirements is more crucial than ever. By implementing the strategies discussed and consulting with tax professionals when needed, you can confidently manage your retirement accounts while maximizing tax advantages and securing your financial future.

Sources

- ASPPA – IRS Updates Forms Related to IRA Compliance

- Cerity Partners – A Pitfall of the Backdoor Roth IRA Conversion

- District Capital Management – Roth IRA Hack

- DRS Financial Partners – Avoiding the Biggest Backdoor Roth IRA Conversion Mistake

- Fidelity – Backdoor Roth IRA

- Fidelity – IRA Contribution Limits

- Finance Strategists – Form 8606

- First American Bank – Conquer Record-Retention Complexities for Retirement

- FI Tax Guy – The Pro-Rata Rule

- White Coat Investor – Form 8606 Mistake Issues Down the Road

- Investor Vanguard – How To Set Up Backdoor IRA

- IRA Help – Two Cautions When Doing a Backdoor Roth Conversion

- Investopedia – Articles Retirement 04/030304

- Investopedia – Roth IRA Conversion Rules

- Investopedia – Backdoor Roth IRA

- IRS – About Form 8606

- IRS – Instructions for Form 8606

- Martin Starnes & Associates – The Tricky Terrain of Backdoor Roth IRAs: Three Common Mistakes

- Morningstar – Backdoor Roth IRA Avoid These 5 Mistakes

- NerdWallet – Not Eligible to Deduct an IRA? Contribute Anyway

- Physician on FIRE – Backdoor

- RG Wealth – How to Avoid the Pro-Rata Rule with Backdoor and Mega Roth Conversions

- Schwab – Backdoor Roth Is It Right You

- SDT Planning – How to Report Your Backdoor Roth IRA on Your Taxes

- Smart Asset – A Guide to the Pro-Rata Rule and Roth IRAs

- SoFi – What is Non Deductible IRA

- TaxSlayer – Pro-Rata rules for Roth conversions Backdoor Roth

- Teach Me Personal Finance – IRS Form 8606 Instructions

- Thrivent – Pro-Rata Rule on Roth IRA Conversions: What to Know, How to Avoid

- TurboTax – What is IRS Form 8606: Nondeductible IRAs

- USI – Best Practices for Maintaining Your Retirement Records

- Vision Retirement – Basics of Roth IRA Conversions

- WealthKeel – Backdoor Roth IRA Guide

- White Coat Investor – Backdoor Roth IRA Tutorial

- Wolters Kluwer – Individual Retirement Accounts: When is IRS Form 8606 Required