The One Big Beautiful Bill Act of 2025: Tax Reform Overview

The One Big Beautiful Bill Act (OBBAA), enacted in July 2025, represents the most sweeping tax reform since the 2017 Tax Cuts and Jobs Act. This landmark legislation makes permanent many TCJA provisions while introducing significant enhancements to individual tax benefits, family credits, and retirement savings options. For taxpayers across all demographics, the law brings certainty through permanent rate structures, expanded deductions, targeted relief for seniors and high-SALT taxpayers, and innovative planning opportunities spanning education, retirement, and estate planning.

Enhanced Family Benefits

The OBBAA delivers significant improvements to family tax benefits, increasing the Child Tax Credit (CTC) from $2,000 to $2,200 per qualifying child under age 17 for the 2025 tax year [Source: Jackson Hewitt]. This $200 increase comes with a refundable portion set at $1,700, meaning families can receive up to this amount as a refund even if they owe no taxes.

A critical improvement is the implementation of automatic inflation adjustments beginning in 2026. Both the base credit amount and the refundable portion will increase annually based on cost-of-living adjustments [Source: Instead.com], ensuring the credit maintains its purchasing power over time.

The Act also permanently establishes the $500 nonrefundable credit for non-child dependents [Source: Bipartisan Policy Center], benefiting families caring for qualifying dependents who don’t meet the child tax credit requirements.

Eligibility requirements have been strengthened under the new legislation. Both the qualifying child and the taxpayer claiming the credit must now possess Social Security Numbers that make them eligible for work in the United States [Source: Ways and Means Committee]. For married couples filing jointly, at least one spouse must have a valid SSN to claim the credit.

The income phase-out thresholds remain at $200,000 for single filers, heads of household, and qualifying surviving spouses, and $400,000 for married couples filing jointly [Source: TurboTax], ensuring middle-income families maintain full access to the credit.

Senior Relief and SALT Cap Adjustments

The OBBAA introduces two targeted tax relief provisions: a new senior deduction and an enhanced State and Local Tax (SALT) cap.

The temporary senior deduction provides $6,000 per eligible individual aged 65 or older for tax years 2025 through 2028 [Source: IRS]. This benefit is available regardless of whether taxpayers itemize deductions or take the standard deduction, making it particularly valuable for seniors who itemize [Source: Ameriprise Financial].

For married couples filing jointly, each eligible spouse can claim the deduction, potentially providing up to $12,000 in additional deductions. However, the deduction begins to phase out at a 6% rate when Modified Adjusted Gross Income (MAGI) exceeds $75,000 for single filers or $150,000 for joint filers [Source: Bipartisan Policy Center].

The SALT deduction cap increases from $10,000 to $40,000 starting in 2025 [Source: Thomson Reuters], primarily benefiting homeowners in high-tax states. The enhanced cap includes an income-based phase-out beginning at $500,000 MAGI, with benefits reducing at a 30% rate for income above this threshold, but never falling below the original $10,000 floor [Source: Bipartisan Policy Center].

Both provisions include inflation adjustments through 2029, though they remain temporary, with the senior deduction expiring after 2028 and the enhanced SALT cap reverting to $10,000 in 2030.

New Savings Vehicles and Wealth Transfer Opportunities

The OBBAA introduces innovative savings vehicles and wealth transfer opportunities. A centerpiece is the creation of birth-based custodial “Trump Accounts” established under new IRC section 530A. These special accounts function as IRAs for minors under 18 before transitioning to traditional IRA rules [Source: Benefits Law Advisor].

For children born between January 1, 2025, and December 31, 2028, who are U.S. citizens, the government provides a $1,000 seed contribution from the Treasury [Source: Kiplinger]. Employers can contribute up to $2,500 annually to employees’ children’s accounts, while parents and relatives can contribute up to $5,000 in after-tax dollars each year, with contributions ceasing once the child reaches 18.

The Act also expands 529 plan flexibility by making permanent the tax-free rollover provision from qualified 529 tuition programs to ABLE accounts [Source: Kutak Rock], allowing families to redirect unused education savings toward supporting individuals with disabilities without tax penalties.

Health Savings Account provisions receive significant enhancements, including permanent telehealth relief that allows high-deductible health plans to provide first-dollar coverage for telehealth services without affecting HSA eligibility [Source: Stinson].

For wealth transfer planning, beginning January 1, 2026, the federal estate, gift, and generation-skipping transfer tax exemptions increase to $15 million per individual and $30 million for married couples [Source: Davis & Gilbert], indexed for inflation starting in 2027.

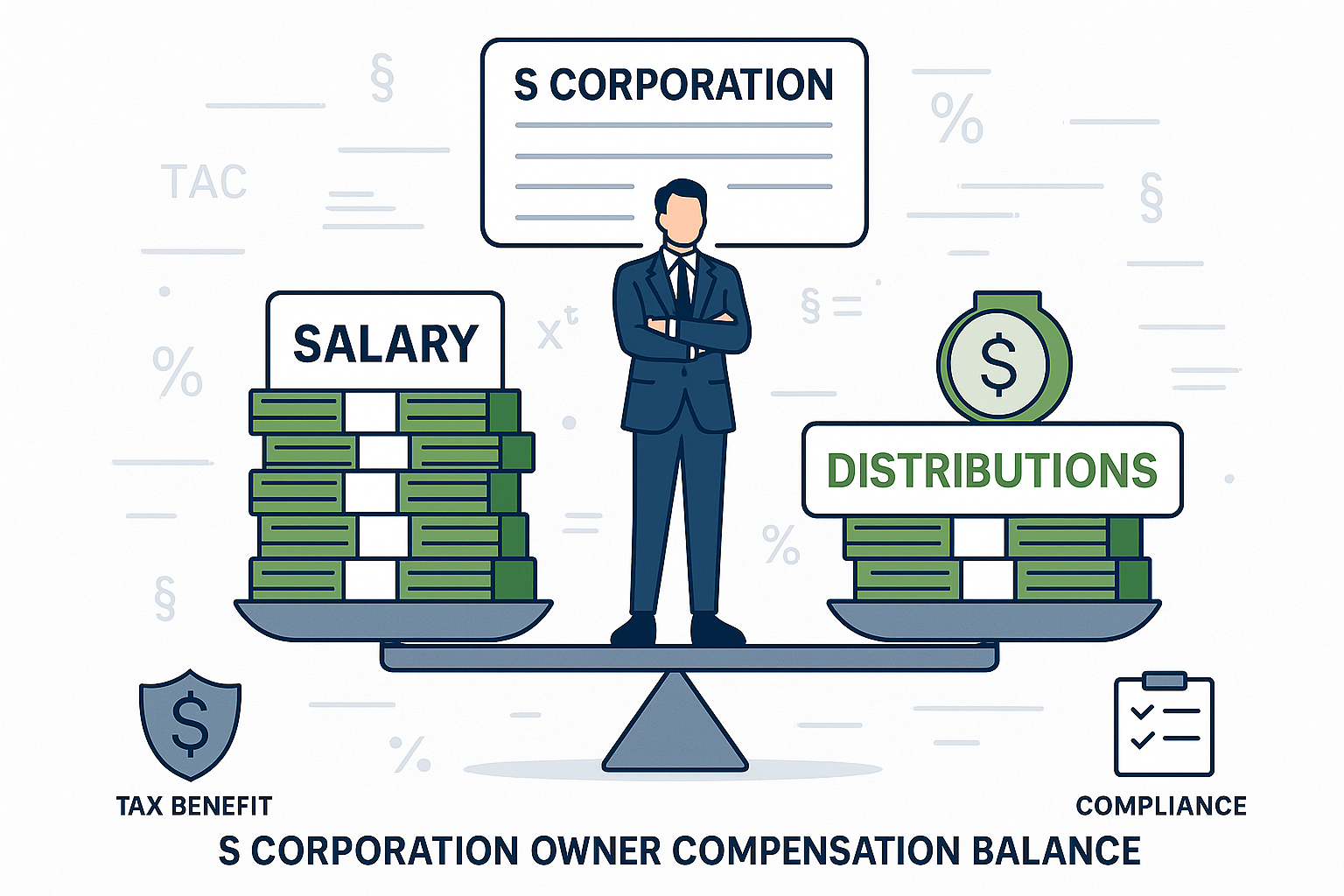

Pass-Through Business Modifications

The OBBAA permanently extends and enhances the Section 199A Qualified Business Income (QBI) deduction. The legislation maintained the 20% rate but expanded the phase-in ranges for specified service trades or businesses from $50,000 to $75,000 for individuals and from $100,000 to $150,000 for joint filers [Source: Foster Garvey].

A significant addition is the new inflation-adjusted minimum QBI deduction of $400 beginning in 2026 for taxpayers with at least $1,000 of qualified business income from businesses in which they materially participate [Source: Buchanan Ingersoll & Rooney].

Combined with the enhanced Section 179 expensing limits—increased to $2.5 million with a $4 million investment threshold—these provisions create powerful incentives for business investment and growth [Source: NK CPA].

Conclusion

The One Big Beautiful Bill Act of 2025 provides unprecedented tax certainty for individuals and families while creating substantial new planning opportunities. As these provisions phase in with varying timelines and eligibility requirements, taxpayers should work with qualified advisors to optimize their tax positions and take full advantage of the law’s benefits while navigating its complexities.

Sources

- Advisors Vanguard – Reference Guide for Advisors on the One Big Beautiful Bill

- Ameriprise Financial – One Big Beautiful Bill Tax Cuts

- Benefits Law Advisor – New Tax-Favored Benefit for Employees with Children

- Bipartisan Policy Center – How the OBBB Changes to the Child Tax Credit Will Impact Families

- Bipartisan Policy Center – How Would the 2025 House Tax Bill Change the SALT Deduction?

- Bipartisan Policy Center – The 2025 Tax Bill Additional 6000 Deduction for Seniors Simplified

- Buchanan Ingersoll & Rooney – One Big, Beautiful Bill . . . Simplified

- Davis & Gilbert – After the One Big Beautiful Bill: Estate Tax Updates

- Foster Garvey – One Big Beautiful Bill Act Part 4: Qualified Business Income Deduction Code Section 199A

- IRS – One Big Beautiful Bill Act Tax Deductions for Working Americans and Seniors

- Jackson Hewitt – How Does One Big Beautiful Bill Impact Child Tax Credit?

- Kiplinger – GOP Proposes MAGA Savings Accounts

- Kutak Rock – EBEC Changes from the OBBBA

- Stinson – Unpacking the One Big Beautiful Bill’s Employee Benefit Provisions

- Thomson Reuters – How the One Big Beautiful Bill Reshapes SALT Planning

- TurboTax – Child Tax Credit

- Ways and Means Committee – The One Big Beautiful Bill Section by Section