Solo 401(k) vs SEP IRA: A 2025 Guide for Self-Employed Professionals

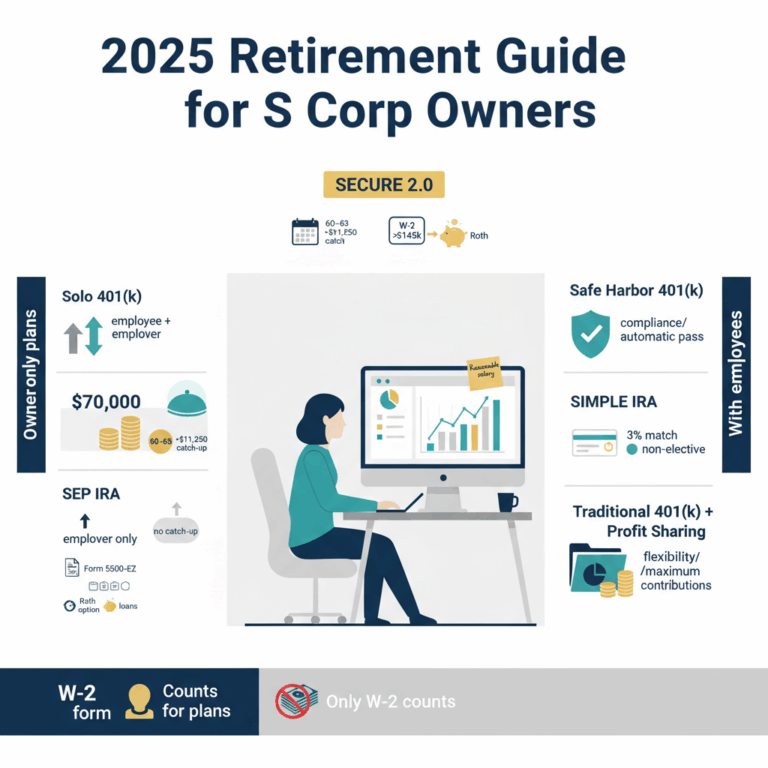

As we navigate through 2025, self-employed individuals and small business owners face a crucial decision in choosing between a Solo 401(k) and a SEP IRA for their retirement planning. This choice has become increasingly significant with the implementation of SECURE 2.0 Act changes and cost-of-living adjustments that have transformed the retirement planning landscape. With higher contribution limits, new Roth options, and enhanced catch-up provisions, understanding the nuances of these retirement vehicles is more important than ever.

Understanding the 2025 Contribution Landscape

The landscape of retirement contributions for self-employed individuals has undergone significant changes in 2025, with enhanced opportunities for retirement savings across both Solo 401(k) and SEP IRA plans.

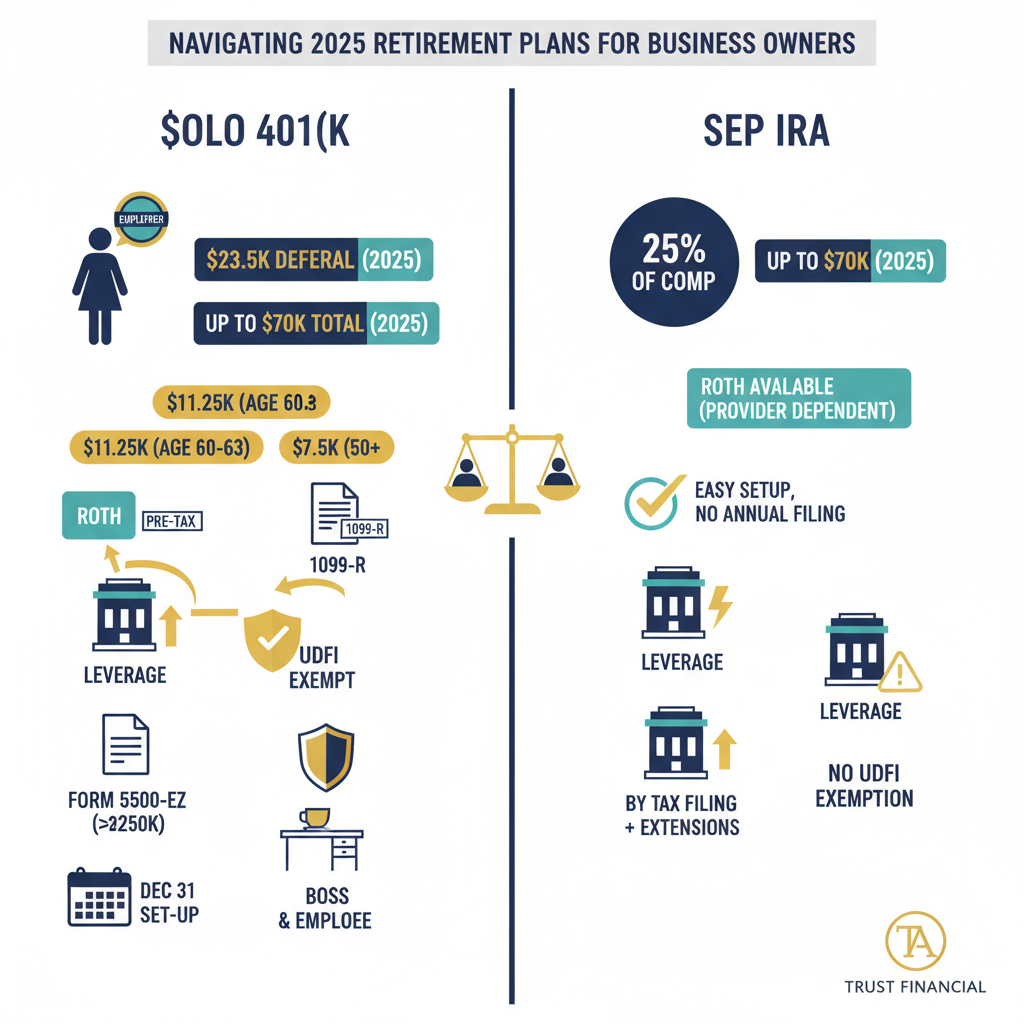

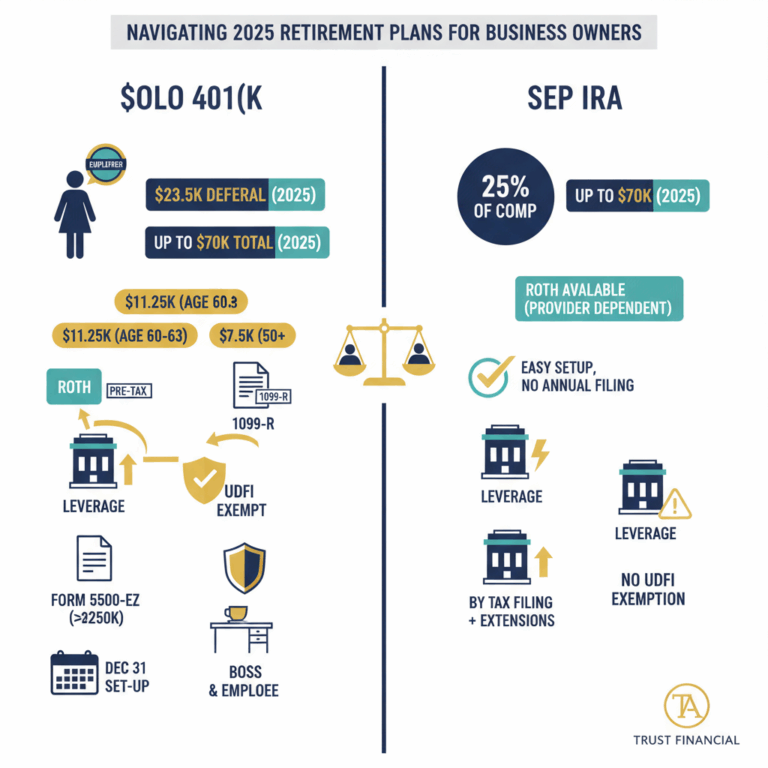

According to Guideline, the standard elective deferral limit for Solo 401(k) plans has increased to $23,500, while the total annual additions limit has reached $70,000.

For Solo 401(k) participants, the contribution structure offers remarkable flexibility.

IRA Financial Group reports that business owners can contribute both as employers and employees. The compensation cap of $350,000 serves as the ceiling for calculating contribution limits, though most participants will reach their annual contribution limits before this becomes relevant.

The catch-up provision landscape has become particularly attractive for older participants. Those aged 60-63 can now make enhanced catch-up contributions of $11,250, significantly higher than the standard $7,500 catch-up amount for participants 50 and older. This creates a unique opportunity for accelerated retirement savings during these critical pre-retirement years.

For SEP IRA holders, the contribution framework remains straightforward but powerful.

Kiplinger’s analysis shows that contributions can reach up to 25% of compensation, with a maximum of $70,000 in 2025. The calculation becomes particularly relevant for high earners, as those with compensation of $280,000 or more will hit the contribution ceiling before reaching the compensation cap.

The Roth Revolution in Retirement Planning

The SECURE 2.0 Act has ushered in transformative changes to Roth options in retirement planning. As of 2023, SEP IRAs gained the ability to accept Roth contributions, following the repeal of previous restrictions. This development allows employees in eligible plans to designate both salary deferrals and employer contributions as Roth contributions, though providers must specifically offer this option.

For Solo 401(k) participants, the tax implications of Roth employer contributions require careful navigation.

The IRS treats these contributions distinctively – as if the employee received a traditional pre-tax employer contribution and then immediately converted it to Roth. This creates a unique reporting scenario where sole proprietors must report their employer contributions as deductible while simultaneously receiving a 1099-R showing a Roth conversion.

Looking ahead to 2026, employees earning over $145,000 in the previous year will be required to make catch-up contributions exclusively as after-tax Roth contributions. This requirement particularly impacts those aged 50 or older, and notably, plans without a Roth option won’t be able to accept catch-up contributions from these high earners.

Advanced Investment Strategies and Real Estate

The Solo 401(k) offers a remarkable advantage through its Unrelated Debt-Financed Income (UDFI) exemption under IRC §514(c)(9), which fundamentally transforms the possibilities for leveraged real estate investing. This exemption allows Solo 401(k) holders to use leverage for real estate investments without triggering unrelated business income tax, provided specific conditions are met.

Beyond real estate, both plans offer access to a broader spectrum of alternative investments, particularly through self-directed options. Recent regulatory changes have expanded these opportunities, with a 2025 executive order specifically aimed at democratizing access to alternative investments. This includes access to private equity, digital assets, and infrastructure investments, though careful consideration must be given to compliance requirements.

Administrative Requirements and Compliance

Understanding and managing administrative requirements is crucial for maintaining compliance and maximizing benefits. For Solo 401(k) plans, one of the most significant administrative responsibilities emerges when plan assets exceed $250,000, triggering the requirement to file Form 5500-EZ annually.

In contrast, SEP IRAs offer remarkable administrative simplicity. According to

the Journal of Accountancy, these plans can typically be established and funded online the same day, with minimal paperwork and no annual filing requirements.

The timing of plan establishment and contributions differs significantly between these options. Solo 401(k) plans must be established by December 31 of the tax year for making both employee and employer contributions. SEP IRAs offer more flexibility, allowing establishment and contributions up until the business’s tax filing deadline, including extensions.

Conclusion

The choice between a Solo 401(k) and SEP IRA in 2025 ultimately depends on your specific circumstances, including income level, business structure, and retirement goals. Solo 401(k)s offer greater flexibility and potentially higher contribution limits at lower income levels, along with features like loans and Roth options. They’re particularly advantageous for real estate investments due to UDFI exemptions. SEP IRAs, while simpler to administer and establish, may become costly with employees and lack some advanced features. Consider your current needs and future plans carefully, verify provider support for desired features, and maintain compliance with relevant regulations.