S Corporation Reasonable Compensation Guide: 2025 Update

In today’s complex tax landscape, S corporation shareholder-employees face increasing scrutiny over their compensation practices. The IRS requires reasonable wages to be paid for services before distributions, with significant consequences for non-compliance. As we navigate through 2024-2025, enhanced enforcement measures, including AI-driven analytics and cross-trigger audits, have intensified the focus on this critical compliance area.

Understanding the Current Enforcement Landscape

The IRS’s enforcement approach has transformed significantly in 2024-2025, marked by sophisticated technological advancement. According to The Tax Adviser, the IRS now employs AI-powered analytics to detect non-compliance, representing a major shift in enforcement methodology.

The agency’s enhanced infrastructure enables precise identification of red flags, particularly focusing on disproportionate distributions relative to reported salaries. Recent tax court decisions suggest that owner-operators should receive salaries equal to at least 70% of comparable market rates, as noted by Pasquesi Partners.

Methodologies for Determining Reasonable Compensation

The IRS recognizes three primary approaches for establishing reasonable compensation:

- The Cost Approach (“Many Hats” method): Ideal for small business owners performing multiple roles, this methodology breaks down responsibilities into distinct components with market-rate compensation assigned to each function.

- The Market Approach: Most favored by federal courts, this method compares owner compensation to similar positions in the same industry, using data from industry surveys and comparable company reports.

- The Income Approach (Independent Investor Test): Evaluates whether a hypothetical investor would find the return on investment acceptable after accounting for owner compensation.

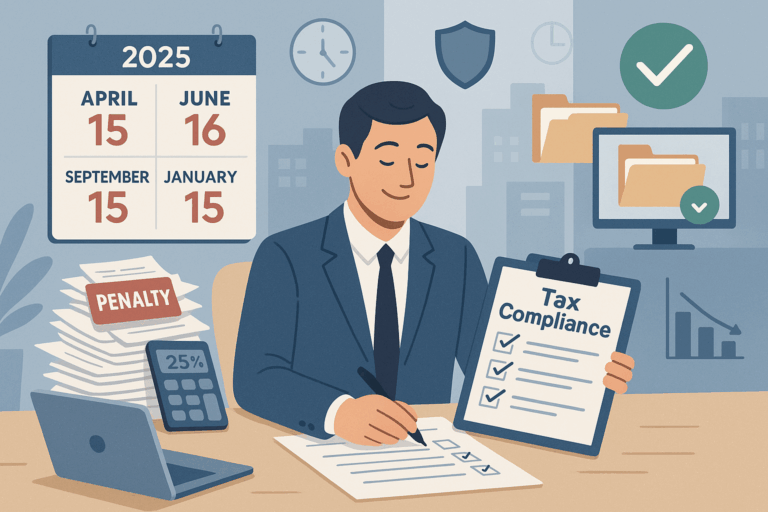

Documentation and Compliance Strategies

Maintaining proper documentation is crucial for demonstrating compliance. Recent compliance guidelines emphasize implementing systematic, contemporaneous record-keeping as part of regular business operations.

Key documentation requirements include:

- Detailed records of shareholder-employee duties

- Time commitment documentation

- Compensation determination processes

- Electronic filing systems for mandatory e-filing

- Beneficial Ownership Information (BOI) reporting

- Regular reviews of documentation practices

Tax Planning Considerations

Strategic compensation planning must balance multiple factors in 2025:

- QBI Deduction Impact: Careful consideration of salary levels against Qualified Business Income optimization, particularly near phase-out thresholds ($394,600/$494,600 for married filing jointly in 2025).

- Remote Work Implications: With 36 states now offering Pass-Through Entity Tax provisions, multi-state operations require careful planning for withholding obligations and state tax apportionment.

- Fringe Benefits: Proper W-2 wage classification remains crucial for retirement plan contributions and health insurance premium deductibility for 2% shareholder-employees.

Conclusion

Success in managing S corporation reasonable compensation requires a well-documented, market-based approach that can withstand scrutiny. By implementing robust documentation practices, utilizing appropriate determination methodologies, and staying current with regulatory changes, S corporation owners can confidently navigate these requirements while optimizing their tax position.

Sources

- Aaron Hall – Legal Review: S Corporation Reasonable Compensation

- Finally – S Corporation Reasonable Salary Guidelines

- Pasquesi Partners – The IRS 9-Factor Test for S Corp Reasonable Compensation

- The Tax Adviser – Advising S Corporation Clients on Reasonable Compensation

- Tax Executive – State and Local Tax Implications for Remote Workforce