The Mega Backdoor Roth Strategy: Maximizing Retirement Savings in 2025

The Mega Backdoor Roth strategy has emerged as a powerful financial tool for high-income earners looking to optimize their retirement savings beyond traditional limits. In 2025, this approach continues to evolve with increased contribution limits and more flexible rules designed to enhance wealth accumulation in tax-advantaged accounts. By leveraging after-tax contributions to employer-sponsored retirement plans, individuals can potentially funnel tens of thousands of additional dollars into Roth accounts, where investments grow tax-free and qualified withdrawals remain untaxed. As retirement planning becomes increasingly complex amid changing tax regulations and economic uncertainties, understanding the intricacies of the Mega Backdoor Roth has become essential for those seeking to maximize their long-term financial security while minimizing tax burdens in retirement.

Employer Plan Requirements and Future Outlook

The success of implementing a Mega Backdoor Roth strategy hinges critically on whether your employer’s retirement plan has specific features in place. Not all 401(k) plans are created equal, and the availability of this advanced strategy depends on particular plan provisions that employers must explicitly include.

Essential Plan Features

For a Mega Backdoor Roth to be viable, your employer’s 401(k) plan must include two fundamental components. First, the plan must permit voluntary after-tax contributions beyond the standard pre-tax or Roth deferral limits [Source: Fidelity]. These after-tax contributions are entirely separate from your regular salary deferrals and typically don’t qualify for employer matching. This provision is non-negotiable—without it, the strategy cannot be implemented.

Second, the plan must offer a mechanism to convert these after-tax funds to Roth status through either in-service withdrawals or in-plan conversions [Source: NerdWallet]. The in-service withdrawal option allows you to transfer after-tax contributions (and their earnings) to a Roth IRA, while the in-plan conversion option lets you move these funds directly into the plan’s Roth 401(k) component.

An often-overlooked requirement is that employer plans must pass nondiscrimination tests when after-tax contributions are involved. The Average Contribution Percentage (ACP) test measures whether highly compensated employees (HCEs) contribute disproportionately compared to non-highly compensated employees (NHCEs) [Source: Finturity]. If too few rank-and-file employees participate, the plan may fail this test, forcing refunds of contributions to HCEs and effectively derailing the Mega Backdoor strategy.

Determining If Your Plan Qualifies

To determine if your employer’s plan supports the Mega Backdoor Roth strategy, start by reviewing the Summary Plan Description (SPD) or consulting directly with your HR department. Specifically, verify whether after-tax contributions beyond regular deferrals are permitted and confirm if in-service distributions or in-plan Roth conversions are allowed [Source: Northern Trust].

When approaching HR, focus on specific questions: “Does our plan allow for voluntary after-tax contributions above the IRS deferral limits?” and “What options exist for converting these after-tax contributions to Roth accounts?” [Source: Employee Fiduciary]. If you encounter uncertainty, request access to the complete plan document or ask HR to consult with the plan administrator.

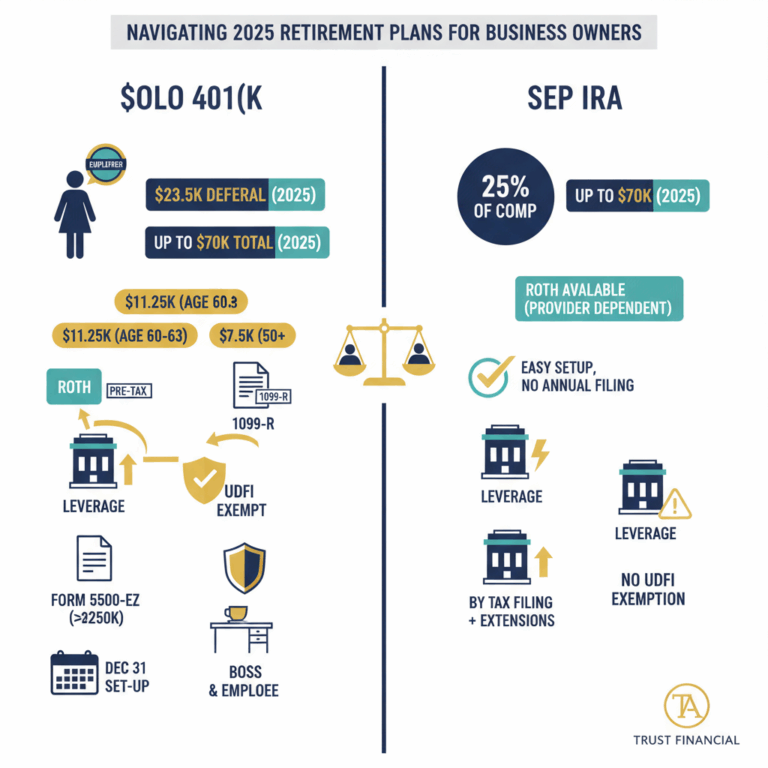

Options for Self-Employed Individuals

Self-employed individuals and small business owners have a distinct advantage when implementing the Mega Backdoor Roth through Solo 401(k) plans. These plans can be specifically designed to include both after-tax contribution provisions and Roth conversion options. The key benefit for solo practitioners is that they bypass the ACP testing requirements that often complicate implementation in larger employer plans [Source: Employee Fiduciary].

When establishing a Solo 401(k) for this purpose, ensure the plan document explicitly includes a Roth provision allowing after-tax contributions to the traditional component, which can later be converted to Roth status. Several custodians specialize in Solo 401(k) plans with these features, though not all standard offerings include them by default.

Advocating for Plan Changes

If your employer’s current 401(k) plan doesn’t support the Mega Backdoor Roth strategy, consider advocating for plan amendments. When approaching your employer about adding these features, focus on the competitive advantage they provide for talent recruitment and retention, particularly for higher-income employees who may have limited other options for Roth contributions [Source: Investopedia].

A persuasive proposal might highlight how implementing after-tax contributions and Roth conversion options would allow high-performing employees to maximize their retirement savings, positioning the company’s benefits package competitively against industry peers. Emphasize that with third-party administrator (TPA) support, administrative burdens can be minimized while significantly enhancing the plan’s appeal [Source: Northern Trust].

Implementation Challenges

Even with the right plan features in place, implementing the Mega Backdoor Roth strategy presents several challenges. The timing of conversions requires careful coordination to minimize tax on earnings, as any growth on after-tax contributions becomes taxable upon conversion. Some practitioners recommend frequent conversions (sometimes quarterly or even bi-weekly) to minimize the accumulation of taxable earnings [Source: Fidelity].

Administrative complexity represents another significant hurdle. Record-keeping for after-tax contributions and their conversions requires meticulous attention to detail, particularly regarding tax basis tracking. Many plan administrators and payroll departments have limited experience managing these transactions, potentially leading to errors in reporting or execution.

Future Outlook for Mega Backdoor Roth Strategies

The future of the Mega Backdoor Roth strategy remains uncertain as we look beyond 2025. While no recent legislation explicitly targets this strategy—it notably survived the SECURE 2.0 Act of 2022 without restrictions—tax professionals remain cautious about its long-term viability [Source: RG Wealth].

The strategy’s continued availability hinges on several factors. Current IRS guidelines continue to permit after-tax 401(k) contributions and their conversion to Roth accounts, provided the plan allows these features. However, experts warn that Congressional appetite for tax reform, particularly amid rising national debt concerns, could eventually lead to restrictions on perceived “loopholes” in retirement savings [Source: SDOCPA].

Political dynamics will likely play a role in the strategy’s longevity. Tax policy shifts targeting wealth accumulation in tax-advantaged accounts could indirectly impact the viability of Mega Backdoor Roth conversions [Source: Mercer Advisors]. Some analysts suggest that the $46,500 post-elective-deferral limit for after-tax 401(k) contributions could become a specific target for legislative changes in upcoming years.

For those considering this strategy, financial advisors recommend a time-sensitive approach—maximizing Mega Backdoor contributions while the opportunity remains available, while simultaneously developing contingency plans should regulations change [Source: Atkinson Wealth Strategies]. Staying informed about legislative developments through regular consultation with financial advisors will be crucial for anyone utilizing or planning to utilize this approach.

Staying Informed and Prepared

Given the potential for legislative changes, maintaining flexibility in retirement planning is essential. Investors should regularly review IRS updates regarding contribution limits and conversion rules, while monitoring tax reform proposals that might affect retirement strategies.

Establishing relationships with financial advisors who specialize in advanced retirement planning can provide early warning about potential regulatory shifts. Many practitioners recommend developing contingency strategies—such as increased direct Roth IRA contributions or alternative tax-advantaged investment vehicles—that could substitute for the Mega Backdoor approach if it becomes restricted.

For now, the Mega Backdoor Roth strategy remains a powerful tool for those with access to qualifying plans. Its effectiveness in building tax-free retirement savings makes it worth pursuing while available, even as prudent investors prepare for potential future restrictions.

Conclusions

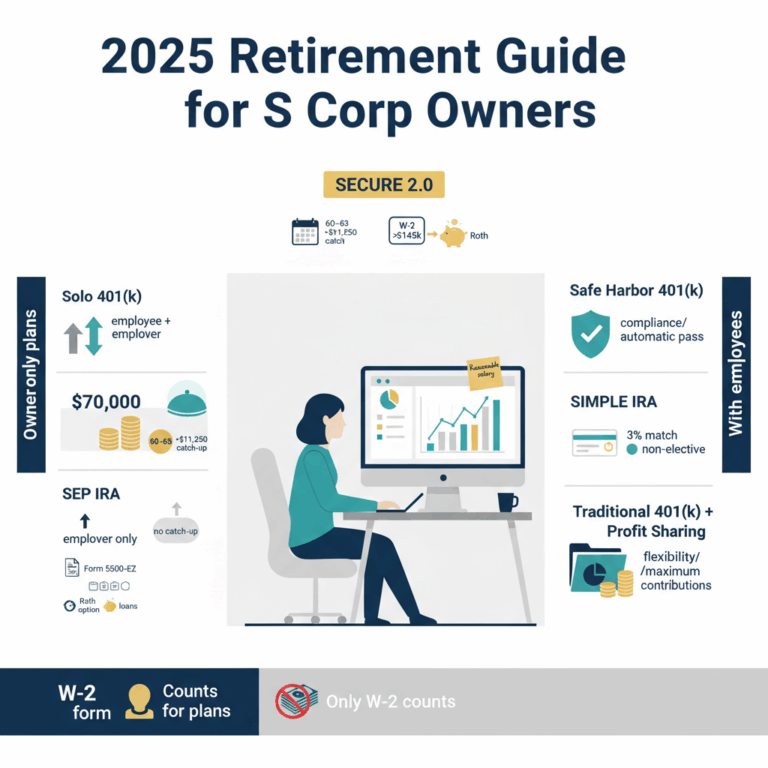

The Mega Backdoor Roth strategy represents one of the most powerful tax-optimization tools available to high-income earners in 2025. With contribution limits now reaching $70,000 for those under 50 and up to $81,250 for those aged 60-63, the potential for tax-free wealth accumulation has never been greater. While implementation requires navigating specific employer plan features and adhering to strict contribution rules, the long-term benefits of tax-free growth and distributions make this approach worth considering for those with the financial capacity to save beyond standard limits. As retirement planning continues to evolve with legislative changes and economic shifts, the Mega Backdoor Roth stands as a testament to the value of strategic financial planning. By mastering this technique, forward-thinking individuals can significantly enhance their retirement readiness while building a legacy of tax-efficient wealth for themselves and future generations.

Sources

- Atkinson Wealth Strategies – Mega Backdoor Roth

- Employee Fiduciary – Mega Backdoor Roth

- Fidelity – Mega Backdoor Roth

- Finturity – Blog

- Investopedia – Mega Backdoor Roth 401(k) Conversion

- Mercer Advisors – Making a Backdoor or Mega Backdoor Roth Contribution in 2025

- NerdWallet – How Mega Backdoor Roths Work

- Northern Trust – Mega Backdoor Roth Conversions

- RG Wealth – Mega Backdoor Roth Strategies

- SDOCPA – Roth vs Mega Backdoor Roth