2025 Retirement Planning Guide for S Corporation Owners

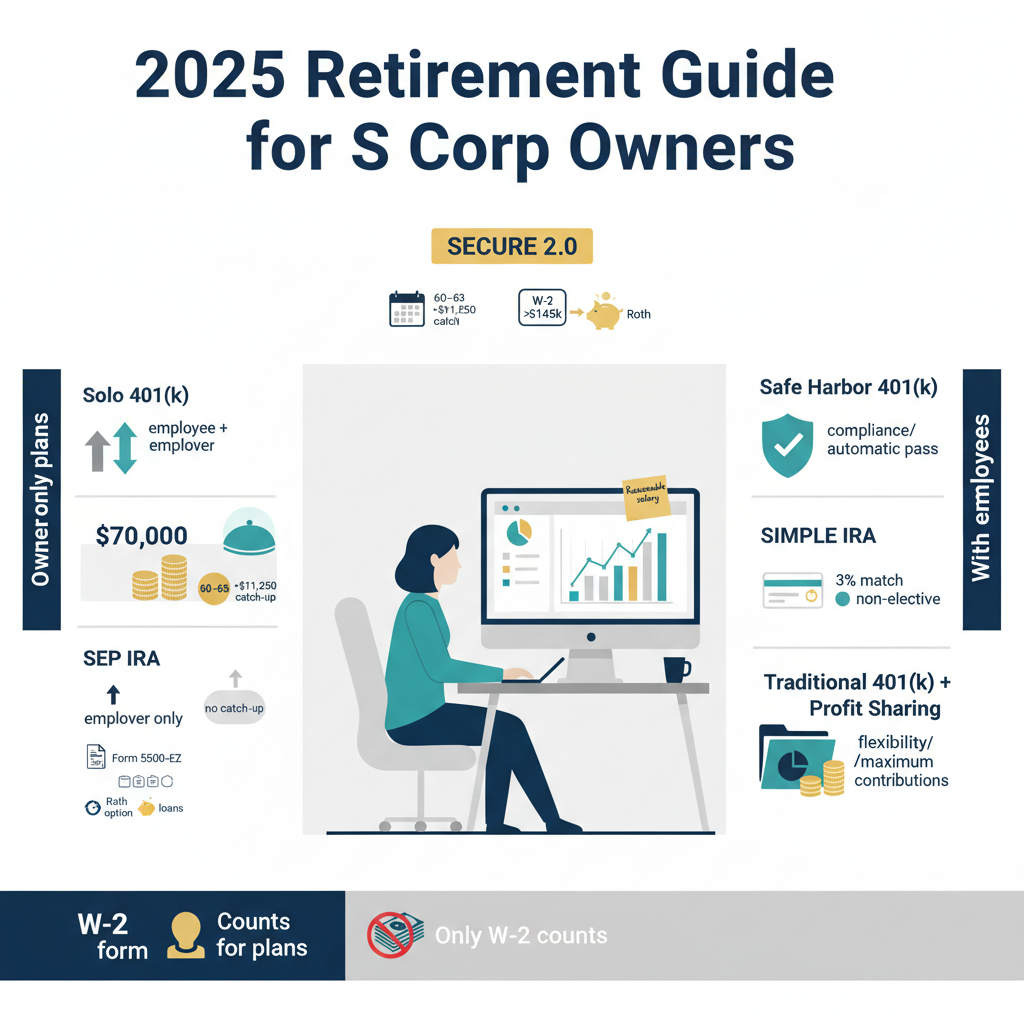

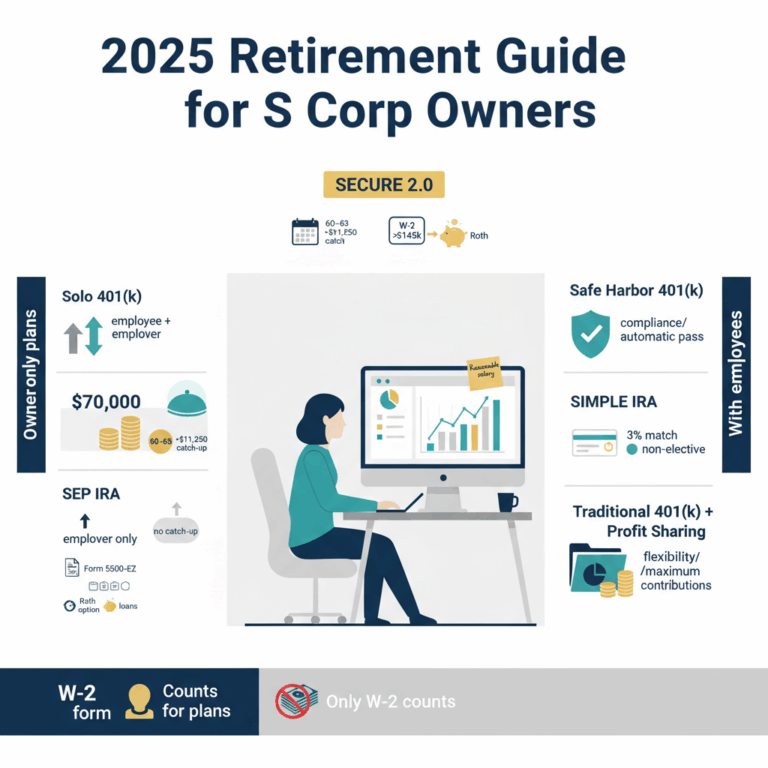

As we navigate through 2025, S corporation owners face crucial decisions in optimizing their retirement planning strategies. With SECURE 2.0 Act implementations introducing enhanced catch-up contributions and innovative plan designs, the options available have never been more diverse. This guide explores the latest retirement planning considerations to help S corporation owners make informed decisions about their retirement future.

Understanding S Corporation Retirement Planning Fundamentals

The cornerstone of S corporation retirement planning lies in reasonable compensation. According to SDO CPA, compensation must reflect fair market value for similar roles, typically ranging from $40,000 to $150,000 or more, depending on industry, location, and company profitability.

For 2025, EP Wealth reports that the maximum combined contribution limit for retirement plans has reached $70,000, with additional catch-up provisions for those over 50. The annual compensation limit for calculating contributions stands at $350,000.

As noted by Manning & Napier, only W-2 income counts for qualified retirement plan purposes, creating a balance between minimizing self-employment taxes and maximizing retirement contributions.

Solo 401(k) vs SEP IRA for Owner-Only S Corporations

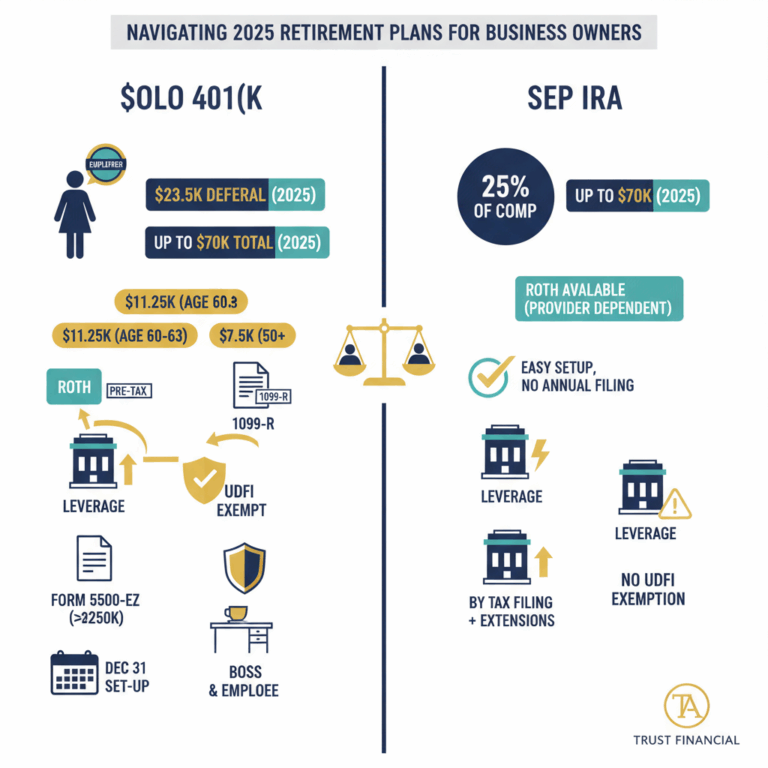

According to Guideline, the Solo 401(k) offers superior flexibility through its dual contribution structure. Owners can contribute up to $23,500 as employees and up to 25% of compensation as employers, potentially reaching $70,000 for those under 50.

For 2025, individuals aged 60-63 can contribute an additional $11,250 on top of standard catch-up amounts, pushing their potential total to $81,250. This advantage over SEP IRAs is significant, as SEPs don’t offer catch-up contributions.

Molen Tax experts note that Solo 401(k)s require Form 5500-EZ filing when assets exceed $250,000, while SEP IRAs maintain minimal paperwork requirements. However, Solo 401(k)s offer unique benefits like loan provisions and Roth contribution options.

Advanced Strategies Under SECURE 2.0

The SECURE 2.0 Act introduces significant changes for 2025. According to Milliman, eligible participants aged 60-63 can now contribute up to $11,250 in catch-up contributions, substantially higher than the standard $7,500 catch-up limit for those 50 and older.

Important considerations exist for higher earners. Fuse Workforce Management notes that those with FICA wages exceeding $145,000 must make catch-up contributions as Roth contributions starting in 2025.

Retirement Plans for S Corporations with Employees

Three primary options emerge for 2025: Safe Harbor 401(k)s, SIMPLE IRAs, and traditional 401(k)s with profit-sharing components. Safe Harbor 401(k)s allow employee deferrals up to $23,500, with enhanced catch-up provisions making total contributions of $34,750 possible for those aged 60-63.

SIMPLE IRAs offer streamlined administration with lower contribution limits, requiring either a 3% matching contribution or 2% non-elective contribution. Traditional 401(k)s with profit-sharing provide maximum flexibility but require careful cost-benefit analysis.

Conclusion

The optimal retirement strategy for S corporation owners in 2025 depends on W-2 wage levels, employee headcount, and desired contribution amounts. Solo 401(k)s remain ideal for owner-only businesses, while firms with employees might prefer Safe Harbor 401(k)s or SIMPLE IRAs. Success lies in aligning retirement strategy with business structure while leveraging SECURE 2.0 benefits.

Sources

[Sources embedded in article]