Navigating Business Meal Deductions: 2025-2026 Transition Guide

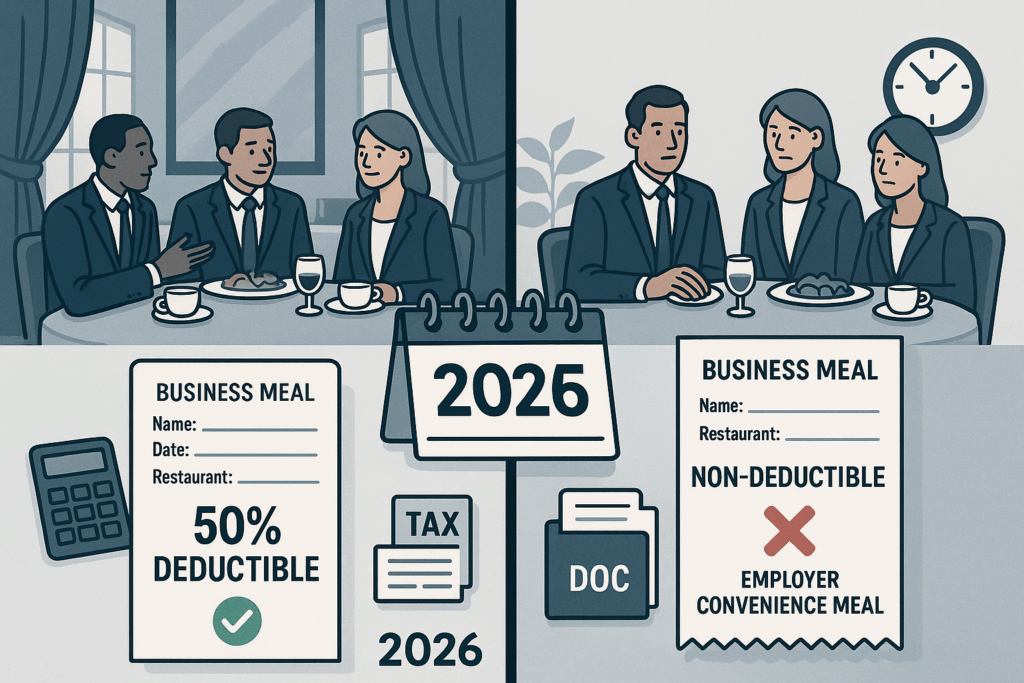

As businesses approach the critical 2025-2026 transition period, understanding the evolving landscape of business meal deductions has never been more important. The Tax Cuts and Jobs Act (TCJA) sunset provisions are set to dramatically alter how organizations can deduct meal-related expenses. Currently, most business meals qualify for 50% deductibility, with specific categories eligible for 100% deductions and transportation workers enjoying an 80% deduction rate. However, starting January 1, 2026, meals provided for employer convenience and de minimis fringe benefits will become entirely non-deductible. This comprehensive guide explores the current rules, upcoming changes, documentation requirements, and strategic approaches to help businesses maximize deductions while preparing for the significant regulatory shift ahead.

Critical Documentation and Substantiation Requirements

Maintaining proper documentation for business meal deductions isn’t just good practice—it’s essential for IRS compliance and protecting your deductions during potential audits. The IRS applies rigorous substantiation standards under Section 274(d) that go beyond typical business expense requirements.

Fundamental Documentation Standards

Section 274(d) establishes stringent substantiation requirements that demand meticulous record-keeping for all business meal expenses. For each meal, you must document five critical elements [Source: The Tax Adviser]:

- Amount – The exact cost of the meal, including tax and tips

- Date – When the meal occurred

- Place – Restaurant name and location

- Business purpose – Specific business topics discussed

- Attendees – Names and business relationships of all participants

This documentation must establish that the expense was ordinary, necessary, and directly connected to your trade or business operations. Vague or general descriptions like “business meeting” or “client lunch” are insufficient and likely to be disallowed during an audit [Source: PKF O’Connor Davies].

Receipt Requirements and Best Practices

The IRS specifically requires receipts for all business meal expenses of $75 or more [Source: PKF O’Connor Davies]. However, tax professionals universally recommend keeping receipts for all business meals regardless of amount. Remember that the receipt alone isn’t sufficient—it must be accompanied by documentation of the business purpose and attendee information.

When calculating deductible meal costs, include:

- The meal itself

- Sales tax

- Tips

However, transportation costs to and from the restaurant aren’t considered part of the meal expense (though they may qualify for separate transportation deductions) [Source: IRS].

Paper vs. Electronic Record-Keeping

The IRS accepts both paper and electronic documentation systems, provided they meet all substantiation requirements [Source: Neat]. However, digital documentation offers significant advantages:

Digital Documentation Benefits:

- Cloud-based storage provides backup protection against loss or damage

- Searchable databases allow quick retrieval during audits

- Integration with accounting software streamlines tax preparation

- Mobile capture ensures contemporaneous recording

- Automatic categorization reduces manual entry errors

Paper receipts, especially thermal receipts commonly used by restaurants, fade over time and become unreadable—potentially leaving you without required documentation during an audit [Source: Neat].

The IRS established the legal foundation for electronic record-keeping through Revenue Procedure 97-22, which grants digital documentation full legal standing for tax purposes [Source: Zoho]. This means properly maintained digital records carry the same weight as original paper documents.

Implementing Effective Documentation Systems

Modern technology offers powerful solutions for meeting business meal documentation requirements:

Mobile Apps for Receipt Capture

Advanced mobile applications utilize SmartScan technology to automatically extract information from photographed receipts, categorize expenses, and apply the correct deduction rules [Source: Expensify]. These systems transform receipt management from a tedious task into a streamlined process that ensures complete documentation.

Calendar Integration for Business Purpose

The most effective documentation systems integrate with your digital calendar to create contemporaneous records of business meetings. This integration automatically establishes who attended the meal and provides a timestamp that satisfies the IRS requirement for contemporaneous documentation [Source: Myshyft].

Contemporaneous Record-Keeping Practices

The timing of your documentation matters significantly. Records created at or near the time of the expense (contemporaneous records) carry much more weight with the IRS than documentation created weeks or months later. Tax courts consistently disallow deductions when business purpose documentation wasn’t prepared contemporaneously with the expense [Source: Journal of Accountancy].

Documentation for Different Types of Business Meals

Different categories of business meals require specific documentation approaches:

Client Meetings

For client meals, document the business relationship of each attendee and provide detailed notes on business topics discussed. This category receives the highest level of IRS scrutiny, so documentation must clearly demonstrate how the discussion directly relates to generating revenue, maintaining client relationships, or developing new business [Source: PKF O’Connor Davies].

Employee Events

Company-wide events like holiday parties (100% deductible) require documentation of employee attendance, the business purpose of fostering employee relations, and receipts showing total costs. For meals provided during employee meetings, document the business topics discussed and maintain attendance records [Source: Taxfyle].

Travel Meals

Business travel meals require documentation that clearly separates business from personal expenses. Maintain records of the travel purpose along with meal receipts. When using the per diem method, you must still document travel dates, destinations, and business purposes, though individual meal receipts aren’t required [Source: Fyle].

Special Considerations for Transportation Workers

Transportation workers subject to Department of Transportation hours-of-service limitations face different substantiation requirements when using per diem allowances. For 2025, transportation workers can deduct 80% of meal expenses (versus the standard 50% for other businesses) and can use simplified per diem rates.

When using per diem rates (currently $80 for Continental US and $86 for Outside Continental US), transportation workers must still maintain documentation of:

- Travel dates

- Locations visited

- Business purpose of travel

While detailed receipts aren’t required when using per diem rates, you must still maintain logs showing dates, locations, and business purposes [Source: IRS Publication 463].

Common Documentation Pitfalls

The IRS frequently disallows business meal deductions due to documentation failures. A recent Tax Court case (T.C. Memo. 2024-82) illustrates what doesn’t work: a software consultant claimed nearly $9,000 in meal expenses as “working lunches” with colleagues but provided only bank statements as proof. The court rejected these deductions because the documentation failed to establish both the business purpose and the relationship of the individuals involved [Source: Botwinick].

Other common pitfalls include:

- Insufficient detail – Vague descriptions like “business lunch” without specific discussion topics

- Missing attendee information – Failing to document who attended and their business relationship

- Late documentation – Creating records weeks or months after the expense occurred

- Inconsistent records – Information that conflicts with other business records

Proactive Documentation Strategies

To ensure your business meal deductions withstand IRS scrutiny:

- Implement a digital system that captures all required information at the time of the expense

- Create standard templates that prompt for all required documentation elements

- Review documentation monthly to ensure completeness before memories fade

- Maintain backup copies of all digital records in secure cloud storage

- Train all employees on proper documentation requirements for business meals they host

Remember that the burden of proof rests entirely with you as the taxpayer. The IRS isn’t required to disprove your deductions—you must provide sufficient evidence to support them [Source: Journal of Accountancy].

By implementing thorough documentation practices, you transform meal receipts from simple slips of paper into valuable tax deductions that can significantly reduce your business tax liability. The time invested in proper documentation pays dividends both in maximized deductions and peace of mind during potential IRS examinations.

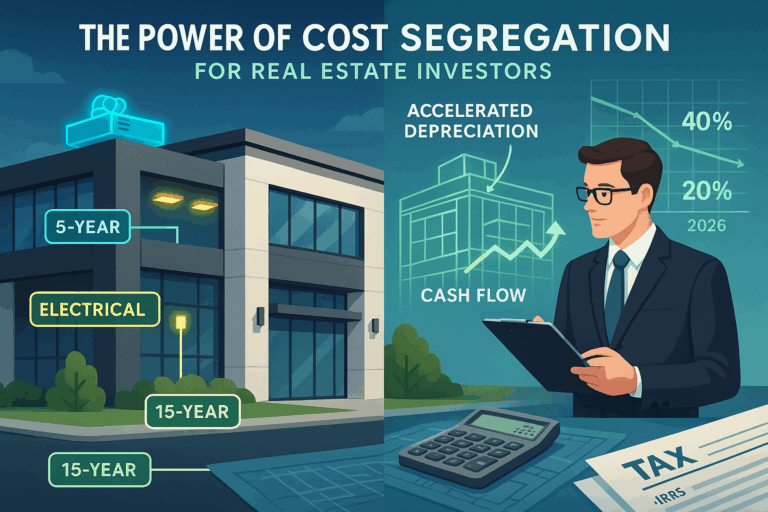

The 2026 Deduction Cliff and Strategic Planning

As businesses navigate the current tax landscape, a significant change looms on the horizon that will fundamentally alter how companies approach employee meals and related benefits. The Tax Cuts and Jobs Act (TCJA) sunset provisions taking effect January 1, 2026, will create what tax professionals are calling the “meal deduction cliff” – a dramatic shift that requires immediate strategic planning and financial restructuring.

Understanding the 2026 Meal Deduction Changes

The most impactful change coming in 2026 is the complete elimination of deductions for meals provided for employer convenience and on-premises eating facilities. These expenses will shift from being 50% deductible to completely non-deductible [Source: Baird Wealth]. This affects various workplace scenarios including:

- Hospital staff meals for doctors and nurses required to remain on-shift

- Meals at businesses with short breaks where employees can’t reasonably leave

- Food provided at remote work sites without nearby restaurant access

- Meals where security procedures make leaving the facility impractical

Additionally, de minimis fringe benefits that are currently 100% deductible will lose their favorable tax treatment entirely. This includes break room coffee and snacks, donuts at staff meetings, and pizza during team training sessions [Source: Alloy Silverstein].

The changes will particularly impact employers operating subsidized company cafeterias. If a cafeteria doesn’t charge employees fair market value for meals, no deduction will be allowed for the entire expense associated with that cafeteria, whether operated directly by the employer or by a third party.

It’s important to note that traditional business meals with clients or prospects will continue to qualify for 50% deductibility, as will travel meals during overnight business trips [Source: FH Associates]. The challenge lies specifically with employee-focused meal programs.

Quantifying the Financial Impact

The financial implications of these changes vary dramatically based on current meal expenditure levels and corporate tax rates. For businesses spending $120,000 annually on employee meals, the tax impact breakdown reveals:

Current Benefits (Through 2025):

- 50% deduction on employer convenience meals: $60,000 deductible

- Tax savings at 21% corporate rate: $12,600 annually

Post-2026 Impact:

- 0% deduction on the same meals: $0 deductible

- Complete loss of tax benefits: $12,600 in additional tax burden

For larger operations spending $200,000 annually on qualifying employee meals, the financial hit becomes more severe. The complete loss of deductibility translates to $42,000 in lost tax benefits annually at standard corporate tax rates [Source: Instead]. Companies with substantial meal programs may face six-figure increases in their effective tax burden.

Strategic Approaches for 2025

Given these impending changes, businesses should implement several strategic approaches during 2025 to prepare for the deduction cliff:

1. Accelerate Meal-Related Expenditures

Front-load meal expenditures and employee appreciation events before the December 31, 2025 deadline. Consider:

- Moving planned 2026 company parties to late 2025

- Upgrading cafeteria equipment while deductions remain available

- Prepaying certain meal service contracts where feasible

- Scheduling client entertainment and business development meals in 2025 rather than early 2026

“Businesses should maximize current deductions by front-loading meal expenditures and employee appreciation events before the December 31, 2025 deadline,” advises tax experts at FA-CPA [Source: FA-CPA].

2. Restructure Meal Benefits as Taxable Compensation

Converting meal programs into taxable compensation increases provides a pathway to maintain business deductions:

- Offer meal allowances as part of salary packages

- Implement stipends for food delivery services

- Consider gross-up payments to offset the additional tax burden for employees

While these become taxable to employees, they remain deductible business expenses for employers, preserving the tax advantage from the company perspective [Source: Neil.Tax].

3. Develop Alternative Benefit Programs

Replace meal benefits with other tax-advantaged alternatives:

- Enhanced Cafeteria Plans: Expand Section 125 plans that allow employees to use pre-tax dollars for various qualified benefits, including dependent care assistance, health savings accounts (HSAs), and group-term life insurance coverage [Source: IRS Publication 15-B].

- Increased 401(k) Matching: Redirect meal program budgets into enhanced retirement contributions, which remain fully deductible business expenses.

- Wellness Program Enhancements: Implement gym memberships, health screenings, and wellness initiatives that qualify as deductible business expenses while promoting employee health and retention.

- Professional Development Stipends: Provide allowances for training, conferences, or educational programs that remain fully deductible as business expenses [Source: Porte Brown].

4. Implement Budget Reallocation Planning

Businesses must reevaluate their overall expense structure to offset the financial impact of lost deductions:

- Conduct a comprehensive audit of current meal and beverage expenses

- Calculate the specific tax implications with your financial advisors

- Reallocate resources from meal programs to other deductible business expenses

- Update accounting systems and expense tracking procedures to reflect the new tax treatment effective January 1, 2026 [Source: Fiffik Law]

Timeline-Based Action Items

To ensure a smooth transition, businesses should follow this timeline of action items:

August – September 2025:

- Complete financial assessment and documentation of current meal expenses

- Review employee handbooks and benefit documentation that reference meal benefits

- Calculate the specific tax impact based on your company’s meal expenditure patterns

October – November 2025:

- Finalize alternative benefit strategies to replace meal programs

- Complete budget restructuring for the 2026 fiscal year

- Develop communication plans to explain changes to employees

December 2025:

- Implement system updates for accounting and expense tracking

- Execute accelerated meal expenditures to maximize final deductions

- Finalize and distribute updated benefit documentation to employees

“Conduct a comprehensive audit of your current meal and beverage expenses to understand the financial impact of losing the 50% deduction,” recommends Fiffik Law Group [Source: Fiffik Law].

Industry-Specific Opportunities

While most businesses face significant challenges, certain industries have secured exceptions through targeted legislation. The One Big Beautiful Bill Act provides some relief to specific sectors:

- Restaurant and catering employees can still receive full deductions for “on-shift meals” during each meal period worked

- The fishing industry receives a notable exception, with meals provided on fishing vessels and fish processing facilities in remote U.S. locations north of 50 degrees latitude qualifying for 100% deductibility starting in 2026 [Source: Covington & Burling LLP]

- Offshore oil rig and gas platform workers

- Maritime crew members required to be provided meals under federal law

These targeted exceptions acknowledge the unique operational requirements of certain industries where meals are integral to workplace function rather than simply a benefit.

Reimagining Employee Benefits

The 2026 deduction cliff represents more than just a tax challenge—it’s an opportunity for businesses to reimagine their approach to employee benefits and workplace culture. Companies that successfully navigate this transition will look beyond traditional meal programs to create innovative benefit packages that support employee well-being while maintaining tax efficiency.

The most forward-thinking organizations are using this transition period to conduct employee surveys, gather feedback on valued benefits, and design comprehensive packages that may actually improve employee satisfaction while adapting to the new tax reality. Rather than viewing these changes as simply a loss of deductions, they’re an invitation to create more personalized benefit structures that truly align with employee needs in 2026 and beyond [Source: OnPay].

Audit Defense and Accounting Best Practices

As businesses navigate the changing landscape of meal deduction rules, establishing robust audit defense and accounting practices becomes increasingly critical, especially with the 2026 deduction cliff approaching. The IRS has enhanced its data analytics capabilities to identify unusual patterns in deduction claims, making proper documentation and accounting systems essential for defending legitimate deductions.

Heightened IRS Scrutiny for Meal Deductions

Business meal deductions face particular scrutiny as 2026 approaches, with several common audit triggers to be aware of. The primary trigger occurs when deductions fall significantly outside industry norms [Source: Anderson Bradshaw Tax]. The IRS maintains sophisticated databases tracking average ranges for industry-specific write-offs, and excessive meal deductions can prompt immediate investigation.

Other red flags include claiming home office deductions alongside business meals without clearly defined spaces, deducting family dinners as business meals without legitimate business participants, and misclassifying personal celebration meals as business expenses [Source: Instead]. These triggers are particularly relevant as businesses might be tempted to maximize deductions before the 2026 changes take effect.

As 2026 approaches, audit risk will likely increase as the IRS anticipates businesses accelerating meal expenditures to capture remaining deductions. “The cumulative impact of losing these deductions can be substantial for businesses that regularly provide onsite meals or meeting refreshments,” notes one tax advisory firm [Source: Alloy Silverstein], creating incentives for aggressive deduction strategies that may invite scrutiny.

Implementing Proper Tracking Systems

Separate Accounting Categories by Deductibility Type

To create a defensible position for meal deductions, businesses should implement separate tracking systems in their accounting software that clearly categorize meals by deductibility type. This means creating distinct general ledger codes for:

- 100% deductible meals: Including business meetings with clients, promotional events open to the public, and certain qualified restaurant meals under temporary provisions

- 50% deductible meals: Standard business meals when they relate to business meetings or are provided for employees working late

- 80% deductible meals: Specifically for transportation industry workers subject to Department of Transportation regulations

- Non-deductible meals: Personal meals or those that will become non-deductible in 2026

“GL codes serve as specific identifiers for meal transactions, allowing businesses to easily sort, filter, and analyze expense data to generate comprehensive financial reports,” explains accounting technology provider Precoro [Source: Precoro]. This coding structure facilitates both current compliance and preparation for the