S Corporation Shareholder Loans: Essential Guidelines for 2025

In the complex landscape of S Corporation taxation, shareholder loans represent a critical area that demands careful attention and understanding. As we navigate through 2025, the IRS has intensified its scrutiny of these financial arrangements through enhanced reporting requirements, particularly with Form 7203. This guide explores the key rules governing S Corporation shareholder loans, from establishing bona fide indebtedness to managing tax implications.

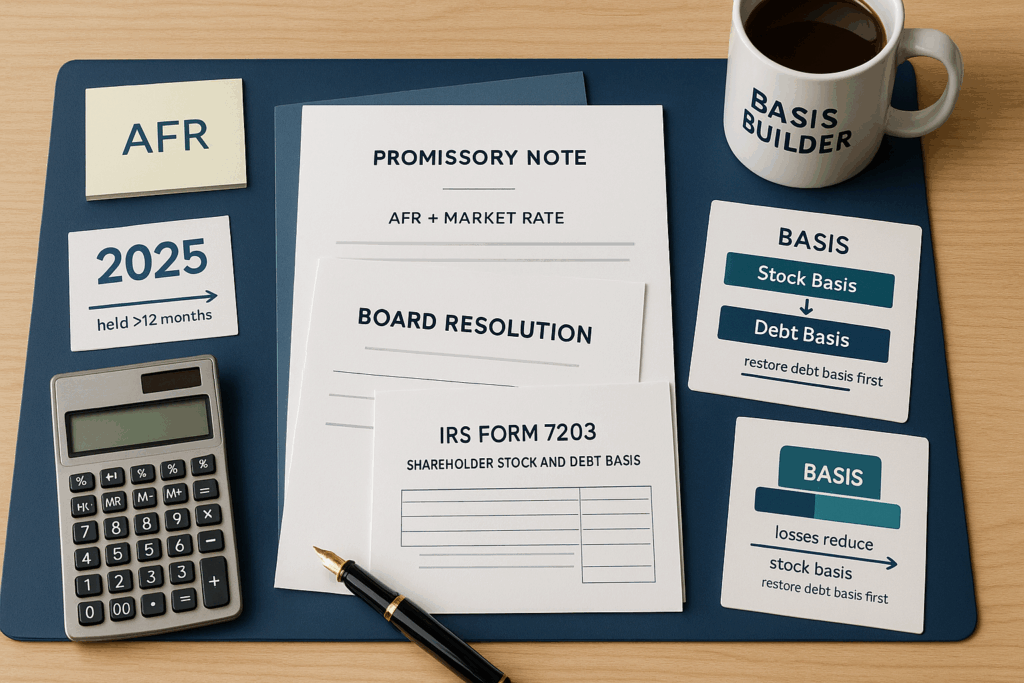

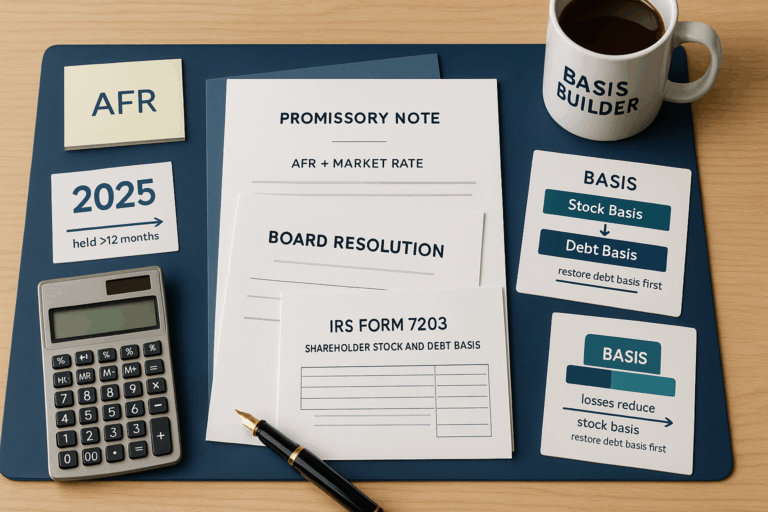

Understanding Bona Fide Indebtedness Requirements

The establishment of bona fide indebtedness is crucial for S Corporation shareholder loans to receive favorable tax treatment. According to IRS Bulletin 2012-27, Treasury Regulation Section 1.366-2(a)(2) requires that shareholder loans must represent genuine indebtedness owed directly to the shareholder. This direct creditor relationship is fundamental – loan guarantees are insufficient to establish debt basis.

To meet the bona fide indebtedness standard, loans must demonstrate economic substance beyond mere bookkeeping entries. Key requirements include:

- Formal documentation through promissory notes

- Market-rate interest charges

- Established repayment schedules

- Clear business purpose documentation

- Proper interest rates at or above IRS Applicable Federal Rates for loans exceeding $10,000

Documentation Standards and Form 7203 Compliance

For S Corporation shareholder loans in 2025, maintaining meticulous documentation has become increasingly critical. According to IRS guidelines, loans exceeding $25,000 must be documented through formal promissory notes that include specific interest rates meeting or exceeding the IRS Applicable Federal Rates (AFRs).

Corporate board resolutions play a vital role in loan documentation. These resolutions should:

- Authorize the loan

- Specify its terms

- Demonstrate the transaction’s business purpose

- Support Form 7203 reporting requirements

Managing Basis Calculations and Loss Deductions

S corporation shareholders must track two distinct types of basis:

- Stock basis: reflecting direct investment in the corporation

- Debt basis: representing personal loans to the entity

Under IRC Section 1366(d), a shareholder’s ability to deduct losses is limited to their combined stock and debt basis. Stock basis adjustments follow a specific ordering system:

- Increases: Initial capital contributions and pass-through income

- Decreases: Distributions and losses

When losses exceed stock basis, shareholders can utilize their debt basis but must follow strict restoration rules. Future income must first restore debt basis before increasing stock basis.

Tax Treatment of Loan Repayments

When an S corporation shareholder’s debt basis has been reduced by passthrough losses, loan repayments can trigger unexpected tax consequences. The character of gain recognition depends on debt structure:

- Open account receivables: Repayment gains treated as ordinary income

- Formally documented loans: May qualify for capital gains treatment

Strategic timing of repayments can significantly impact tax liability. For capital gains treatment, shareholders should:

- Utilize written promissory notes with market-rate interest

- Establish clear repayment terms

- Hold debt instruments for more than 12 months before repayment

- Consider spreading repayments across multiple tax years

Conclusion

Success in navigating S Corporation shareholder loans depends on maintaining proper documentation, understanding basis calculations, and ensuring compliance with current regulations. The introduction of Form 7203 has brought increased transparency to shareholder basis tracking, making it essential to maintain detailed records and seek professional guidance when needed.