How to Pay Estimated Taxes in 2025: New Electronic Rules

Understanding Federal Estimated Tax Payments in 2025 As we navigate through 2025, understanding federal estimated tax payments has become more crucial than ever, especially with the IRS’s transition to mandatory electronic payments by September 30, 2025. This comprehensive guide explores who needs to make estimated tax payments, when they’re due, and how to comply with the latest requirements. Understanding Your Estimated Tax Payment Obligations For the 2025 tax year, you must make quarterly estimated tax payments if you expect to owe at least $1,000 in federal tax after subtracting withholdings and credits. This requirement particularly affects individuals with income not subject to regular withholding. The safe harbor rules provide important protection against penalties. According to TurboTax, you can avoid penalties by paying either 90% of your current year’s tax liability or 100% of your previous year’s tax (increasing to 110% if your previous year’s adjusted gross income exceeded $150,000). Various income sources trigger estimated tax obligations. Self-employed individuals, including freelancers and gig workers, must pay both income tax and self-employment tax through estimated payments. Investment income from capital gains, dividends, and rental property typically requires estimated tax payments when withholding is insufficient. The penalty for underpayment can be significant. The IRS charges a 7% annual interest rate on underpayments, calculated quarterly. However, proper planning and adherence to safe harbor rules can help avoid these penalties entirely. Key Dates and Payment Schedule for 2025 The IRS maintains a structured quarterly payment schedule: – First payment (January-March income): April 15, 2025 – Second payment (April-May income): June 16, 2025 – Third payment (June-August income): September 15, 2025 – Final payment (September-December income): January 15, 2026 When payment deadlines fall on weekends or federal holidays, taxpayers have until the next business day to submit payments without penalty. Notably, taxpayers can skip the January 15, 2026 payment if they file their complete 2025 tax return by February 2, 2026, and pay any remaining tax due. Electronic Payment Requirements and Options Starting September 30, 2025, paper checks will be phased out in favor of mandatory electronic payments. This change stems from Executive Order 14247, aiming to modernize federal payment systems and reduce processing costs. The IRS offers several secure electronic payment options: – IRS Direct Pay: Offers simple, immediate processing with no registration required – Electronic Federal Tax Payment System (EFTPS): Provides advanced features like payment scheduling – Digital wallets and debit/credit card payments through authorized processors Processing times vary by method – Direct Pay transactions typically complete within one business day, while EFTPS payments should be scheduled at least one day ahead. Limited exceptions exist for individuals lacking access to banking services, with the Treasury Department establishing a waiver process for eligible cases. Strategies for Managing Irregular Income For taxpayers with irregular or seasonal income, the annualized income installment method proves particularly valuable. This approach allows payment calculations based on actual income timing rather than assuming equal quarterly earnings. Using Form 2210 Schedule AI, you can adjust estimated tax payments to match income fluctuations. For example, if 75% of your annual income arrives in the fourth quarter, this method prevents penalties that might otherwise occur from lower payments in earlier quarters. Strategic withholding adjustments can provide additional flexibility. Increasing withholding later in the year can be effective since withholding is treated as paid evenly throughout the year, regardless of timing. For self-employed individuals and freelancers, maintaining a dedicated tax savings account and regularly setting aside a percentage of income helps ensure funds availability when payment deadlines arrive. Conclusion The landscape of estimated tax payments is evolving rapidly with the transition to electronic payments. Understanding your obligations, leveraging safe harbor provisions, and staying informed about payment options are crucial for financial success. By following these guidelines and adapting to new electronic payment requirements, you can effectively manage your tax obligations while avoiding penalties. [Sources sections remain unchanged] This edited version maintains the essential information while reaching closer to the target word count through more concise phrasing and removal of redundant information.

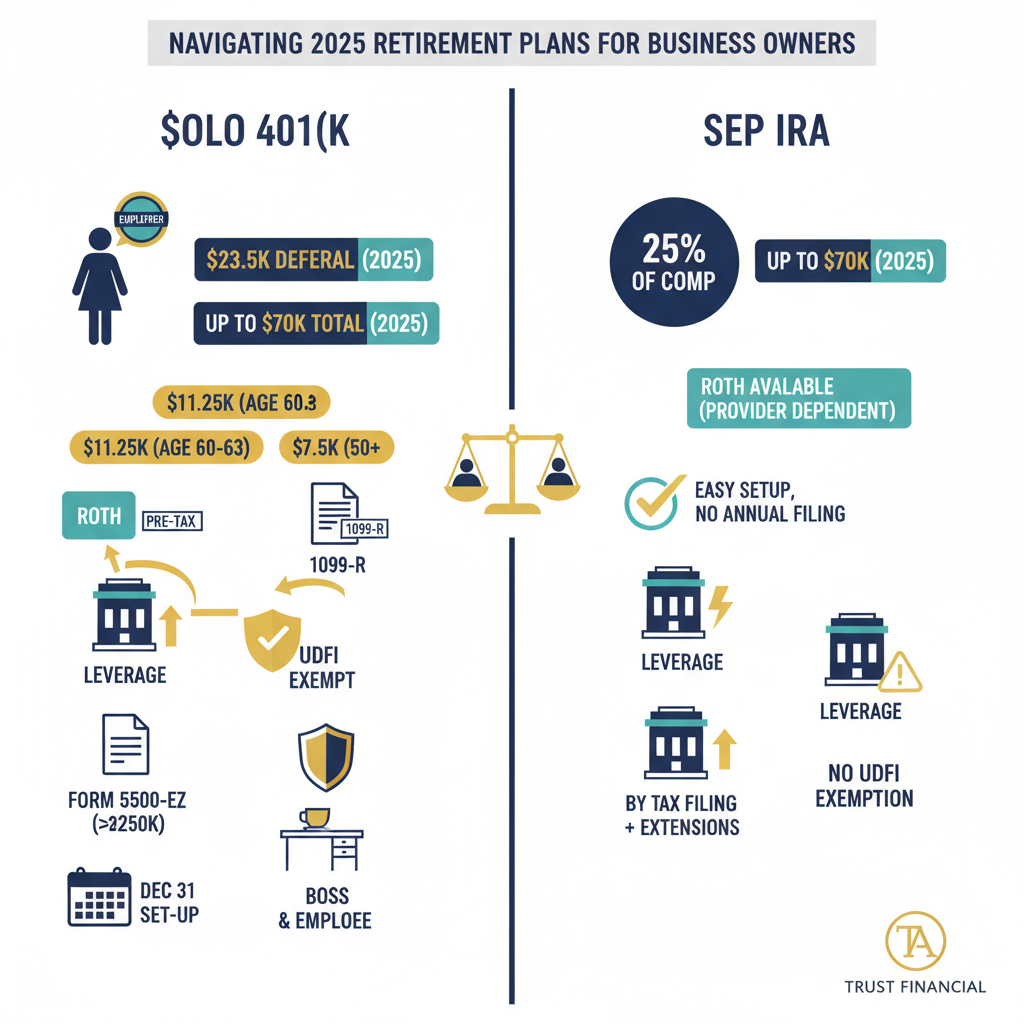

Solo 401(k) vs SEP IRA: Which is Better for You in 2025?

Solo 401(k) vs SEP IRA: A 2025 Guide for Self-Employed Professionals As we navigate through 2025, self-employed individuals and small business owners face a crucial decision in choosing between a Solo 401(k) and a SEP IRA for their retirement planning. This choice has become increasingly significant with the implementation of SECURE 2.0 Act changes and cost-of-living adjustments that have transformed the retirement planning landscape. With higher contribution limits, new Roth options, and enhanced catch-up provisions, understanding the nuances of these retirement vehicles is more important than ever. Understanding the 2025 Contribution Landscape The landscape of retirement contributions for self-employed individuals has undergone significant changes in 2025, with enhanced opportunities for retirement savings across both Solo 401(k) and SEP IRA plans. According to Guideline, the standard elective deferral limit for Solo 401(k) plans has increased to $23,500, while the total annual additions limit has reached $70,000. For Solo 401(k) participants, the contribution structure offers remarkable flexibility. IRA Financial Group reports that business owners can contribute both as employers and employees. The compensation cap of $350,000 serves as the ceiling for calculating contribution limits, though most participants will reach their annual contribution limits before this becomes relevant. The catch-up provision landscape has become particularly attractive for older participants. Those aged 60-63 can now make enhanced catch-up contributions of $11,250, significantly higher than the standard $7,500 catch-up amount for participants 50 and older. This creates a unique opportunity for accelerated retirement savings during these critical pre-retirement years. For SEP IRA holders, the contribution framework remains straightforward but powerful. Kiplinger’s analysis shows that contributions can reach up to 25% of compensation, with a maximum of $70,000 in 2025. The calculation becomes particularly relevant for high earners, as those with compensation of $280,000 or more will hit the contribution ceiling before reaching the compensation cap. The Roth Revolution in Retirement Planning The SECURE 2.0 Act has ushered in transformative changes to Roth options in retirement planning. As of 2023, SEP IRAs gained the ability to accept Roth contributions, following the repeal of previous restrictions. This development allows employees in eligible plans to designate both salary deferrals and employer contributions as Roth contributions, though providers must specifically offer this option. For Solo 401(k) participants, the tax implications of Roth employer contributions require careful navigation. The IRS treats these contributions distinctively – as if the employee received a traditional pre-tax employer contribution and then immediately converted it to Roth. This creates a unique reporting scenario where sole proprietors must report their employer contributions as deductible while simultaneously receiving a 1099-R showing a Roth conversion. Looking ahead to 2026, employees earning over $145,000 in the previous year will be required to make catch-up contributions exclusively as after-tax Roth contributions. This requirement particularly impacts those aged 50 or older, and notably, plans without a Roth option won’t be able to accept catch-up contributions from these high earners. Advanced Investment Strategies and Real Estate The Solo 401(k) offers a remarkable advantage through its Unrelated Debt-Financed Income (UDFI) exemption under IRC §514(c)(9), which fundamentally transforms the possibilities for leveraged real estate investing. This exemption allows Solo 401(k) holders to use leverage for real estate investments without triggering unrelated business income tax, provided specific conditions are met. Beyond real estate, both plans offer access to a broader spectrum of alternative investments, particularly through self-directed options. Recent regulatory changes have expanded these opportunities, with a 2025 executive order specifically aimed at democratizing access to alternative investments. This includes access to private equity, digital assets, and infrastructure investments, though careful consideration must be given to compliance requirements. Administrative Requirements and Compliance Understanding and managing administrative requirements is crucial for maintaining compliance and maximizing benefits. For Solo 401(k) plans, one of the most significant administrative responsibilities emerges when plan assets exceed $250,000, triggering the requirement to file Form 5500-EZ annually. In contrast, SEP IRAs offer remarkable administrative simplicity. According to the Journal of Accountancy, these plans can typically be established and funded online the same day, with minimal paperwork and no annual filing requirements. The timing of plan establishment and contributions differs significantly between these options. Solo 401(k) plans must be established by December 31 of the tax year for making both employee and employer contributions. SEP IRAs offer more flexibility, allowing establishment and contributions up until the business’s tax filing deadline, including extensions. Conclusion The choice between a Solo 401(k) and SEP IRA in 2025 ultimately depends on your specific circumstances, including income level, business structure, and retirement goals. Solo 401(k)s offer greater flexibility and potentially higher contribution limits at lower income levels, along with features like loans and Roth options. They’re particularly advantageous for real estate investments due to UDFI exemptions. SEP IRAs, while simpler to administer and establish, may become costly with employees and lack some advanced features. Consider your current needs and future plans carefully, verify provider support for desired features, and maintain compliance with relevant regulations.

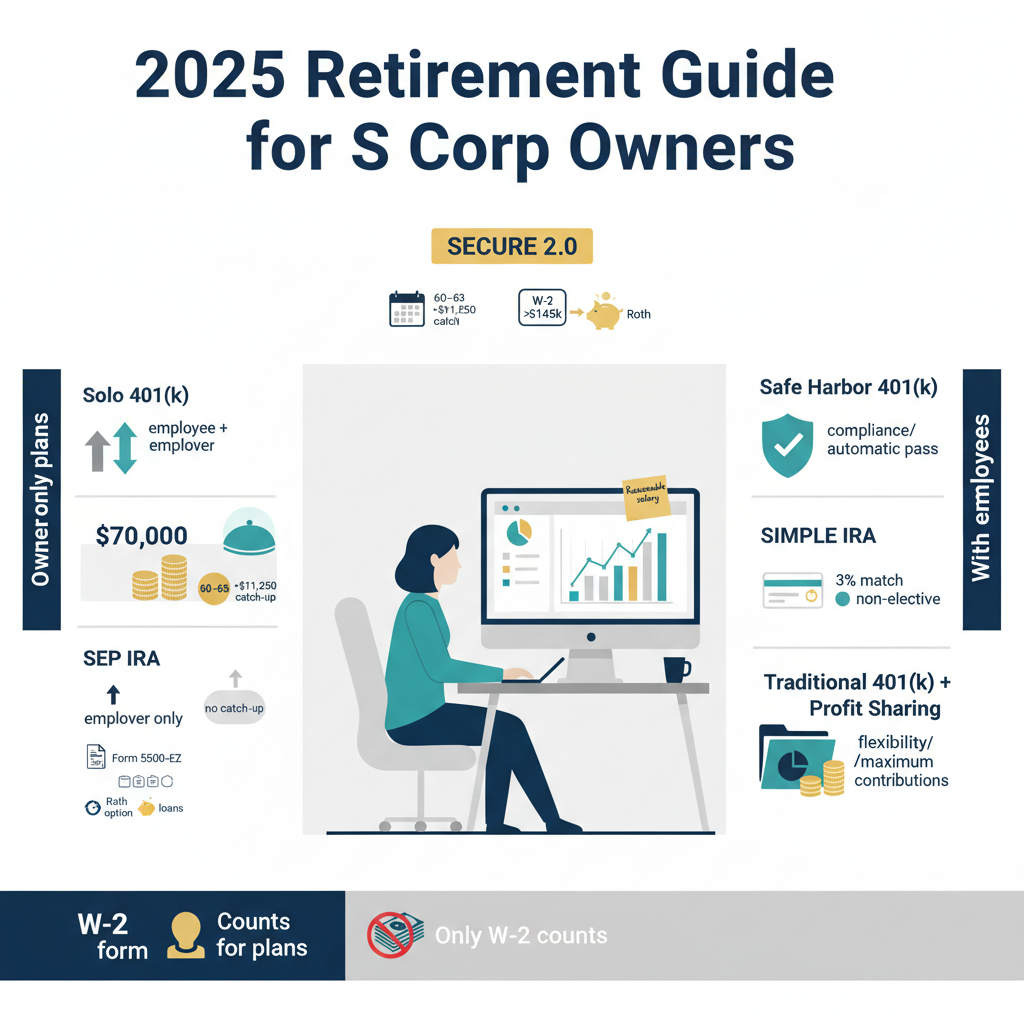

2025 Retirement Guide: Smart Planning for S Corp Owners

2025 Retirement Planning Guide for S Corporation Owners As we navigate through 2025, S corporation owners face crucial decisions in optimizing their retirement planning strategies. With SECURE 2.0 Act implementations introducing enhanced catch-up contributions and innovative plan designs, the options available have never been more diverse. This guide explores the latest retirement planning considerations to help S corporation owners make informed decisions about their retirement future. Understanding S Corporation Retirement Planning Fundamentals The cornerstone of S corporation retirement planning lies in reasonable compensation. According to SDO CPA, compensation must reflect fair market value for similar roles, typically ranging from $40,000 to $150,000 or more, depending on industry, location, and company profitability. For 2025, EP Wealth reports that the maximum combined contribution limit for retirement plans has reached $70,000, with additional catch-up provisions for those over 50. The annual compensation limit for calculating contributions stands at $350,000. As noted by Manning & Napier, only W-2 income counts for qualified retirement plan purposes, creating a balance between minimizing self-employment taxes and maximizing retirement contributions. Solo 401(k) vs SEP IRA for Owner-Only S Corporations According to Guideline, the Solo 401(k) offers superior flexibility through its dual contribution structure. Owners can contribute up to $23,500 as employees and up to 25% of compensation as employers, potentially reaching $70,000 for those under 50. For 2025, individuals aged 60-63 can contribute an additional $11,250 on top of standard catch-up amounts, pushing their potential total to $81,250. This advantage over SEP IRAs is significant, as SEPs don’t offer catch-up contributions. Molen Tax experts note that Solo 401(k)s require Form 5500-EZ filing when assets exceed $250,000, while SEP IRAs maintain minimal paperwork requirements. However, Solo 401(k)s offer unique benefits like loan provisions and Roth contribution options. Advanced Strategies Under SECURE 2.0 The SECURE 2.0 Act introduces significant changes for 2025. According to Milliman, eligible participants aged 60-63 can now contribute up to $11,250 in catch-up contributions, substantially higher than the standard $7,500 catch-up limit for those 50 and older. Important considerations exist for higher earners. Fuse Workforce Management notes that those with FICA wages exceeding $145,000 must make catch-up contributions as Roth contributions starting in 2025. Retirement Plans for S Corporations with Employees Three primary options emerge for 2025: Safe Harbor 401(k)s, SIMPLE IRAs, and traditional 401(k)s with profit-sharing components. Safe Harbor 401(k)s allow employee deferrals up to $23,500, with enhanced catch-up provisions making total contributions of $34,750 possible for those aged 60-63. SIMPLE IRAs offer streamlined administration with lower contribution limits, requiring either a 3% matching contribution or 2% non-elective contribution. Traditional 401(k)s with profit-sharing provide maximum flexibility but require careful cost-benefit analysis. Conclusion The optimal retirement strategy for S corporation owners in 2025 depends on W-2 wage levels, employee headcount, and desired contribution amounts. Solo 401(k)s remain ideal for owner-only businesses, while firms with employees might prefer Safe Harbor 401(k)s or SIMPLE IRAs. Success lies in aligning retirement strategy with business structure while leveraging SECURE 2.0 benefits. Sources [Sources embedded in article]

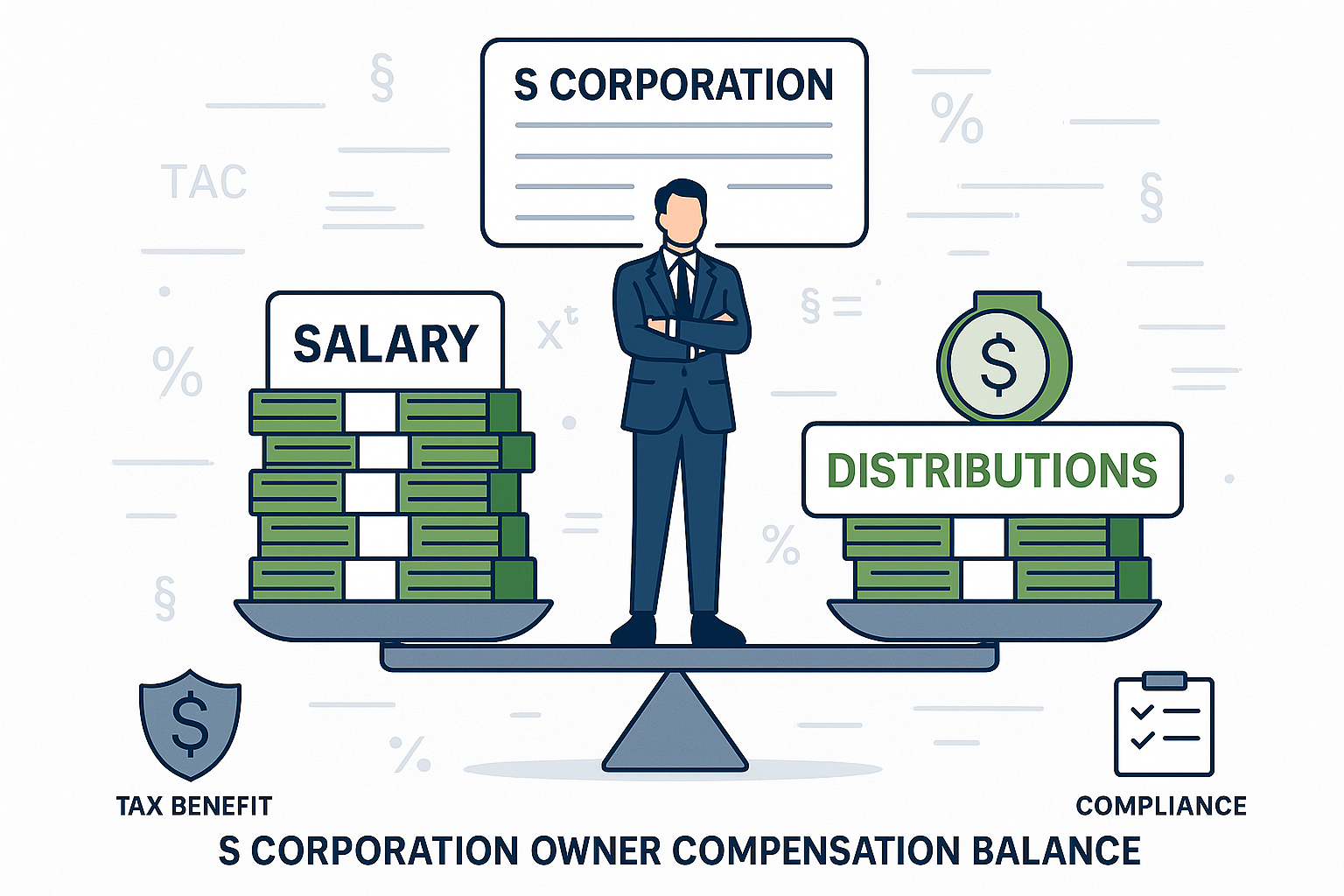

2025 S Corp Compensation Guide: New IRS Rules Explained

S Corporation Reasonable Compensation Guide: 2025 Update In today’s complex tax landscape, S corporation shareholder-employees face increasing scrutiny over their compensation practices. The IRS requires reasonable wages to be paid for services before distributions, with significant consequences for non-compliance. As we navigate through 2024-2025, enhanced enforcement measures, including AI-driven analytics and cross-trigger audits, have intensified the focus on this critical compliance area. Understanding the Current Enforcement Landscape The IRS’s enforcement approach has transformed significantly in 2024-2025, marked by sophisticated technological advancement. According to The Tax Adviser, the IRS now employs AI-powered analytics to detect non-compliance, representing a major shift in enforcement methodology. The agency’s enhanced infrastructure enables precise identification of red flags, particularly focusing on disproportionate distributions relative to reported salaries. Recent tax court decisions suggest that owner-operators should receive salaries equal to at least 70% of comparable market rates, as noted by Pasquesi Partners. Methodologies for Determining Reasonable Compensation The IRS recognizes three primary approaches for establishing reasonable compensation: The Cost Approach (“Many Hats” method): Ideal for small business owners performing multiple roles, this methodology breaks down responsibilities into distinct components with market-rate compensation assigned to each function. The Market Approach: Most favored by federal courts, this method compares owner compensation to similar positions in the same industry, using data from industry surveys and comparable company reports. The Income Approach (Independent Investor Test): Evaluates whether a hypothetical investor would find the return on investment acceptable after accounting for owner compensation. Documentation and Compliance Strategies Maintaining proper documentation is crucial for demonstrating compliance. Recent compliance guidelines emphasize implementing systematic, contemporaneous record-keeping as part of regular business operations. Key documentation requirements include: Detailed records of shareholder-employee duties Time commitment documentation Compensation determination processes Electronic filing systems for mandatory e-filing Beneficial Ownership Information (BOI) reporting Regular reviews of documentation practices Tax Planning Considerations Strategic compensation planning must balance multiple factors in 2025: QBI Deduction Impact: Careful consideration of salary levels against Qualified Business Income optimization, particularly near phase-out thresholds ($394,600/$494,600 for married filing jointly in 2025). Remote Work Implications: With 36 states now offering Pass-Through Entity Tax provisions, multi-state operations require careful planning for withholding obligations and state tax apportionment. Fringe Benefits: Proper W-2 wage classification remains crucial for retirement plan contributions and health insurance premium deductibility for 2% shareholder-employees. Conclusion Success in managing S corporation reasonable compensation requires a well-documented, market-based approach that can withstand scrutiny. By implementing robust documentation practices, utilizing appropriate determination methodologies, and staying current with regulatory changes, S corporation owners can confidently navigate these requirements while optimizing their tax position. Sources Aaron Hall – Legal Review: S Corporation Reasonable Compensation Finally – S Corporation Reasonable Salary Guidelines Pasquesi Partners – The IRS 9-Factor Test for S Corp Reasonable Compensation The Tax Adviser – Advising S Corporation Clients on Reasonable Compensation Tax Executive – State and Local Tax Implications for Remote Workforce

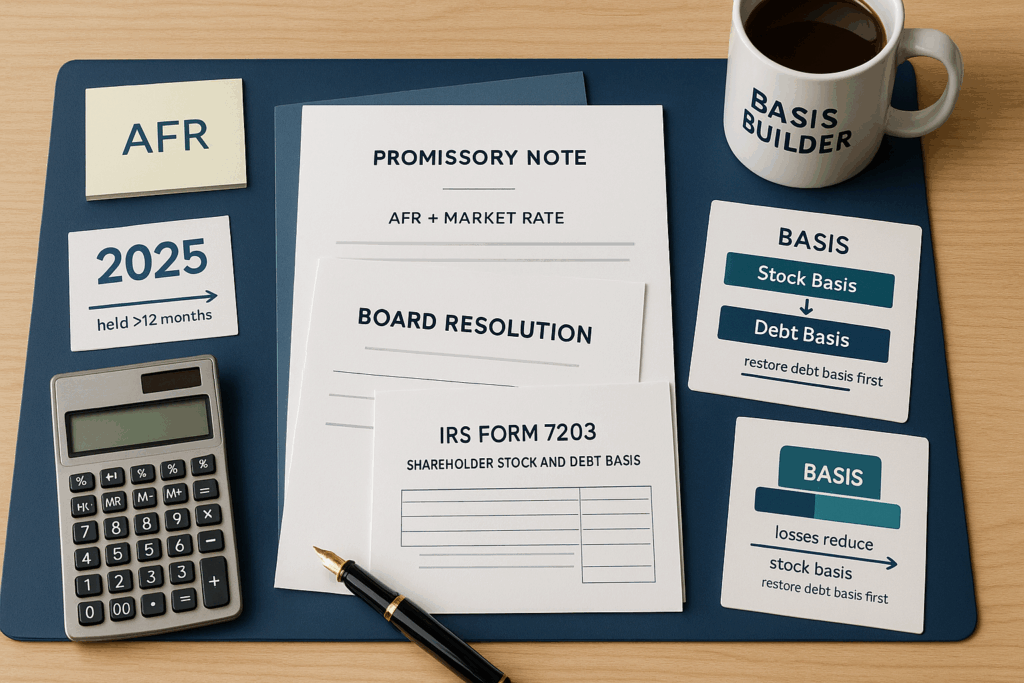

S Corp Shareholder Loans: Your 2025 Tax Planning Guide

S Corporation Shareholder Loans: Essential Guidelines for 2025 In the complex landscape of S Corporation taxation, shareholder loans represent a critical area that demands careful attention and understanding. As we navigate through 2025, the IRS has intensified its scrutiny of these financial arrangements through enhanced reporting requirements, particularly with Form 7203. This guide explores the key rules governing S Corporation shareholder loans, from establishing bona fide indebtedness to managing tax implications. Understanding Bona Fide Indebtedness Requirements The establishment of bona fide indebtedness is crucial for S Corporation shareholder loans to receive favorable tax treatment. According to IRS Bulletin 2012-27, Treasury Regulation Section 1.366-2(a)(2) requires that shareholder loans must represent genuine indebtedness owed directly to the shareholder. This direct creditor relationship is fundamental – loan guarantees are insufficient to establish debt basis. To meet the bona fide indebtedness standard, loans must demonstrate economic substance beyond mere bookkeeping entries. Key requirements include: Formal documentation through promissory notes Market-rate interest charges Established repayment schedules Clear business purpose documentation Proper interest rates at or above IRS Applicable Federal Rates for loans exceeding $10,000 Documentation Standards and Form 7203 Compliance For S Corporation shareholder loans in 2025, maintaining meticulous documentation has become increasingly critical. According to IRS guidelines, loans exceeding $25,000 must be documented through formal promissory notes that include specific interest rates meeting or exceeding the IRS Applicable Federal Rates (AFRs). Corporate board resolutions play a vital role in loan documentation. These resolutions should: Authorize the loan Specify its terms Demonstrate the transaction’s business purpose Support Form 7203 reporting requirements Managing Basis Calculations and Loss Deductions S corporation shareholders must track two distinct types of basis: Stock basis: reflecting direct investment in the corporation Debt basis: representing personal loans to the entity Under IRC Section 1366(d), a shareholder’s ability to deduct losses is limited to their combined stock and debt basis. Stock basis adjustments follow a specific ordering system: Increases: Initial capital contributions and pass-through income Decreases: Distributions and losses When losses exceed stock basis, shareholders can utilize their debt basis but must follow strict restoration rules. Future income must first restore debt basis before increasing stock basis. Tax Treatment of Loan Repayments When an S corporation shareholder’s debt basis has been reduced by passthrough losses, loan repayments can trigger unexpected tax consequences. The character of gain recognition depends on debt structure: Open account receivables: Repayment gains treated as ordinary income Formally documented loans: May qualify for capital gains treatment Strategic timing of repayments can significantly impact tax liability. For capital gains treatment, shareholders should: Utilize written promissory notes with market-rate interest Establish clear repayment terms Hold debt instruments for more than 12 months before repayment Consider spreading repayments across multiple tax years Conclusion Success in navigating S Corporation shareholder loans depends on maintaining proper documentation, understanding basis calculations, and ensuring compliance with current regulations. The introduction of Form 7203 has brought increased transparency to shareholder basis tracking, making it essential to maintain detailed records and seek professional guidance when needed. Sources IRS Bulletin 2012-27 IRS – Instructions for Form 1120S The Tax Adviser – Avoiding Gain When S Corporation Shareholder Loans Are Repaid UpCounsel – Loans to Shareholders S Corp Guide

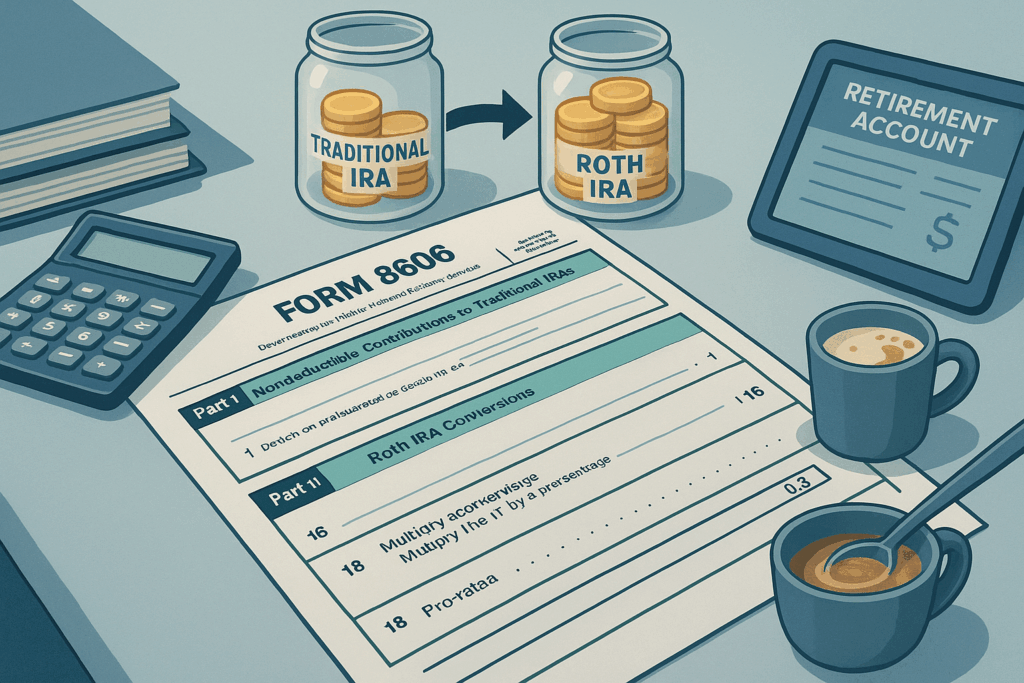

Master Form 8606: The Ultimate IRA Tax Guide for 2025

Form 8606: The Essential Guide to Reporting IRA Contributions and Conversions in 2025 Form 8606 stands as a crucial document in the complex landscape of retirement tax planning, particularly for taxpayers managing nondeductible IRA contributions and Roth conversions. As we move into 2025, understanding this form has become increasingly important with the rising popularity of backdoor Roth conversions and the intricacies of the pro-rata rule. Whether you’re a seasoned investor or new to retirement planning, properly documenting your IRA transactions is essential for tax compliance and avoiding costly penalties. This comprehensive guide explores the purpose of Form 8606, breaks down the reporting requirements for nondeductible contributions, walks through the process of Roth conversions, and provides strategic insights to help you navigate distribution rules while maintaining accurate records for your retirement accounts. The Purpose and Filing Requirements of Form 8606 Form 8606 serves as the critical documentation for tracking nondeductible contributions and distributions related to IRAs. This often-overlooked form plays a vital role in preventing double taxation and ensuring proper reporting of retirement account transactions to the IRS. Form 8606 fulfills three essential functions in IRA reporting. First, it documents nondeductible contributions to traditional IRAs, particularly important when your income exceeds deduction limits. Second, it calculates the taxable portion of distributions from traditional, SEP, or SIMPLE IRAs that contain nondeductible contributions. Third, it tracks Roth IRA conversions and distributions, establishing the basis for future tax-free withdrawals [Source: Wolters Kluwer]. You must file Form 8606 in several specific circumstances. The most common is when making nondeductible contributions to a traditional IRA. For 2025, contribution limits are $7,000 for those under 50 and $8,000 for those 50 and older. The form is also required when taking distributions from IRAs with nondeductible contributions, when converting traditional IRAs to Roth IRAs, and when receiving certain distributions from Roth IRAs [Source: TurboTax]. For the 2025 tax year (filed in 2026), Form 8606 has expanded to address recent tax law changes related to special distribution types. These include qualified birth/adoption distributions, domestic abuse distributions, emergency personal expense distributions, and terminal illness distributions [Source: ASPPA]. These updates ensure proper tracking of these specialized withdrawals that may have different tax treatments. The consequences of failing to file Form 8606 can be serious. The IRS imposes a $50 penalty for each instance of non-filing unless you can demonstrate reasonable cause [Source: Investopedia]. More significantly, without this form, you risk losing track of your basis (nondeductible contributions), potentially leading to double taxation when you withdraw funds. Additionally, overstating nondeductible contributions can result in a $100 penalty if deemed non-accidental. Form 8606 must be filed with your annual tax return (Form 1040) by the standard tax filing deadline—typically April 15th of the following year. For the 2025 tax year, this would be April 15, 2026, unless extensions apply [Source: IRS]. Consider a practical example: You contribute $7,500 (nondeductible) to a Traditional IRA in 2025 and immediately convert it to a Roth IRA. On Form 8606, you would report the total contribution on Line 1 ($7,500) and track the basis to ensure tax-free growth [Source: WealthKeel]. Without this documentation, you might face double taxation when eventually withdrawing these funds. Another scenario: You have $30,000 in Traditional IRAs, with $5,000 being nondeductible contributions reported on previous Form 8606 filings. If you take a $10,000 distribution in 2025, Form 8606 calculates the tax-free portion using the pro-rata rule and reports the taxable and non-taxable amounts appropriately [Source: Teach Me Personal Finance]. Form 8606 creates a permanent record that the IRS uses to verify the nontaxable portions of your future IRA distributions. This documentation is particularly valuable when switching tax preparers or dealing with inherited IRAs that have basis from nondeductible contributions. Even when accountants suggest otherwise, submitting Form 8606 with proper documentation remains a best practice to protect yourself from future tax complications. Mastering Nondeductible Contributions and the Pro-Rata Rule Understanding nondeductible IRA contributions and navigating the pro-rata rule are essential skills for maximizing retirement tax strategies, especially for higher-income earners who face contribution restrictions elsewhere. This chapter dives deep into these concepts, providing the knowledge you need to make informed decisions and properly report them on Form 8606. What Are Nondeductible IRA Contributions? Nondeductible IRA contributions are after-tax dollars placed into a traditional IRA when you’re unable to claim a tax deduction for those contributions. Unlike their deductible counterparts, these contributions don’t reduce your current-year taxable income, but they do create a valuable “basis” in your IRA that can be withdrawn tax-free in the future [Source: SoFi]. The primary benefits of nondeductible contributions include: Tax-deferred growth on all earnings until withdrawal No income limits for eligibility to contribute Partial tax-free withdrawals in retirement (the contributed principal) Backdoor Roth IRA potential for high-income earners For 2025, you can contribute up to $7,000 if you’re under 50 years old or $8,000 if you’re 50 or older [Source: Fidelity]. When Nondeductible Contributions Make Sense Nondeductible contributions become particularly relevant when: Your income exceeds deduction thresholds for traditional IRAs (for 2025, that’s above $89,000 for single filers with a workplace plan, or above $146,000 for joint filers with a workplace plan) You’re already maximizing contributions to workplace retirement plans You earn too much to contribute directly to a Roth IRA but want the eventual benefits of Roth-style tax-free withdrawals [Source: NerdWallet] The Pro-Rata Rule Explained When you have both pre-tax (deductible) and after-tax (nondeductible) money in your traditional IRAs, the pro-rata rule comes into play. As the IRS explains it, you cannot cherry-pick which funds to withdraw or convert first. The famous “cream in coffee” analogy illustrates this concept perfectly: imagine your total IRA funds as a cup of coffee mixed with cream. The cream represents your after-tax contributions, while the coffee represents your pre-tax funds. When you take a sip (withdrawal or conversion), you get a proportional mix of both cream and coffee—you can’t selectively drink just the cream [Source: FI Tax Guy]. The rule applies across all your traditional, SEP, and SIMPLE IRAs collectively, not

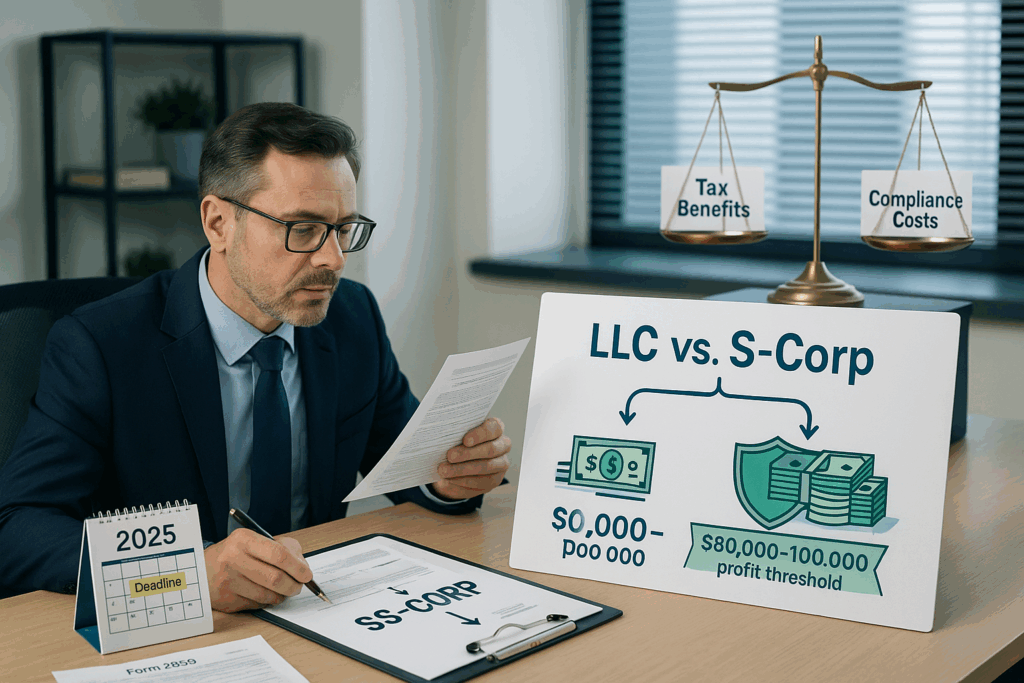

S Corporation Tax Advantages: When to Make the Switch in 2025

Maximizing Tax Benefits: When to Choose an S Corporation Structure in 2025 In the complex landscape of business entity selection, few choices carry as much tax and operational significance as deciding whether to form an S Corporation. As 2025 brings us closer to key tax provision expirations, entrepreneurs must carefully evaluate the implications of S Corp election against alternatives like LLCs. This choice extends beyond mere tax considerations into areas of governance, growth potential, and compliance requirements. With the 20% Qualified Business Income (QBI) deduction set to expire after 2025 and evolving IRS regulations, business owners face a critical window for strategic entity planning. This article examines when S Corporation status delivers optimal benefits, when alternative structures may better serve your goals, and provides a framework for making this consequential business decision. When to Choose an S Corporation Structure Determining the ideal time to elect S Corporation status requires careful consideration of your business financials and growth trajectory. The decision typically hinges on reaching a specific profitability threshold where tax benefits outweigh the additional compliance costs. The general consensus among tax professionals is that businesses generating between $80,000 to $100,000 in annual profits typically begin to see meaningful advantages from S Corporation status [Source: Long Gilbert & Co]. At this profit level, the self-employment tax savings become substantial enough to justify the additional paperwork and compliance requirements. Let’s examine the math: Consider a business making $100,000 in net income. As a single-member LLC, you’d pay self-employment tax (15.3%) on the entire amount, resulting in approximately $15,300 in self-employment taxes. By contrast, an S Corporation owner could take a $60,000 reasonable salary (subject to payroll taxes) and $40,000 in distributions. The payroll taxes would apply only to the $60,000 salary, saving roughly $6,120 in self-employment taxes on the distribution portion [Source: Collective]. As profitability increases, so do the potential tax savings. At $200,000 in earnings, an LLC owner pays self-employment tax on the entire amount ($30,600), while an S Corporation owner with an $80,000 reasonable salary and $120,000 in distributions would pay significantly less—approximately $12,240 in payroll taxes on the salary portion, resulting in over $18,000 in tax savings [Source: Thomson Reuters]. Timing your S Corporation election requires understanding important deadlines. For newly formed businesses, Form 2553 must be filed within 75 days of formation to secure S Corporation status for the first tax year [Source: Harbor Compliance]. For existing businesses operating on a calendar year, the deadline is March 15th of the year the election will take effect [Source: Gordon Law]. Business stability is another crucial consideration. S Corporations thrive in environments with predictable cash flows and steady growth patterns. Industries like professional services, healthcare, consulting, and consumer goods typically benefit most from S Corporation status due to their relatively stable income patterns [Source: Tax Planiq]. Conversely, businesses in highly volatile sectors like technology startups, cyclical commodities, or seasonal retail may find the tax benefits inconsistent due to unpredictable income fluctuations. S Corporation status also offers significant advantages for retirement planning. Owners can implement powerful strategies like combining Solo 401(k) plans with cash balance plans, potentially allowing contributions exceeding $500,000 annually [Source: Emparion]. The structure enables both employer and employee contributions to retirement plans, significantly boosting tax-advantaged savings compared to sole proprietorships [Source: RC Reports]. Recent policy developments have further enhanced S Corporation benefits. For instance, SALT parity reforms adopted in 31 states allow pass-through entities to deduct state income taxes at the entity level, saving businesses over $10 billion annually [Source: S-CORP]. The decision to elect S Corporation status should align with your business’s growth stage, industry characteristics, and retirement goals. When your business consistently generates profits above $80,000-$100,000, operates in a relatively stable industry, and you’re seeking to maximize retirement contributions while minimizing self-employment taxes, an S Corporation structure likely makes financial sense. Limitations and Drawbacks of S Corporation Status While S Corporations offer significant tax benefits, they come with substantial restrictions and operational burdens that can outweigh the advantages for many businesses. Understanding these limitations is crucial before making this election. The ownership restrictions for S Corporations are particularly stringent. Companies are limited to a maximum of 100 shareholders, though family members can be counted as a single shareholder to provide some flexibility [Source: Fusion Taxes]. Only U.S. citizens and resident aliens can own shares, completely excluding foreign investors and entities from ownership [Source: Collective]. This can severely restrict growth opportunities, especially for businesses with international ambitions. Perhaps the most limiting restriction for growth-oriented businesses is the single class of stock requirement. S Corporations cannot issue different classes of stock with varying rights or preferences, making them incompatible with venture capital funding structures [Source: CooleyGo]. Venture capitalists typically require preferred stock with anti-dilution protections, liquidation preferences, and redemption rights—none of which are available with S Corporation status. This forces growing businesses to either forego significant investment opportunities or abandon their S election entirely. The compliance burden for S Corporations is substantial and often underestimated. Owners must maintain formal corporate practices including board meetings and detailed minutes [Source: Block Advisors]. Additionally, they face complex tax filing requirements, including the annual Form 1120-S, Schedule K-1 for each shareholder, and quarterly payroll tax returns [Source: IRS]. This paperwork burden translates to higher accounting costs, with many S Corporations spending $2,000-$5,000 annually on compliance. The “reasonable compensation” requirement poses another significant challenge. S Corporation owner-employees must pay themselves a market-rate salary before taking distributions [Source: Collective]. The IRS closely scrutinizes these arrangements, and underpayment can result in reclassification of distributions as wages subject to employment taxes, plus penalties [Source: ADP]. S Corporations also impose rigid profit distribution requirements. Unlike LLCs, which allow flexible distributions, S Corporations must allocate profits strictly according to ownership percentages [Source: MBO Partners]. This restricts the ability to reward shareholders based on their contributions or involvement. Finally, basis limitations can restrict the ability to deduct losses. S Corporation shareholders can only deduct losses to the extent of their basis in the company, potentially leaving valuable tax

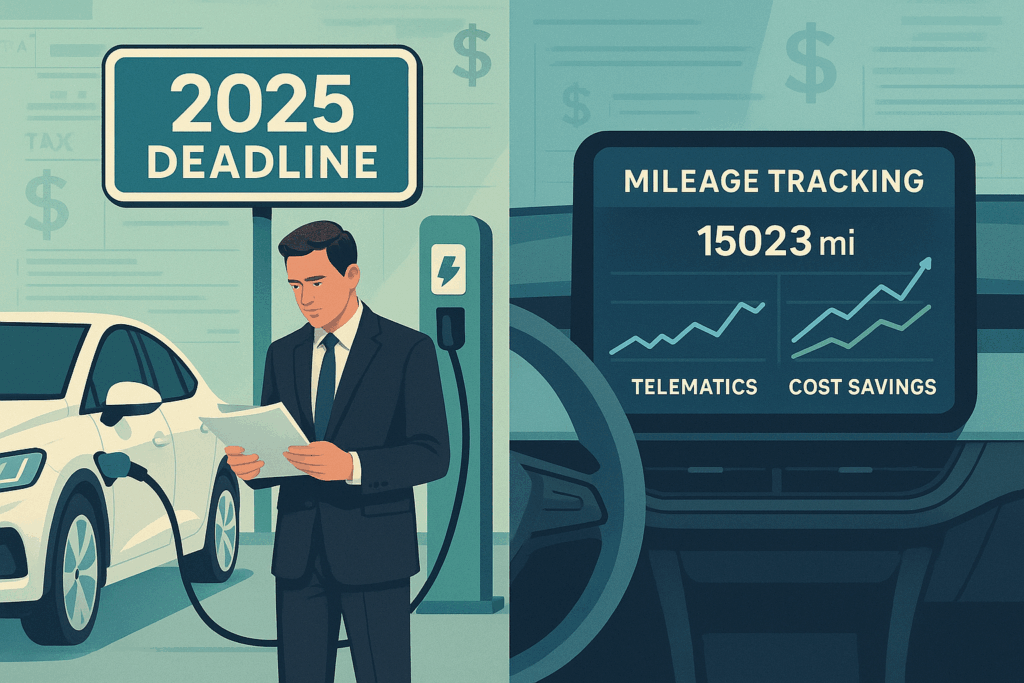

2025 Business Vehicle Strategy: Tax Breaks Before Deadlines

Navigating Business Vehicle Decisions in 2025: Tax Incentives, Rising Costs, and Compliance In today’s economic climate, small business owners face increasingly complex decisions regarding their business vehicles. With rising costs across fuel, insurance, and maintenance, combined with evolving tax regulations and incentives, the right vehicle strategy can significantly impact your bottom line. The year 2025 brings notable changes: the IRS has increased the standard mileage rate to 70 cents per mile, modified Section 280F luxury auto limits, and maintained generous clean vehicle incentives with approaching deadlines. This guide explores how small businesses can optimize vehicle expenses, ensure compliance, and leverage available tax benefits. Clean Vehicle Incentives: A Closing Window of Opportunity Small businesses looking to electrify their fleets in 2025 have powerful but rapidly expiring tax incentives to consider. The Commercial Clean Vehicle Credit (Section 45W) faces a critical sunset date of September 30, 2025 [Source: IRA Tracker], while the Alternative Fuel Vehicle Refueling Property Credit (Section 30C) remains available until June 30, 2026 [Source: Electrification Coalition]. For the 45W credit, businesses can claim the lesser of: 30% of the vehicle’s basis (15% for hybrid vehicles) The incremental cost compared to similar gasoline/diesel vehicles Maximum credits are $7,500 for vehicles under 14,000 pounds GVWR and $40,000 for heavier vehicles [Source: Cherry Bekaert]. Qualifying vehicles must: Be manufactured by qualified manufacturers Be used primarily for business in the United States Meet battery capacity requirements (at least 7 kilowatt hours for vehicles under 14,000 pounds) Be subject to depreciation [Source: IRS] For charging infrastructure, Section 30C offers a 30% credit up to $100,000 per charging station, covering both equipment and associated infrastructure costs [Source: MGO]. Approximately 99% of U.S. land area now qualifies under rural or underserved community provisions [Source: Crux Climate]. Tax-exempt organizations can also benefit through Elective Pay provisions, transforming tax credits into direct payments from the Treasury [Source: Treasury Department]. Managing Rising Insurance Costs Through Technology Commercial auto insurance has become a major expense, with premium increases reaching alarming levels. In early 2024, rates jumped between 9% and 9.8%, approaching 10% by year-end [Source: Dom Risk]. This trend continues into 2025, with first-quarter rates showing a 9.4% year-over-year increase. Driving factors include: Widespread driver shortages “Nuclear verdicts” with massive settlements Inflation affecting repair costs Increased distracted driving incidents Telematics technology offers a powerful solution for controlling these costs. These systems enable usage-based insurance (UBI) that rewards safe driving behaviors with lower premiums. Small businesses implementing telematics can achieve immediate premium discounts of up to 30-40% [Source: Bankrate]. Key safety metrics tracked include: Hard braking frequency Speed compliance Acceleration patterns [Source: McGriff] Implementation costs typically range from $15-$50 per vehicle monthly for software, with hardware expenses varying by system complexity [Source: Tech.co]. Options include comprehensive fleet management platforms like Samsara, telematics-focused solutions like Omnitracs, or basic GPS tracking systems. Beyond insurance savings, telematics provides additional benefits: Route optimization reduces fuel costs Driver monitoring extends vehicle life Preventive maintenance scheduling prevents costly breakdowns Documentation of business usage for tax purposes [Source: Geotab] Substantiation and Audit-Proofing Your Vehicle Deductions Vehicle deductions represent significant tax-saving opportunities but also rank among the most scrutinized areas during IRS audits. With standard mileage rates reaching 70 cents per mile in 2025 [Source: Everlance], proper documentation is essential. The IRS requires “contemporaneous” record-keeping, meaning documentation must be created at or near the time of each business trip [Source: Geotab]. A compliant mileage log must include: Date of each trip Starting and ending locations Business purpose Odometer readings Total business miles driven Additionally, you must maintain annual records showing total business versus personal mileage to establish your business-use percentage [Source: DriversNote]. The 50% business use threshold is particularly critical. Section 179 deductions and accelerated depreciation require your vehicle to be used more than 50% for business purposes throughout its class life [Source: Section179.org]. If business use drops below this threshold in subsequent years, you face “recapture” of previously claimed deductions. Common red flags include claiming exactly 100% business use, using round numbers for business percentages, showing inconsistent year-over-year patterns, and including commuting miles improperly [Source: JR Martin CPA]. Modern GPS-enabled mileage tracking apps automatically separate business from personal miles while providing detailed documentation. Leading options include MileIQ, TripLog, Everlance, and Fyle [Source: Fyle]. Conclusion Optimizing your small business vehicle strategy requires balancing immediate tax benefits with long-term operational considerations. The increased 2025 standard mileage rate offers potentially greater deductions for high-mileage businesses, while clean vehicle incentives provide substantial savings before expiration. Regardless of your vehicle choice, meticulous record-keeping remains essential, and telematics can both reduce insurance costs and strengthen documentation practices. By treating business vehicles as strategic assets rather than mere expenses, you’ll maximize tax benefits while building a more efficient and audit-resistant operation. Sources Bankrate – Telematics insurance facing new heat over privacy concerns Cherry Bekaert – Section 45W Tax Credit Updates for Commercial EVs Crux Climate – 30C Proposed Guidance Dom Risk – 2025 Market Outlook Commercial Auto Insurance DriversNote – IRS Mileage Log Requirements Electrification Coalition – EV and Charging Tax Credits After the One Big Beautiful Bill Act Everlance – IRS Mileage Rate 2025 for Insurance Agents Fyle – 5 Mistakes When Claiming IRS Mileage Deductions Geotab – Fleet Costs Geotab – IRS Mileage Log Requirements Treasury Department – Elective Pay Presentation IRA Tracker – IRA Section 13403 Clean Commercial Vehicle Credit IRS – Alternative Fuel Vehicle Refueling Property Credit for Tax-Exempt Entities IRS – Commercial Clean Vehicle Credit JR Martin CPA – Vehicle Deduction Red Flags That Could Trigger IRS Audit McGriff – Leveraging telematics for large trucking firms MGO – 2025 Clean Energy Tax Credit Deadlines Section179.org – Section 179 Vehicle Deductions Tech.co – Fleet Management Cost

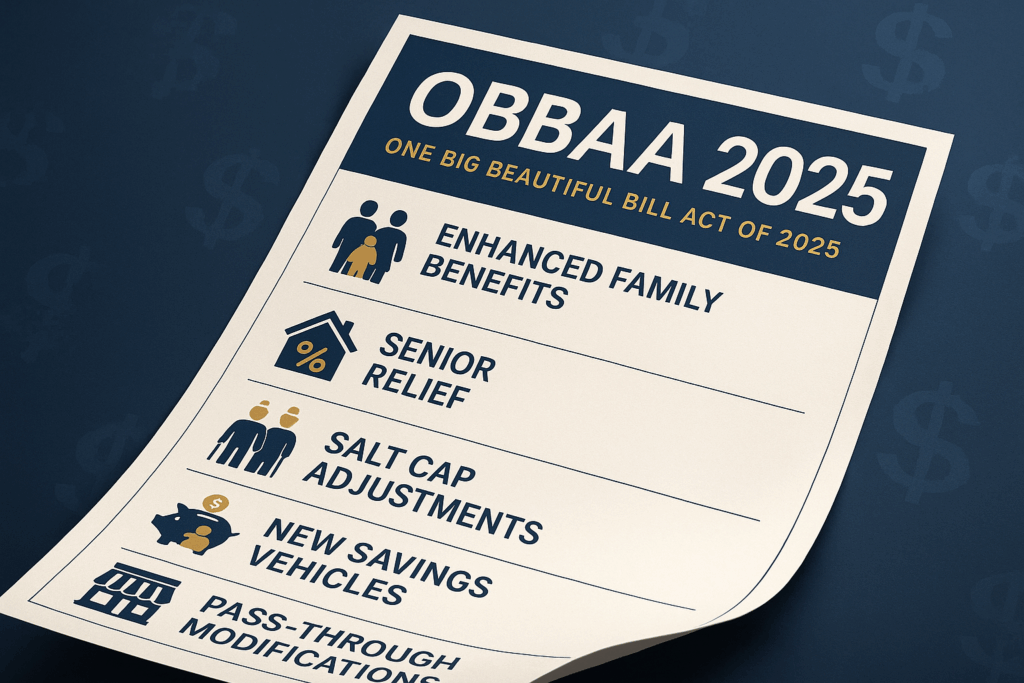

2025 Tax Reform: What the OBBAA Means for Your Money

The One Big Beautiful Bill Act of 2025: Tax Reform Overview The One Big Beautiful Bill Act (OBBAA), enacted in July 2025, represents the most sweeping tax reform since the 2017 Tax Cuts and Jobs Act. This landmark legislation makes permanent many TCJA provisions while introducing significant enhancements to individual tax benefits, family credits, and retirement savings options. For taxpayers across all demographics, the law brings certainty through permanent rate structures, expanded deductions, targeted relief for seniors and high-SALT taxpayers, and innovative planning opportunities spanning education, retirement, and estate planning. Enhanced Family Benefits The OBBAA delivers significant improvements to family tax benefits, increasing the Child Tax Credit (CTC) from $2,000 to $2,200 per qualifying child under age 17 for the 2025 tax year [Source: Jackson Hewitt]. This $200 increase comes with a refundable portion set at $1,700, meaning families can receive up to this amount as a refund even if they owe no taxes. A critical improvement is the implementation of automatic inflation adjustments beginning in 2026. Both the base credit amount and the refundable portion will increase annually based on cost-of-living adjustments [Source: Instead.com], ensuring the credit maintains its purchasing power over time. The Act also permanently establishes the $500 nonrefundable credit for non-child dependents [Source: Bipartisan Policy Center], benefiting families caring for qualifying dependents who don’t meet the child tax credit requirements. Eligibility requirements have been strengthened under the new legislation. Both the qualifying child and the taxpayer claiming the credit must now possess Social Security Numbers that make them eligible for work in the United States [Source: Ways and Means Committee]. For married couples filing jointly, at least one spouse must have a valid SSN to claim the credit. The income phase-out thresholds remain at $200,000 for single filers, heads of household, and qualifying surviving spouses, and $400,000 for married couples filing jointly [Source: TurboTax], ensuring middle-income families maintain full access to the credit. Senior Relief and SALT Cap Adjustments The OBBAA introduces two targeted tax relief provisions: a new senior deduction and an enhanced State and Local Tax (SALT) cap. The temporary senior deduction provides $6,000 per eligible individual aged 65 or older for tax years 2025 through 2028 [Source: IRS]. This benefit is available regardless of whether taxpayers itemize deductions or take the standard deduction, making it particularly valuable for seniors who itemize [Source: Ameriprise Financial]. For married couples filing jointly, each eligible spouse can claim the deduction, potentially providing up to $12,000 in additional deductions. However, the deduction begins to phase out at a 6% rate when Modified Adjusted Gross Income (MAGI) exceeds $75,000 for single filers or $150,000 for joint filers [Source: Bipartisan Policy Center]. The SALT deduction cap increases from $10,000 to $40,000 starting in 2025 [Source: Thomson Reuters], primarily benefiting homeowners in high-tax states. The enhanced cap includes an income-based phase-out beginning at $500,000 MAGI, with benefits reducing at a 30% rate for income above this threshold, but never falling below the original $10,000 floor [Source: Bipartisan Policy Center]. Both provisions include inflation adjustments through 2029, though they remain temporary, with the senior deduction expiring after 2028 and the enhanced SALT cap reverting to $10,000 in 2030. New Savings Vehicles and Wealth Transfer Opportunities The OBBAA introduces innovative savings vehicles and wealth transfer opportunities. A centerpiece is the creation of birth-based custodial “Trump Accounts” established under new IRC section 530A. These special accounts function as IRAs for minors under 18 before transitioning to traditional IRA rules [Source: Benefits Law Advisor]. For children born between January 1, 2025, and December 31, 2028, who are U.S. citizens, the government provides a $1,000 seed contribution from the Treasury [Source: Kiplinger]. Employers can contribute up to $2,500 annually to employees’ children’s accounts, while parents and relatives can contribute up to $5,000 in after-tax dollars each year, with contributions ceasing once the child reaches 18. The Act also expands 529 plan flexibility by making permanent the tax-free rollover provision from qualified 529 tuition programs to ABLE accounts [Source: Kutak Rock], allowing families to redirect unused education savings toward supporting individuals with disabilities without tax penalties. Health Savings Account provisions receive significant enhancements, including permanent telehealth relief that allows high-deductible health plans to provide first-dollar coverage for telehealth services without affecting HSA eligibility [Source: Stinson]. For wealth transfer planning, beginning January 1, 2026, the federal estate, gift, and generation-skipping transfer tax exemptions increase to $15 million per individual and $30 million for married couples [Source: Davis & Gilbert], indexed for inflation starting in 2027. Pass-Through Business Modifications The OBBAA permanently extends and enhances the Section 199A Qualified Business Income (QBI) deduction. The legislation maintained the 20% rate but expanded the phase-in ranges for specified service trades or businesses from $50,000 to $75,000 for individuals and from $100,000 to $150,000 for joint filers [Source: Foster Garvey]. A significant addition is the new inflation-adjusted minimum QBI deduction of $400 beginning in 2026 for taxpayers with at least $1,000 of qualified business income from businesses in which they materially participate [Source: Buchanan Ingersoll & Rooney]. Combined with the enhanced Section 179 expensing limits—increased to $2.5 million with a $4 million investment threshold—these provisions create powerful incentives for business investment and growth [Source: NK CPA]. Conclusion The One Big Beautiful Bill Act of 2025 provides unprecedented tax certainty for individuals and families while creating substantial new planning opportunities. As these provisions phase in with varying timelines and eligibility requirements, taxpayers should work with qualified advisors to optimize their tax positions and take full advantage of the law’s benefits while navigating its complexities. Sources Advisors Vanguard – Reference Guide for Advisors on the One Big Beautiful Bill Ameriprise Financial – One Big Beautiful Bill Tax Cuts Benefits Law Advisor – New Tax-Favored Benefit for Employees with Children Bipartisan Policy Center – How the OBBB Changes to the Child Tax Credit Will Impact Families Bipartisan Policy Center – How Would the 2025 House Tax Bill Change the SALT Deduction? Bipartisan Policy Center – The 2025 Tax Bill Additional 6000 Deduction for Seniors

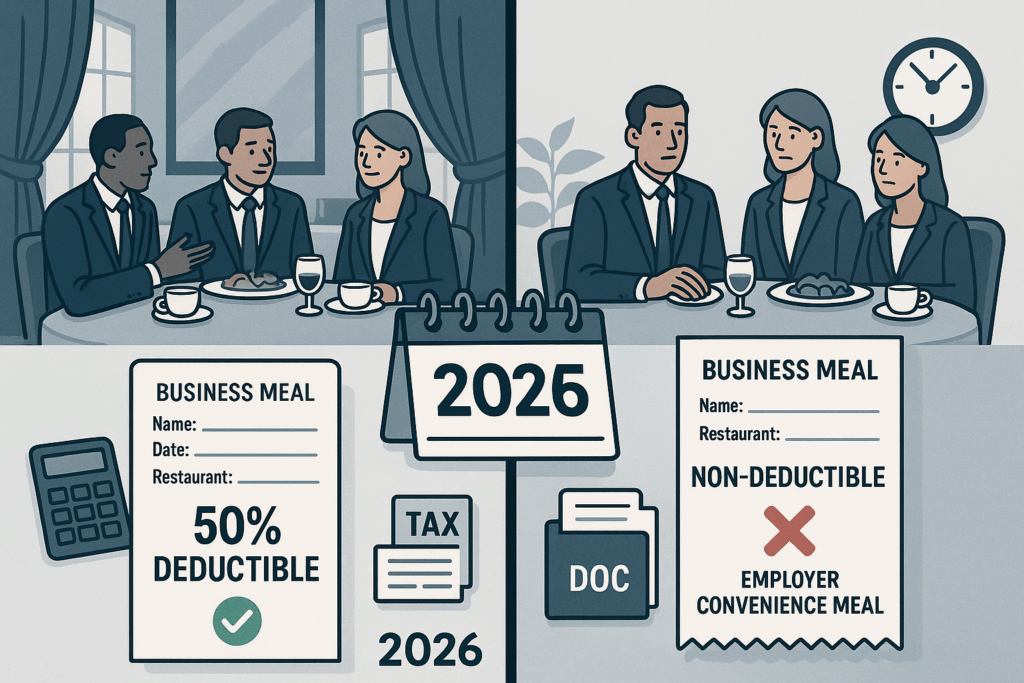

Business Meal Deductions: 2025-2026 Tax Changes Explained

Navigating Business Meal Deductions: 2025-2026 Transition Guide As businesses approach the critical 2025-2026 transition period, understanding the evolving landscape of business meal deductions has never been more important. The Tax Cuts and Jobs Act (TCJA) sunset provisions are set to dramatically alter how organizations can deduct meal-related expenses. Currently, most business meals qualify for 50% deductibility, with specific categories eligible for 100% deductions and transportation workers enjoying an 80% deduction rate. However, starting January 1, 2026, meals provided for employer convenience and de minimis fringe benefits will become entirely non-deductible. This comprehensive guide explores the current rules, upcoming changes, documentation requirements, and strategic approaches to help businesses maximize deductions while preparing for the significant regulatory shift ahead. Critical Documentation and Substantiation Requirements Maintaining proper documentation for business meal deductions isn’t just good practice—it’s essential for IRS compliance and protecting your deductions during potential audits. The IRS applies rigorous substantiation standards under Section 274(d) that go beyond typical business expense requirements. Fundamental Documentation Standards Section 274(d) establishes stringent substantiation requirements that demand meticulous record-keeping for all business meal expenses. For each meal, you must document five critical elements [Source: The Tax Adviser]: Amount – The exact cost of the meal, including tax and tips Date – When the meal occurred Place – Restaurant name and location Business purpose – Specific business topics discussed Attendees – Names and business relationships of all participants This documentation must establish that the expense was ordinary, necessary, and directly connected to your trade or business operations. Vague or general descriptions like “business meeting” or “client lunch” are insufficient and likely to be disallowed during an audit [Source: PKF O’Connor Davies]. Receipt Requirements and Best Practices The IRS specifically requires receipts for all business meal expenses of $75 or more [Source: PKF O’Connor Davies]. However, tax professionals universally recommend keeping receipts for all business meals regardless of amount. Remember that the receipt alone isn’t sufficient—it must be accompanied by documentation of the business purpose and attendee information. When calculating deductible meal costs, include: The meal itself Sales tax Tips However, transportation costs to and from the restaurant aren’t considered part of the meal expense (though they may qualify for separate transportation deductions) [Source: IRS]. Paper vs. Electronic Record-Keeping The IRS accepts both paper and electronic documentation systems, provided they meet all substantiation requirements [Source: Neat]. However, digital documentation offers significant advantages: Digital Documentation Benefits: Cloud-based storage provides backup protection against loss or damage Searchable databases allow quick retrieval during audits Integration with accounting software streamlines tax preparation Mobile capture ensures contemporaneous recording Automatic categorization reduces manual entry errors Paper receipts, especially thermal receipts commonly used by restaurants, fade over time and become unreadable—potentially leaving you without required documentation during an audit [Source: Neat]. The IRS established the legal foundation for electronic record-keeping through Revenue Procedure 97-22, which grants digital documentation full legal standing for tax purposes [Source: Zoho]. This means properly maintained digital records carry the same weight as original paper documents. Implementing Effective Documentation Systems Modern technology offers powerful solutions for meeting business meal documentation requirements: Mobile Apps for Receipt Capture Advanced mobile applications utilize SmartScan technology to automatically extract information from photographed receipts, categorize expenses, and apply the correct deduction rules [Source: Expensify]. These systems transform receipt management from a tedious task into a streamlined process that ensures complete documentation. Calendar Integration for Business Purpose The most effective documentation systems integrate with your digital calendar to create contemporaneous records of business meetings. This integration automatically establishes who attended the meal and provides a timestamp that satisfies the IRS requirement for contemporaneous documentation [Source: Myshyft]. Contemporaneous Record-Keeping Practices The timing of your documentation matters significantly. Records created at or near the time of the expense (contemporaneous records) carry much more weight with the IRS than documentation created weeks or months later. Tax courts consistently disallow deductions when business purpose documentation wasn’t prepared contemporaneously with the expense [Source: Journal of Accountancy]. Documentation for Different Types of Business Meals Different categories of business meals require specific documentation approaches: Client Meetings For client meals, document the business relationship of each attendee and provide detailed notes on business topics discussed. This category receives the highest level of IRS scrutiny, so documentation must clearly demonstrate how the discussion directly relates to generating revenue, maintaining client relationships, or developing new business [Source: PKF O’Connor Davies]. Employee Events Company-wide events like holiday parties (100% deductible) require documentation of employee attendance, the business purpose of fostering employee relations, and receipts showing total costs. For meals provided during employee meetings, document the business topics discussed and maintain attendance records [Source: Taxfyle]. Travel Meals Business travel meals require documentation that clearly separates business from personal expenses. Maintain records of the travel purpose along with meal receipts. When using the per diem method, you must still document travel dates, destinations, and business purposes, though individual meal receipts aren’t required [Source: Fyle]. Special Considerations for Transportation Workers Transportation workers subject to Department of Transportation hours-of-service limitations face different substantiation requirements when using per diem allowances. For 2025, transportation workers can deduct 80% of meal expenses (versus the standard 50% for other businesses) and can use simplified per diem rates. When using per diem rates (currently $80 for Continental US and $86 for Outside Continental US), transportation workers must still maintain documentation of: Travel dates Locations visited Business purpose of travel While detailed receipts aren’t required when using per diem rates, you must still maintain logs showing dates, locations, and business purposes [Source: IRS Publication 463]. Common Documentation Pitfalls The IRS frequently disallows business meal deductions due to documentation failures. A recent Tax Court case (T.C. Memo. 2024-82) illustrates what doesn’t work: a software consultant claimed nearly $9,000 in meal expenses as “working lunches” with colleagues but provided only bank statements as proof. The court rejected these deductions because the documentation failed to establish both the business purpose and the relationship of the individuals involved [Source: Botwinick]. Other common pitfalls include: Insufficient detail – Vague descriptions like “business