Maximizing Tax Benefits: When to Choose an S Corporation Structure in 2025

In the complex landscape of business entity selection, few choices carry as much tax and operational significance as deciding whether to form an S Corporation. As 2025 brings us closer to key tax provision expirations, entrepreneurs must carefully evaluate the implications of S Corp election against alternatives like LLCs. This choice extends beyond mere tax considerations into areas of governance, growth potential, and compliance requirements. With the 20% Qualified Business Income (QBI) deduction set to expire after 2025 and evolving IRS regulations, business owners face a critical window for strategic entity planning. This article examines when S Corporation status delivers optimal benefits, when alternative structures may better serve your goals, and provides a framework for making this consequential business decision.

When to Choose an S Corporation Structure

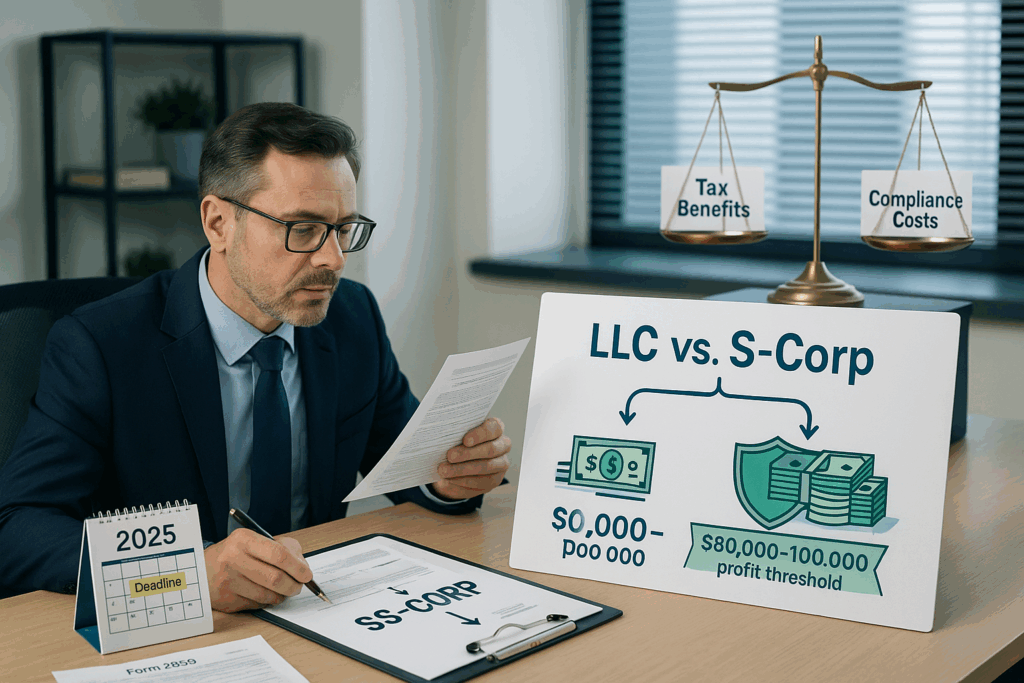

Determining the ideal time to elect S Corporation status requires careful consideration of your business financials and growth trajectory. The decision typically hinges on reaching a specific profitability threshold where tax benefits outweigh the additional compliance costs.

The general consensus among tax professionals is that businesses generating between $80,000 to $100,000 in annual profits typically begin to see meaningful advantages from S Corporation status [Source: Long Gilbert & Co]. At this profit level, the self-employment tax savings become substantial enough to justify the additional paperwork and compliance requirements.

Let’s examine the math: Consider a business making $100,000 in net income. As a single-member LLC, you’d pay self-employment tax (15.3%) on the entire amount, resulting in approximately $15,300 in self-employment taxes. By contrast, an S Corporation owner could take a $60,000 reasonable salary (subject to payroll taxes) and $40,000 in distributions. The payroll taxes would apply only to the $60,000 salary, saving roughly $6,120 in self-employment taxes on the distribution portion [Source: Collective].

As profitability increases, so do the potential tax savings. At $200,000 in earnings, an LLC owner pays self-employment tax on the entire amount ($30,600), while an S Corporation owner with an $80,000 reasonable salary and $120,000 in distributions would pay significantly less—approximately $12,240 in payroll taxes on the salary portion, resulting in over $18,000 in tax savings [Source: Thomson Reuters].

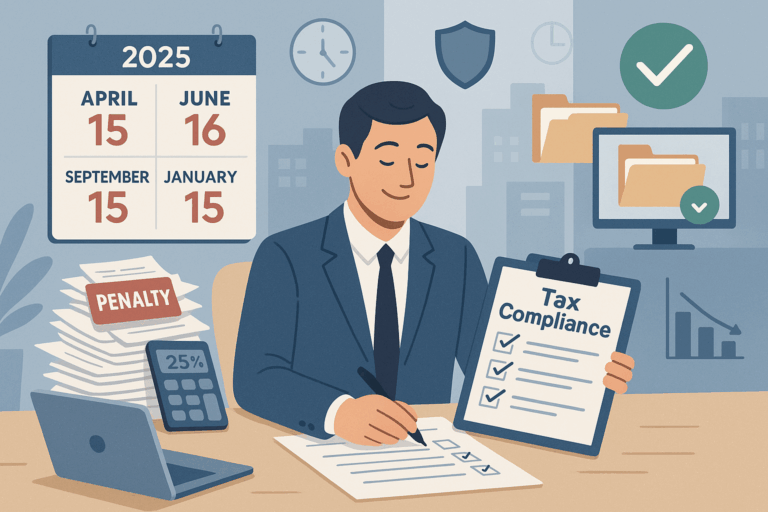

Timing your S Corporation election requires understanding important deadlines. For newly formed businesses, Form 2553 must be filed within 75 days of formation to secure S Corporation status for the first tax year [Source: Harbor Compliance]. For existing businesses operating on a calendar year, the deadline is March 15th of the year the election will take effect [Source: Gordon Law].

Business stability is another crucial consideration. S Corporations thrive in environments with predictable cash flows and steady growth patterns. Industries like professional services, healthcare, consulting, and consumer goods typically benefit most from S Corporation status due to their relatively stable income patterns [Source: Tax Planiq]. Conversely, businesses in highly volatile sectors like technology startups, cyclical commodities, or seasonal retail may find the tax benefits inconsistent due to unpredictable income fluctuations.

S Corporation status also offers significant advantages for retirement planning. Owners can implement powerful strategies like combining Solo 401(k) plans with cash balance plans, potentially allowing contributions exceeding $500,000 annually [Source: Emparion]. The structure enables both employer and employee contributions to retirement plans, significantly boosting tax-advantaged savings compared to sole proprietorships [Source: RC Reports].

Recent policy developments have further enhanced S Corporation benefits. For instance, SALT parity reforms adopted in 31 states allow pass-through entities to deduct state income taxes at the entity level, saving businesses over $10 billion annually [Source: S-CORP].

The decision to elect S Corporation status should align with your business’s growth stage, industry characteristics, and retirement goals. When your business consistently generates profits above $80,000-$100,000, operates in a relatively stable industry, and you’re seeking to maximize retirement contributions while minimizing self-employment taxes, an S Corporation structure likely makes financial sense.

Limitations and Drawbacks of S Corporation Status

While S Corporations offer significant tax benefits, they come with substantial restrictions and operational burdens that can outweigh the advantages for many businesses. Understanding these limitations is crucial before making this election.

The ownership restrictions for S Corporations are particularly stringent. Companies are limited to a maximum of 100 shareholders, though family members can be counted as a single shareholder to provide some flexibility [Source: Fusion Taxes]. Only U.S. citizens and resident aliens can own shares, completely excluding foreign investors and entities from ownership [Source: Collective]. This can severely restrict growth opportunities, especially for businesses with international ambitions.

Perhaps the most limiting restriction for growth-oriented businesses is the single class of stock requirement. S Corporations cannot issue different classes of stock with varying rights or preferences, making them incompatible with venture capital funding structures [Source: CooleyGo]. Venture capitalists typically require preferred stock with anti-dilution protections, liquidation preferences, and redemption rights—none of which are available with S Corporation status. This forces growing businesses to either forego significant investment opportunities or abandon their S election entirely.

The compliance burden for S Corporations is substantial and often underestimated. Owners must maintain formal corporate practices including board meetings and detailed minutes [Source: Block Advisors]. Additionally, they face complex tax filing requirements, including the annual Form 1120-S, Schedule K-1 for each shareholder, and quarterly payroll tax returns [Source: IRS]. This paperwork burden translates to higher accounting costs, with many S Corporations spending $2,000-$5,000 annually on compliance.

The “reasonable compensation” requirement poses another significant challenge. S Corporation owner-employees must pay themselves a market-rate salary before taking distributions [Source: Collective]. The IRS closely scrutinizes these arrangements, and underpayment can result in reclassification of distributions as wages subject to employment taxes, plus penalties [Source: ADP].

S Corporations also impose rigid profit distribution requirements. Unlike LLCs, which allow flexible distributions, S Corporations must allocate profits strictly according to ownership percentages [Source: MBO Partners]. This restricts the ability to reward shareholders based on their contributions or involvement.

Finally, basis limitations can restrict the ability to deduct losses. S Corporation shareholders can only deduct losses to the extent of their basis in the company, potentially leaving valuable tax deductions unused [Source: Smith Schafer].

The penalties for non-compliance can be severe. Violations of any S Corporation requirement can result in involuntary termination of S status, forcing an immediate conversion to C Corporation with potential double taxation [Source: BBC Incorporate]. This transition can create unexpected tax liabilities and operational disruptions, particularly for unprepared businesses.

Decision Framework and Future Considerations

A comprehensive decision framework for evaluating S Corporation viability requires weighing multiple factors against your business’s unique needs and trajectory. This structured approach helps navigate the complex interplay of tax advantages, compliance burdens, and future flexibility.

Essential Questions for Business Owners

Before committing to S Corporation status, ask yourself these foundational questions:

First, consider your liability needs. Different structures offer varying degrees of personal asset protection. As the Small Business Administration notes, high-risk industries like construction typically benefit from LLC or corporate structures that separate personal and business liabilities.

Evaluate your ownership structure and growth plans. S Corporations face strict limitations with a 100-shareholder cap, U.S. citizen/resident requirement, and single class of stock restriction. If you envision international investors or complex ownership arrangements, these constraints may become problematic. According to Wolters Kluwer, “S-Corps suit teams prioritizing stability; LLCs better for custom ownership structures.”

Assess your tax situation carefully. While S Corporations offer valuable self-employment tax savings through the reasonable compensation strategy, this advantage must be weighed against compliance requirements. Waverly Advisors emphasizes that excessive distributions versus low wages can trigger IRS scrutiny and potential reclassification of income.

Timing Considerations and QBI Impact

The looming 2025 expiration of the 20% Qualified Business Income (QBI) deduction represents a critical timing factor. This deduction significantly enhances S Corporation tax benefits, but its sunset will alter the equation. Post-2025, tax strategy will shift from QBI optimization to salary structure, potentially making C Corporations more attractive for high-income businesses facing individual tax rates up to 37% versus the corporate 21% rate.

Comparative Analysis with Alternative Structures

Consider how S Corporations stack up against alternatives:

LLCs offer superior flexibility with no shareholder restrictions, customizable ownership structures, and simplified management. Stripe’s resource center highlights that LLCs can elect S Corporation tax treatment while maintaining their operational simplicity, potentially offering “the best of both worlds” for qualifying businesses.

C Corporations suit businesses focused on scalability and capital attraction. They allow unlimited worldwide shareholders and multiple stock classes, making them ideal for venture capital or public offerings according to Shopify’s business guide.

Maintaining Future Flexibility

Business circumstances evolve, requiring structure adaptability. Investopedia recommends implementing regular entity evaluations, particularly at trigger points like revenue thresholds, ownership changes, or international expansion.

Develop transition pathways between entity structures. For example, many businesses start as S Corporations and later convert to C Corporations for funding rounds. Understanding conversion implications helps preserve options as your business evolves.

Create a monitoring system for tax law changes. NetSuite advises establishing a tax advisory team including CPAs and attorneys who track relevant legislation that might impact your entity structure’s benefits.

When evaluating S Corporation viability, remember that optimal structure decisions balance immediate tax benefits with long-term strategy. The framework’s effectiveness comes from its ability to adapt as both your business and tax environment evolve.

Conclusion

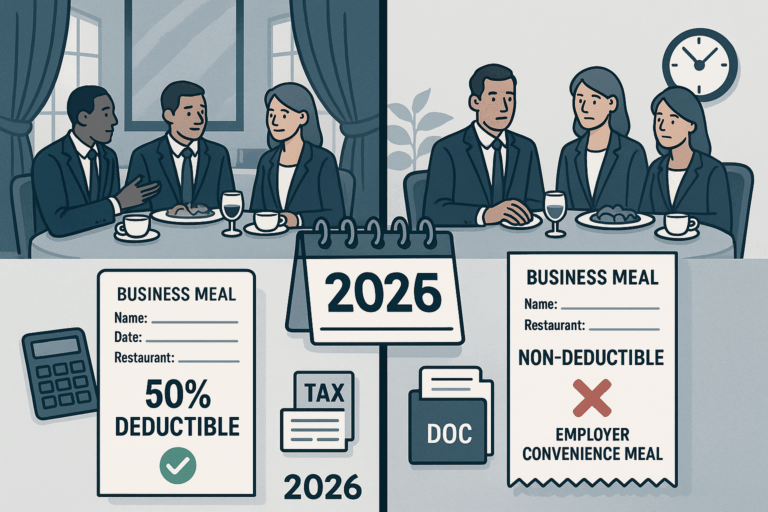

Determining whether S Corporation status aligns with your business objectives requires careful analysis of your unique circumstances. The ideal candidate typically generates at least $80,000-$100,000 in annual profits, allowing meaningful tax savings to outweigh compliance costs. S Corps work best for businesses with straightforward ownership structures planning long-term operations with consistent profitability. However, high-growth entities seeking external investment, international expansion, or flexible profit distribution may find LLCs more suitable. As we approach the 2026 expiration of key tax provisions, timing becomes increasingly critical. Whether electing S Corp status or avoiding it, the decision should derive from a comprehensive assessment of your business’s current situation and future trajectory rather than general tax advantages alone. Consult qualified tax and legal professionals to evaluate your specific scenario, as entity structure decisions form the foundation upon which your business’s financial future will be built.

Sources

- ADP – S Corp Payroll

- BBC Incorporate – S Corporation Advantages and Disadvantages

- Block Advisors – S Corp Reasonable Compensation

- Collective – LLC vs S Corp Which is the Best for Freelancers

- Collective – Freelancers Guide to Paying Yourself a Salary from an S Corporation

- Collective – S Corp Ownership Rules

- CooleyGo – S Corporations Basics

- CorpNet – S Corp Election Deadline

- Emparion – Best Retirement Plan for S Corp Owners Options

- Farrell Fritz – Maintaining S Corporation Status: Eligibility Requirements, Termination Risks, and IRS Relief Options

- Fusion Taxes – 4 Limitations of S Corporation Entities

- Gordon Law – Time for S Corp Election

- Harbor Compliance – S Corp Election Deadline

- Hinckley Allen – Converting an LLC to an S Corporation: A Mistake Waiting to Happen

- Investopedia – Which Type of Organization Is Best for Your Business

- IRS – About Form 1120-S

- LegalZoom – S Corp vs LLC

- Long Gilbert & Co – What is S Corporation Benefits Guide

- MBO Partners – Forming an S Corporation Pros and Cons

- NetSuite – Business Structure Articles

- PSS CPAs – S Corp vs LLC: Which Structure to Choose

- RC Reports – A Guide to S Corp 401k

- Run Pollen – LLC vs S Corp: The Ultimate Guide for Independent Consultants

- S Corporation Association – S Corps Legislative Victories

- Small Business Administration – Choose a Business Structure

- Shopify – S Corp vs C Corp

- Smith Howard – S Corporations: Key Tax and Non-Tax Considerations for Entrepreneurs

- Smith Schafer – Advantages Disadvantages of S Corporations

- Stripe – S Corp vs LLC

- Thomson Reuters – S Corp vs C Corp vs LLC What’s the Difference and Which One is Better for Your Business

- Tax Planiq – Maximizing Tax Efficiency A Deep Dive into S Corporation Entity Selection

- Waverly Advisors – To S-Corp or Not to S-Corp: Evaluating the Tax Implications for Your LLC

- Wolters Kluwer – S Corporation Advantages and Disadvantages