Hey there, fellow entrepreneurs! If you’re only hitting up your CPA when the tax man comes knocking, you might be missing out on a treasure trove of savings and financial wizardry. Let’s dive into why making your CPA your BFF (at least financially speaking) all year round is a smart move for your business’s wallet.

1. Kicking Off a New Venture or Side Gig Got a brilliant idea brewing? Before you set the world on fire with your startup or side hustle, loop in your CPA. From getting your books straight to snagging every deduction possible, early advice is golden. Avoid the classic no-nos like mixing personal and business funds or overlooking juicy deductions by keeping your CPA in the know.

2. Changes in Your Personal Saga (Marriage, Divorce, or Calling It Quits) Life’s big moments don’t just fill your photo albums; they can shake up your taxes too. Whether you’re tying the knot, signing divorce papers, or just need to update your status, a heads-up to your CPA can unlock some serious tax perks.

3. Plunging into Other Ventures All investments aren’t viewed the same through the tax lens. Dropping some cash into a small business or partnership? That’s going to tweak your tax scene. Keep your CPA on speed dial to navigate these waters smoothly.

4. Expanding Your Family Tree Welcoming a new bundle of joy? Beyond the sleepless nights, there’s some financial sunshine – tax credits! Make sure your CPA knows about your newest family member to cash in on credits like the child tax credit or the dependent care credit.

5. Borrowing Some Dough Whether it’s for personal use or fueling your business dreams, the way you structure a loan can have big tax implications. A chat with your CPA before you sign on the dotted line can save you a headache (and some cash) later on.

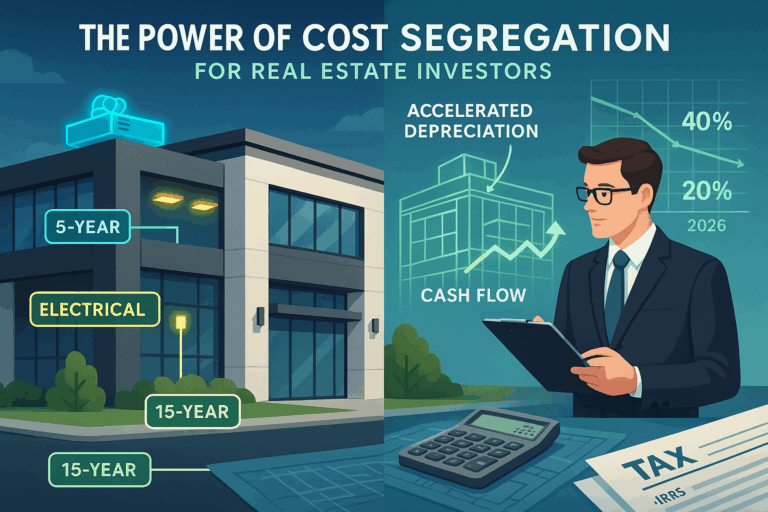

6. Diving into Real Estate Whether you’re buying, selling, or investing in real estate, it’s a whole different ballgame tax-wise. Partner with a CPA who knows their way around property deals to make the most of your investment.

The Bottom Line: It’s All About Staying Connected 📞 Building a proactive partnership with your CPA can seriously level up your financial game. Regular check-ins mean you’re always ready to pivot, plan, and pocket more savings and growth opportunities.

On the hunt for a CPA who’s in it for more than just the annual tax tango? At Chery CPA Firm, we’re all about walking this financial journey with you every step of the way. Hit us up to discover how we can help your business thrive and keep your finances in tip-top shape.

- #TaxSmartMoves 💡 #LifeChangesTaxes 🔄 #InvestSmart 🏦 #EntrepreneurshipJourney 🚀 #CheryCPA