Yo, it’s Vlad, your friendly neighborhood CPA and fellow entrepreneur. We’re all hustling in this wild business arena, aiming to dunk our way to success and growth. But here’s the scoop: there’s a sneaky MVP that’s often left warming the bench until the final buzzer – tax planning. Weaving tax strategy into your financial game isn’t just about sticking to the playbook; it’s your slam dunk for beefing up that bottom line. Let’s break down why tax planning should be front and center in your financial lineup.

Amps Up Your Cash Flow 🚀

First up, cash flow – the heartbeat of our hustle. Think of smart tax planning as uncovering treasure right under your nose. It’s all about grabbing every deduction and credit in sight, keeping that cash where it belongs – with you. This isn’t just pocket change; it’s fuel for growing your empire, diving into new adventures, or cushioning those rough patches. Plus, staying ahead of the game with taxes means you dodge those end-of-season surprises, keeping your financial game on point.

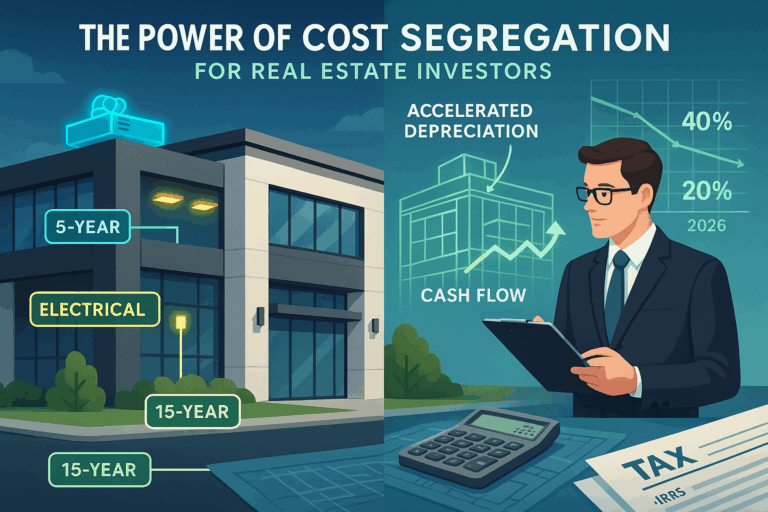

Shrinks Your Tax Bill 💸

Who’s not into saving some green? Clever tax moves can slash your tax bill big time. It’s all about mastering the tax game so you can make plays that benefit your wallet. From timing your asset buys for max deductions to pushing income into a lower-tax year, these strategies are game-changers in how much you fork over to Uncle Sam. And let’s keep it real, less tax means more loot for your business and, by extension, more for you and the fam.

Hones Your Business Strategy 🎯

Tax planning isn’t just about keeping more cash; it’s a key player in your overall business playbook. It influences everything from your business structure to how you pay yourself and make those big-money moves. Deciding between an S Corporation or an LLC isn’t just alphabet soup; it’s about making choices with real tax consequences that shape your financial future.

Keeps You in Good Graces with the Law 🚔

Playing by the rules is non-negotiable in the biz world. A solid tax strategy doesn’t just keep you legit; it saves you from the migraine of audits and fines. Regular pow-wows with a tax guru (yours truly) ensure you’re always in the loop on tax updates, keeping your business nimble and ready to pivot.

Prepares You for Tomorrow 🌟

Top-notch tax planning is all about looking ahead. It sets up a framework for financial practices that grow with your business. Dreaming of launching new products, exploring new territories, or expanding your crew? A strong tax strategy means your growth isn’t just a flash in the pan but something you can bank on for the long run.

Conclusion: The Magic of Teaming Up with Pros

Diving into tax laws might sound like a snooze fest, but you’re not flying solo. Partnering with a squad like Chery CPA PLLC (yep, that’s my crew) means your tax planning is strategic, on-point, and tailored to your unique hustle.

So, let’s not sleep on taxes. Elevating tax planning to star player status in your financial strategy unlocks major savings, keeps you playing clean, and lays the groundwork for real growth. Ready to bring tax planning off the bench? Holler at Chery CPA PLLC, and let’s ensure your business is not just balling but winning big.

#TaxPlanningHustle 💪 #CashFlowBoost 💸 #TaxSavingsWin 🏆 #LegallyLegit 👮 #FutureProofFinances 🔮