Standard Mileage vs. Actual Expenses: Maximizing 2025 Tax Savings

Standard Mileage vs. Actual Expenses: Maximizing Your 2025 Vehicle Tax Deductions Ah, the joyous season of tax calculations – where the thrill of potential savings meets the agony of deciphering IRS hieroglyphics. For business owners and self-employed individuals who view their vehicles as mobile offices, the choice between the standard mileage deduction and the actual expenses method can feel like deciding between two different routes on a foggy mountain road. In 2025, with the standard mileage rate hitting an all-time high of 70 cents per mile, the stakes are even higher. This decision isn’t merely an accounting footnote – it’s a strategic choice that could save (or cost) you thousands of dollars. Whether you’re racking up miles as a rideshare warrior or carefully tracking every oil change for your company car, understanding the nuances of these deduction methods has never been more crucial. Buckle up as we navigate the twisted roads of tax efficiency to help you arrive at maximum savings. The Evolution of Vehicle Tax Deductions Your vehicle tax deductions have been on quite the journey since 2008, riding the economic rollercoaster with all the twists, turns, and occasional loop-de-loops that would make even the most seasoned theme park enthusiast dizzy. Let’s buckle up and take this tax-deduction time machine for a spin, shall we? The IRS standard mileage rate—that magical number that transforms your business driving into sweet tax relief—has been anything but static. Like a car with a temperamental transmission, it’s jerked forward and backward in response to economic conditions and policy changes [Source: TripLog Mileage]. The Great Recession and Its Aftermath (2008-2017) In 2008, as the economy was skidding into the Great Recession, the IRS did something it rarely does—it hit the brakes mid-year and changed direction, bumping the rate from 50.5 cents to 58.5 cents [Source: Company Mileage]. This mid-year adjustment was like an emergency maneuver to avoid the economic potholes created by skyrocketing fuel prices. The economic recovery period brought a gradual downshift in rates. From 2015 to 2017, we witnessed a steady decline from 57.5 cents to 53.5 cents per mile [Source: DriversNote]. Think of it as the tax equivalent of coasting downhill in neutral—reflecting relatively stable economic conditions and falling oil prices. The Tax Cuts and Jobs Act Detour (2018) Then came the Tax Cuts and Jobs Act (TCJA), which rerouted the entire tax landscape. Like a GPS recalculating after you’ve taken a wrong turn, it eliminated moving expense deductions for everyone except military personnel—a restriction that’s been with us for nearly a decade now [Source: Everlance]. For many taxpayers, this was like finding out their favorite shortcut had been permanently closed. The Pandemic Pit Stop (2020-2022) When COVID-19 forced the world into park, the mileage rates reflected our collective standstill. In 2020, the business rate decreased to 57.5 cents (down 1.5 cents from 2019), and it continued its downward journey to 56 cents in 2021 [Source: Timeero]. With lockdowns in place and remote work becoming the norm, fewer miles were being driven, and fuel demand plummeted faster than a car with no brakes on a steep hill. But as the world started to emerge from pandemic restrictions, we witnessed economic whiplash. The IRS made another rare mid-year adjustment in 2022, accelerating from 58.5 cents to 62.5 cents per mile [Source: MileIQ]. This 4-cent jump reflected the sudden inflation and fuel price spikes caused by global pandemic-related shortages and supply chain disruptions that hit like a deer in the headlights. The Road to Recovery (2023-2025) In 2023, we saw the largest year-over-year increase since 2008, with rates shifting into high gear at 65.5 cents—a 7-cent jump [Source: IRS]. This was the economic equivalent of flooring it to make up for lost time. And now, in 2025, we’ve reached a milestone: 70 cents per mile [Source: TripLog Mileage]. This 3-cent increase from 2024 might seem like a modest adjustment, but it represents continued pressure from rising maintenance costs, inflation, and our ever-fluctuating fuel prices. The Impact on Different Drivers These evolving rates haven’t just been numbers on an IRS publication—they’ve had real-world impacts on businesses and self-employed individuals alike. Consider these real-world scenarios: For a self-employed consultant driving 5,000 business miles in 2025, the deduction comes to a healthy $3,500 (5,000 × $0.70) [Source: Cardata]. That’s like getting a free high-end laptop every year just for driving to client meetings! Meanwhile, the delivery driver who logs 30,000 miles can claim a whopping $21,000 in deductions—enough to buy a new vehicle every few years [Source: Bailey Scarano]. For businesses with employee reimbursement programs, the new rates have necessitated policy adjustments. A company with sales representatives who collectively drive 100,000 business miles will now reimburse $70,000 rather than the $67,000 they would have at 2024 rates [Source: CRI Advisors]. Beyond Business: Medical and Charitable Rates While the business rate has been on this wild ride, other rates have moved at a more leisurely pace. The medical and moving rate sits at 21 cents per mile in 2025 (applicable only to military personnel for moving expenses under the TCJA) [Source: NRCA]. The charitable rate, meanwhile, has remained stuck in neutral at 14 cents per mile since—wait for it—1998! [Source: Steward Ingram]. Talk about being parked in the same spot for over two decades! This mileage rate evolution reflects more than just numbers—it’s a roadmap of our economic journey. From recession to recovery, pandemic to resilience, these rates have navigated the economic landscape like a well-used GPS, guiding taxpayers through terrain both smooth and challenging. As we cruise into the future with our 70-cent-per-mile business rate, one thing is certain: this tax deduction will continue its journey, responding to whatever economic traffic conditions lie ahead. Standard Mileage Rate Decoded For the financially savvy road warrior navigating the highways and byways of tax season, the standard mileage rate method stands as a beacon of simplicity in the murky waters of business deductions. Let’s pop the hood on this streamlined approach and see what makes it purr for

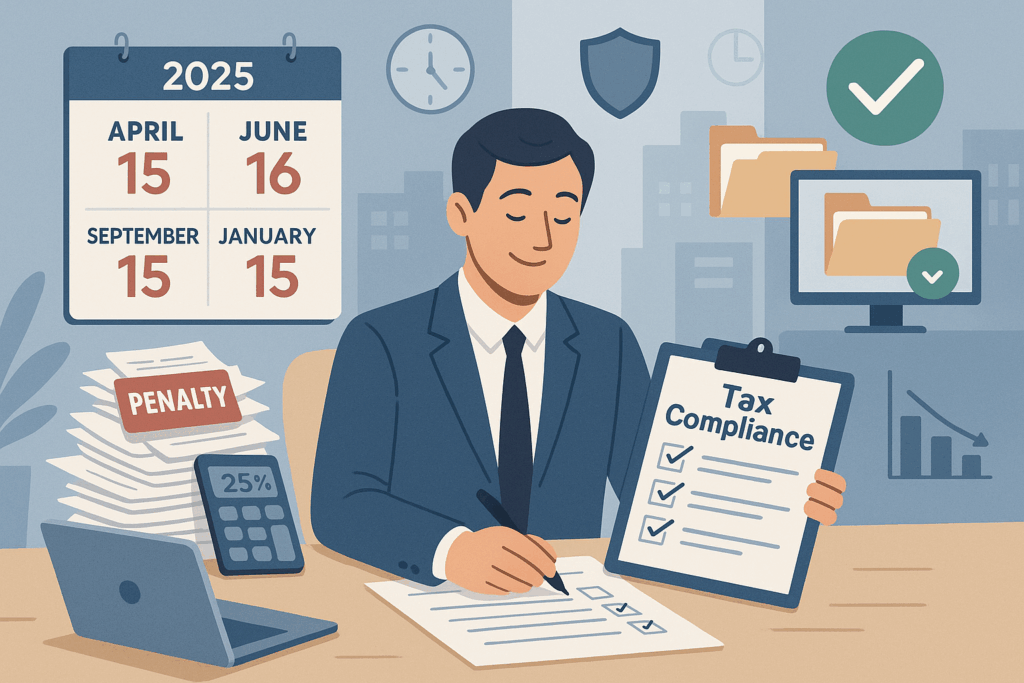

IRS Penalties: How to Avoid the 25% Tax Trap in 2025

IRS Penalties for Late Payments and Underpayments: A Comprehensive Guide for 2025 The Internal Revenue Service penalties for late payments and underpayments have significant financial implications for taxpayers who fail to meet their obligations in 2025. These penalties serve as incentives for timely tax compliance but can substantially increase tax liabilities when not properly managed. With the standard late payment penalty set at 0.5% per month (capped at 25%), and underpayment interest accruing at 7% annually compounded daily, understanding the nuances of these penalties has become essential for effective financial planning. This article explores the complex structures of IRS penalties, highlighting critical differences between various types of penalties, providing strategies for compliance, and examining special cases where penalties may be reduced or avoided. Whether you’re a business owner, independent contractor, or individual taxpayer, this comprehensive guide will equip you with the knowledge needed to navigate tax regulations effectively and minimize unnecessary financial burdens. Understanding IRS Late Payment Penalties Navigating Underpayment Penalties While late payment penalties apply after tax deadlines pass, underpayment penalties occur when you haven’t paid enough tax throughout the year. The IRS requires taxpayers to pay taxes as income is earned through withholding or quarterly estimated payments. Failing to do so triggers underpayment penalties, which differ significantly from late payment penalties in both calculation and application. For 2025, underpayment penalties accrue at a 7% annual interest rate compounded daily [Source: IRS]. This seemingly modest rate can accumulate substantially due to daily compounding. For example, a $5,000 underpayment over six months would result in approximately $175 in penalties. The compounding nature means larger underpayments and longer durations create exponentially increasing penalties. To avoid these penalties, the IRS offers several “safe harbor” provisions. Meeting any one of these requirements exempts you from underpayment penalties: Pay at least 90% of your current year’s tax liability through withholding or estimated payments [Source: JSM & Associates] Pay 100% of your previous year’s tax liability (110% if your adjusted gross income exceeded $150,000) [Source: H&R Block] Owe less than $1,000 in tax after subtracting withholdings and credits [Source: Papaya Global] The 2025 quarterly estimated tax payment schedule follows specific deadlines: First quarter (January 1-March 31): Due April 15, 2025 Second quarter (April 1-May 31): Due June 16, 2025 Third quarter (June 1-August 31): Due September 15, 2025 Fourth quarter (September 1-December 31): Due January 15, 2026 [Source: Kiplinger] Missing these deadlines triggers penalties for each quarter’s underpayment, calculated from the due date until the payment date or the following April 15, whichever comes first. For taxpayers with irregular income patterns, the IRS offers the annualized income installment method. This approach, documented on Form 2210 Schedule AI, allows taxpayers to make uneven quarterly payments based on actual income received in each period [Source: Investopedia]. This method particularly benefits: Self-employed individuals with fluctuating income Seasonal workers with concentrated earning periods Retirees with irregular investment distributions Anyone with significant income variability throughout the year Form 2210 (Underpayment of Estimated Tax) serves as the primary document for calculating these penalties. While the IRS typically computes the penalty automatically, filing Form 2210 allows taxpayers to request waivers or use the annualized income method to potentially reduce penalties [Source: IRS]. Different taxpayer categories require tailored strategies to manage underpayment risks. For W-2 employees with substantial side income, adjusting withholding on their primary job can compensate for tax obligations from secondary earnings. Those earning over $150,000 annually must remember the elevated 110% prior-year threshold for safe harbor protection [Source: JSM & Associates]. Special Cases and Filing Extensions Filing extensions provide crucial flexibility for taxpayers, but understanding their limitations is essential. When you file Form 4868 before the April 15, 2025 deadline, you gain additional time to file your return (until October 15, 2025) but not additional time to pay taxes owed [Source: Boston 25 News]. This distinction is critical since penalties and interest on unpaid taxes begin accruing from the original due date regardless of extensions. Three approved methods exist for requesting an extension: using IRS Free File on IRS.gov, making an electronic payment while selecting “extension” as the payment reason (keep your confirmation number), or mailing Form 4868 to the appropriate IRS address [Source: IRS]. To avoid penalties, pay at least 90% of taxes owed by April 15, even when requesting an extension. Several special circumstances may qualify for automatic penalty relief. Taxpayers affected by federally declared disasters receive automatic extensions for both filing and payment deadlines. For example, those affected by Oklahoma wildfires beginning March 14, 2025, have until November 3, 2025, to file returns and make payments [Source: IRS]. This relief applies automatically to those with an IRS address in the disaster area. Military personnel serving in combat zones receive significant extensions beyond standard provisions. These taxpayers qualify for an automatic 180-day extension beginning upon leaving the eligible area or hospital discharge [Source: TurboTax]. The calculation becomes even more favorable when adding unused filing days prior to deployment. For example, leaving a combat zone on April 1 (15 days before the deadline) grants a 195-day extension. These extensions also apply to spouses and dependents, even when filing separately. U.S. taxpayers living abroad automatically receive a two-month extension to June 16, 2025 (pushed from June 15 due to the weekend) [Source: IRS]. If additional time is needed, they can request a secondary extension to October 15, 2025, through Form 4868 or electronic filing methods. However, payment remains due by April 15 to avoid interest and late payment penalties of 0.5% per month. Extension requirements differ significantly between federal and state taxes. While a federal extension via Form 4868 provides six months to file, state extension processes vary widely [Source: TurboTax]. Some states (like Wisconsin, Alabama, and California) grant automatic extensions without requiring forms, while others (including Maryland and New York) require state-specific extension forms. Always verify your state’s specific requirements, as federal extensions don’t automatically apply to state taxes. For deceased taxpayers, filing obligations continue. The IRS requires a final individual tax return (Form 1040 or 1040-SR) for

Tax-Free Reimbursements: S Corp Owners’ Ultimate Savings Guide

Maximizing Tax Savings with Accountable Reimbursement Plans for S Corporation Owners Navigating the complex landscape of corporate taxation requires strategic planning, especially for S Corporation owners seeking to optimize their financial position. An Accountable Reimbursement Plan represents one of the most effective tax-saving mechanisms available to S Corporation shareholders in today’s tax environment. These plans enable owners to receive tax-free reimbursements for legitimate business expenses while allowing their corporation to claim valuable deductions. Since the Tax Cuts and Jobs Act eliminated many unreimbursed employee expense deductions, implementing a properly structured Accountable Plan has become increasingly crucial. This comprehensive guide explores how S Corporation owners can establish compliant reimbursement systems, identify eligible expenses, and navigate IRS requirements to maximize tax advantages while minimizing audit risk. Understanding Accountable Reimbursement Plans for S Corporations An Accountable Reimbursement Plan for S Corporations is a structured system that allows owners and employees to receive tax-free reimbursements for qualifying business expenses paid with personal funds. These plans enable the corporation to deduct these costs while providing significant tax advantages to S Corp owners [Source: Collective]. S Corporation owners need to understand how these plans work, especially since the Tax Cuts and Jobs Act (TCJA) eliminated deductions for unreimbursed employee expenses in 2017. This change made accountable plans even more valuable as a tax planning strategy for business owners [Source: Teh CPA]. For a reimbursement plan to qualify as “accountable” in the IRS’s eyes, it must meet three essential criteria: Business Connection: Reimbursements must cover expenses incurred for services performed as an employee. This includes costs like home office expenses or a cell phone used partially for work [Source: Thomas Kopelman]. Substantiation: All expenses must be properly documented with receipts or records showing amounts, dates, places, and business purpose. While a formal written policy isn’t explicitly required, establishing consistent procedures is crucial [Source: Online Taxman]. Return of Excess: Any advances exceeding actual costs must be returned within a “reasonable period” or be treated as taxable wages [Source: WCG Inc]. The difference between accountable and non-accountable plans is significant. With an accountable plan, reimbursements are excluded from gross income and not reported on Form W-2. In contrast, non-accountable plan reimbursements are taxable as wages, reported on W-2, and subject to income and employment taxes [Source: Dean Dorton]. A common misconception is that informal arrangements are sufficient. However, proper documentation is essential – many S Corp owners mistakenly believe they can estimate business use percentages without clear records, which invites IRS scrutiny [Source: Texas Workforce Commission]. Let’s look at a practical example: If you have a $100 monthly cell phone bill and use it 70% for business purposes, an accountable plan allows tax-free reimbursement of $70 while your S Corp deducts this as a business expense. Without such a plan, you’d pay the full $100 personally with no tax benefit [Source: Collective Help Center]. By implementing an accountable plan, S Corporation owners can legally convert what would otherwise be nondeductible personal expenses into legitimate business deductions, creating significant tax savings while maintaining compliance with IRS regulations. Tax Benefits and Financial Advantages Let’s talk about why Accountable Reimbursement Plans are a game-changer for S Corporation owners when it comes to tax efficiency. If you’ve been running your S Corp without one, you’re likely leaving money on the table! Slashing Your Tax Bill: The W-2 Income Reduction Effect When you reimburse yourself through an Accountable Plan, those reimbursements aren’t included in your W-2 income. This creates immediate tax savings on multiple fronts. For instance, let’s look at a business owner who uses their cell phone 70% for business purposes, costing $100 monthly. Under an Accountable Plan, the S Corporation can reimburse $70 each month as a tax-free payment to the owner [Source: Collective]. This creates annual tax savings of approximately $585 when you factor in federal income tax (24%), state income tax (7%), and payroll taxes (7.65%) [Source: Online Taxman]. Home office expenses offer even more substantial savings. Consider an S Corp owner using 25% of their home exclusively for business. With monthly utilities of $200 and internet of $100, the business portion equals $75 monthly. Implementing an Accountable Plan for these expenses saves approximately $285 annually in combined self-employment and income taxes [Source: Piece of Wealth Planning]. Why These Plans Became Crucial After the Tax Cuts and Jobs Act The Tax Cuts and Jobs Act (TCJA) of 2017 eliminated the deduction for unreimbursed employee expenses for tax years 2018 through 2025 [Source: H&R Block]. Before this change, employees could deduct business expenses that exceeded 2% of their adjusted gross income. Now, that option is gone. This makes Accountable Plans the only viable method for S Corporation owners to reduce their tax burden for legitimate business expenses. Without one, you’re stuck paying personal taxes on income that you’re using for business purposes – essentially paying taxes on money that isn’t actually personal income [Source: TurboTax]. Double-Sided Tax Benefits Accountable Plans create a win-win tax situation for both you personally and your S Corporation: Corporation Benefits: Your S Corp deducts the reimbursed expenses directly from its taxable income, reducing the pass-through profits that would otherwise flow to your personal tax return [Source: Club Capital]. Personal Benefits: The reimbursements you receive aren’t subject to federal income tax, state income tax, or the 7.65% payroll taxes (Social Security and Medicare) [Source: Thomas Kopelman]. For example, a business owner reimbursed $10,000 annually for legitimate business expenses through an Accountable Plan could save approximately $3,865 in combined taxes (assuming 24% federal, 7% state, and 7.65% payroll taxes). Important Limitations to Keep in Mind While Accountable Plans offer significant advantages, they come with restrictions: Documentation Requirements: You must maintain detailed records substantiating each expense’s business purpose, amount, and timing [Source: Collective]. Legitimate Business Connection: Only genuine business expenses qualify. Personal expenses disguised as business costs will trigger IRS scrutiny [Source: Piece of Wealth Planning]. Timely Reporting: Expenses must be substantiated and excess amounts returned within reasonable timeframes (typically within 60 days) [Source: Massey and Company CPA].

Solo 401(k) 2025: Unlock Higher Retirement Contributions

Solo 401(k) in 2025: Maximizing Retirement Benefits for the Self-Employed The Solo 401(k) plan has emerged as a powerful retirement vehicle for self-employed individuals and business owners with no employees other than a spouse. As 2025 unfolds, significant changes to contribution limits and regulatory updates through the SECURE 2.0 Act are reshaping the retirement planning landscape. With employee contribution limits rising to $23,500 and combined limits reaching up to $81,250 for certain age groups, understanding how to leverage these enhancements is crucial for optimizing your retirement strategy. This article explores the evolving Solo 401(k) framework, examining the increased contribution opportunities, tax planning options, and potential challenges faced by plan holders. Whether you’re a seasoned entrepreneur or newly self-employed, these insights will help you navigate the complex world of retirement planning with confidence and maximize your financial security for the future. Understanding the 2025 Contribution Landscape Tax-Optimization with Pre-Tax and Roth Options Self-employed individuals with Solo 401(k) plans have a powerful advantage in retirement planning: the ability to strategically allocate contributions between pre-tax and Roth options within the same plan. This tax diversification strategy can significantly impact your retirement nest egg and tax situation in later years. Understanding the Fundamental Differences Pre-tax and Roth contributions represent two distinct approaches to retirement saving, each with unique tax implications: Pre-Tax Contributions: These contributions reduce your current taxable income, providing immediate tax savings at your marginal tax rate. For example, if you’re in the 22% federal tax bracket, a $10,000 pre-tax contribution could save you $2,200 in taxes this year [Source: Carry.com]. However, both your contributions and their growth will be taxed as ordinary income when withdrawn in retirement. Roth Contributions: Made with after-tax dollars, these contributions provide no immediate tax benefit. However, qualified withdrawals in retirement—including all growth—are completely tax-free [Source: Solo401k.com]. This creates a tax-free income stream that can be invaluable during retirement. The Solo 401(k) Advantage: Contribution Flexibility Unlike many employer-sponsored plans, Solo 401(k)s offer unique flexibility by allowing you to make both types of contributions within the same plan [Source: Vestwell]. This creates opportunities for strategic tax planning: As an employee, you can direct your elective deferrals ($23,500 in 2025) to either pre-tax, Roth, or a combination of both. As an employer, your profit-sharing contributions (up to 25% of compensation) must be made pre-tax. This structure allows for nuanced tax planning strategies that can be adjusted annually based on your financial situation. Strategic Allocation Approaches The optimal allocation between pre-tax and Roth contributions depends primarily on your current versus anticipated future tax brackets. While predicting future tax rates involves some uncertainty, several guiding principles can help: Current vs. Future Tax Rate Analysis: If you expect to be in a lower tax bracket during retirement, pre-tax contributions may provide greater lifetime tax benefits. Conversely, if you anticipate being in a higher tax bracket later, Roth contributions would likely be more advantageous [Source: Ameriprise]. Tax Diversification Strategy: Rather than choosing exclusively between pre-tax and Roth, consider building both types of accounts to create tax flexibility in retirement. This approach—sometimes called “tax diversification”—allows you to strategically withdraw from different account types based on your tax situation in any given year [Source: Farther]. Practical Example: Balancing Contributions by Life Stage Consider how different professionals might approach contribution allocation: Early-Career Professional: A self-employed consultant earning $80,000 might allocate their employee deferrals primarily to Roth accounts while their income (and tax bracket) is relatively lower. This maximizes tax-free growth potential over a longer time horizon. Peak-Earning Physician: A doctor with $350,000 in net income might direct their employee deferrals to pre-tax accounts to reduce current high-bracket taxation, while simultaneously building some Roth assets for tax diversification [Source: RBC Wealth Management]. Near-Retirement Business Owner: A business owner age 62 with substantial pre-tax retirement assets might prioritize Roth contributions to build tax-free withdrawal options, potentially helping manage required minimum distributions and Medicare premium surcharges later. Enhanced Catch-Up Provisions for Ages 60-63 The SECURE 2.0 Act created special opportunities for those aged 60-63. Beginning in 2025, individuals in this age group can make enhanced catch-up contributions of $11,250 to their Solo 401(k) plans (compared to the standard $7,500 catch-up for those 50+ in other age ranges) [Source: Morgan Lewis]. Strategic consideration: For high-income self-employed individuals in this age bracket, you face a unique opportunity to supercharge retirement savings. However, be aware that beginning in 2026, if your prior year income exceeds $145,000, all catch-up contributions must be made as Roth contributions [Source: IRS]. Advanced Strategy: The “Mega Backdoor Roth” in Solo 401(k)s For self-employed individuals seeking to maximize Roth savings, a specialized Solo 401(k) plan design can enable what’s commonly called the “Mega Backdoor Roth” strategy. This involves: Making after-tax (non-Roth) contributions to your Solo 401(k), beyond the standard employee deferral limits Converting these after-tax contributions to Roth status through in-plan Roth conversions This strategy requires specific plan provisions that allow both after-tax contributions and in-plan Roth conversions [Source: Solo401k.com]. When properly implemented, it can potentially allow you to contribute up to the full annual defined contribution limit ($70,000 in 2025, or $77,500 for those 50+) to Roth accounts [Source: Carry.com]. Determining Your Optimal Allocation: A Worksheet Approach To determine your optimal allocation between pre-tax and Roth contributions, consider this calculation framework: Step 1: Calculate your adjusted net income for retirement plan purposes: Net Profit from Self-Employment: $________ Self-Employment Tax Deduction (Net Profit × 15.3% × 0.5): $________ Adjusted Net Income: $________ Step 2: Analyze your current marginal tax rate versus anticipated retirement tax rate: Current Federal Tax Bracket: _____% State: _____% Projected Retirement Tax Bracket: _____% State: _____% Step 3: Model the long-term impact using a comparative analysis [Source: TIAA]: For a $10,000 contribution: – Pre-tax value today: $10,000 contribution + $2,400 tax savings (assuming 24% bracket) – Roth value today: $10,000 contribution (no immediate tax savings) After 25 years at 7% growth: – Pre-tax account: $54,274 (before taxes) – After taxes at 20% bracket: $43,419 – After taxes at 30% bracket: $37,992 – Roth account: $54,274

Cost Segregation: Maximize Real Estate Tax Benefits in 2025

Maximizing Returns: The Power of Cost Segregation for Real Estate Investors in 2025 As real estate investors navigate an increasingly complex tax landscape in 2025, cost segregation emerges as a powerful strategy to optimize returns and enhance cash flow. This tax planning approach allows property owners to reclassify building components into categories with shorter depreciation schedules, accelerating tax deductions and creating significant early-year savings. With bonus depreciation reduced to 40% this year and further reductions on the horizon, understanding how to leverage cost segregation has never been more crucial. This article explores the fundamentals of cost segregation, its implementation process, and its potential to transform investment outcomes in today’s evolving tax environment. Implementing a Successful Cost Segregation Study To maximize tax benefits through cost segregation, real estate investors need a systematic approach that combines professional expertise, thorough documentation, and strategic timing. The implementation process follows several critical steps to ensure both maximum tax savings and IRS compliance. Assembling Your Professional Team A successful cost segregation study requires specialized professionals working in concert. At minimum, your team should include qualified engineers who analyze physical property components, tax specialists who understand IRS classifications, and a CPA familiar with cost segregation benefits. When selecting a cost segregation firm, prioritize those with engineering expertise and a proven track record of defending studies during IRS scrutiny. Engineers play a particularly crucial role, as they apply technical knowledge to identify components that qualify for accelerated depreciation. They “map building components, identify non-structural elements eligible for shorter depreciation periods (e.g., electrical systems, HVAC), and allocate costs” Source: Maven Cost Segregation. Gathering Essential Documentation Before beginning the study, collect comprehensive documentation that engineers will need for their analysis: Blueprints and architectural plans to identify physical components eligible for reclassification Construction contracts and invoices showing itemized costs for materials and systems Purchase agreements detailing the property acquisition and allocated costs Improvement records for any renovations or additions made since purchase These documents enable engineers to “dissect invoices and project budgets into asset-specific allocations” Source: KBKG, providing the foundation for defensible asset reclassification. The Study Process and Timeline A professional cost segregation study typically takes 4-8 weeks to complete, depending on property complexity. The optimal time to conduct a study is immediately after acquiring a property or completing construction, allowing you to capture the maximum depreciation benefits from day one Source: NAIOP. If you’ve owned the property for several years, the IRS permits “look-back studies” to retroactively claim missed deductions by filing Form 3115 (Application for Change in Accounting Method). This allows you to catch up on accelerated depreciation without amending prior returns Source: Rocket Mortgage. Investment Required and ROI Evaluation Professional cost segregation studies typically cost between $5,000 and $15,000, with variations based on property size, complexity, and the scope of analysis Source: Corporate Tax Advisors. For smaller properties valued under $2 million, costs may range from $2,500 to $6,000. To determine if this investment makes financial sense, apply this general guideline: properties valued at $500,000 or more typically generate enough tax savings to justify the cost. The potential return on investment is substantial, as tax savings often outweigh study costs by “10-100x” Source: Windes. Implementing the Study Findings After completing the study, work with your tax professional to: Update depreciation schedules for reclassified assets File appropriate tax forms, including Form 3115 for look-back studies Maintain detailed documentation of all reclassified components According to tax experts, you should “keep the full cost segregation report, including property analysis methodologies, detailed asset classifications and cost allocations” Source: CSSI Services to withstand potential IRS scrutiny. Ensuring IRS Compliance The IRS has specific requirements for cost segregation studies outlined in their Cost Segregation Audit Techniques Guide. To ensure your study meets these standards: Use professionals with established cost segregation expertise Ensure the study applies engineering-based methodology rather than merely estimating Obtain a detailed written report with specific asset classifications and supporting documentation Verify that the methodology aligns with IRS-approved approaches Adhering to these guidelines minimizes audit risk and provides “audit-ready documentation” that generates “detailed reports linking classifications to IRS regulations, ensuring defendable audit positions” Source: Maven Cost Segregation. Post-Study Best Practices After implementing your cost segregation study, adopt these best practices to maximize benefits: Conduct regular reviews of your depreciation schedule every 3-5 years Document any asset disposals or replacements Plan for potential depreciation recapture when selling the property Consider complementary tax strategies that work alongside cost segregation By following these implementation steps, real estate investors can successfully leverage cost segregation to accelerate depreciation deductions, increase cash flow, and enhance overall investment returns while maintaining compliance with IRS requirements. The Step-by-Step Implementation Process A successful cost segregation study follows a structured approach. The journey begins with a feasibility analysis to determine if your property qualifies based on factors like age, size, usage, and renovation costs. This critical first step ensures the potential tax savings will exceed the study’s cost Source: Segregation Holding. Next comes the engineering review and site analysis phase. Engineers conduct comprehensive on-site surveys, photographing and documenting assets like flooring, electrical systems, and fixtures. They then allocate costs by classifying these assets into IRS-compliant categories using construction estimates, schematics, and industry cost databases Source: KBKG. The heart of the process involves detailed cost reallocation, where assets are broken down into shorter depreciation categories. For instance, office renovations might be reclassified as tangible property with a 7-year depreciation life, while landscaping elements could qualify as non-structural components with 5-15 year depreciation periods Source: Rocket Mortgage. Required Documentation and Timeline Before initiating a cost segregation study, gather essential documentation to ensure accuracy and compliance. This includes purchase and acquisition information such as closing statements, fixed asset schedules, and land value allocation documents Source: Acena Consulting. Construction-related documents like blueprints, floor plans, contracts, and utility drawings are equally crucial for proper asset classification Source: Engineered Tax Services. Timing is critical for maximizing benefits. For new construction, initiate the study during the building phase to access detailed cost records. For existing properties, complete the

Master the Mega Backdoor Roth: Unlock $70K+ in 2025

The Mega Backdoor Roth Strategy: Maximizing Retirement Savings in 2025 The Mega Backdoor Roth strategy has emerged as a powerful financial tool for high-income earners looking to optimize their retirement savings beyond traditional limits. In 2025, this approach continues to evolve with increased contribution limits and more flexible rules designed to enhance wealth accumulation in tax-advantaged accounts. By leveraging after-tax contributions to employer-sponsored retirement plans, individuals can potentially funnel tens of thousands of additional dollars into Roth accounts, where investments grow tax-free and qualified withdrawals remain untaxed. As retirement planning becomes increasingly complex amid changing tax regulations and economic uncertainties, understanding the intricacies of the Mega Backdoor Roth has become essential for those seeking to maximize their long-term financial security while minimizing tax burdens in retirement. Employer Plan Requirements and Future Outlook The success of implementing a Mega Backdoor Roth strategy hinges critically on whether your employer’s retirement plan has specific features in place. Not all 401(k) plans are created equal, and the availability of this advanced strategy depends on particular plan provisions that employers must explicitly include. Essential Plan Features For a Mega Backdoor Roth to be viable, your employer’s 401(k) plan must include two fundamental components. First, the plan must permit voluntary after-tax contributions beyond the standard pre-tax or Roth deferral limits [Source: Fidelity]. These after-tax contributions are entirely separate from your regular salary deferrals and typically don’t qualify for employer matching. This provision is non-negotiable—without it, the strategy cannot be implemented. Second, the plan must offer a mechanism to convert these after-tax funds to Roth status through either in-service withdrawals or in-plan conversions [Source: NerdWallet]. The in-service withdrawal option allows you to transfer after-tax contributions (and their earnings) to a Roth IRA, while the in-plan conversion option lets you move these funds directly into the plan’s Roth 401(k) component. An often-overlooked requirement is that employer plans must pass nondiscrimination tests when after-tax contributions are involved. The Average Contribution Percentage (ACP) test measures whether highly compensated employees (HCEs) contribute disproportionately compared to non-highly compensated employees (NHCEs) [Source: Finturity]. If too few rank-and-file employees participate, the plan may fail this test, forcing refunds of contributions to HCEs and effectively derailing the Mega Backdoor strategy. Determining If Your Plan Qualifies To determine if your employer’s plan supports the Mega Backdoor Roth strategy, start by reviewing the Summary Plan Description (SPD) or consulting directly with your HR department. Specifically, verify whether after-tax contributions beyond regular deferrals are permitted and confirm if in-service distributions or in-plan Roth conversions are allowed [Source: Northern Trust]. When approaching HR, focus on specific questions: “Does our plan allow for voluntary after-tax contributions above the IRS deferral limits?” and “What options exist for converting these after-tax contributions to Roth accounts?” [Source: Employee Fiduciary]. If you encounter uncertainty, request access to the complete plan document or ask HR to consult with the plan administrator. Options for Self-Employed Individuals Self-employed individuals and small business owners have a distinct advantage when implementing the Mega Backdoor Roth through Solo 401(k) plans. These plans can be specifically designed to include both after-tax contribution provisions and Roth conversion options. The key benefit for solo practitioners is that they bypass the ACP testing requirements that often complicate implementation in larger employer plans [Source: Employee Fiduciary]. When establishing a Solo 401(k) for this purpose, ensure the plan document explicitly includes a Roth provision allowing after-tax contributions to the traditional component, which can later be converted to Roth status. Several custodians specialize in Solo 401(k) plans with these features, though not all standard offerings include them by default. Advocating for Plan Changes If your employer’s current 401(k) plan doesn’t support the Mega Backdoor Roth strategy, consider advocating for plan amendments. When approaching your employer about adding these features, focus on the competitive advantage they provide for talent recruitment and retention, particularly for higher-income employees who may have limited other options for Roth contributions [Source: Investopedia]. A persuasive proposal might highlight how implementing after-tax contributions and Roth conversion options would allow high-performing employees to maximize their retirement savings, positioning the company’s benefits package competitively against industry peers. Emphasize that with third-party administrator (TPA) support, administrative burdens can be minimized while significantly enhancing the plan’s appeal [Source: Northern Trust]. Implementation Challenges Even with the right plan features in place, implementing the Mega Backdoor Roth strategy presents several challenges. The timing of conversions requires careful coordination to minimize tax on earnings, as any growth on after-tax contributions becomes taxable upon conversion. Some practitioners recommend frequent conversions (sometimes quarterly or even bi-weekly) to minimize the accumulation of taxable earnings [Source: Fidelity]. Administrative complexity represents another significant hurdle. Record-keeping for after-tax contributions and their conversions requires meticulous attention to detail, particularly regarding tax basis tracking. Many plan administrators and payroll departments have limited experience managing these transactions, potentially leading to errors in reporting or execution. Future Outlook for Mega Backdoor Roth Strategies The future of the Mega Backdoor Roth strategy remains uncertain as we look beyond 2025. While no recent legislation explicitly targets this strategy—it notably survived the SECURE 2.0 Act of 2022 without restrictions—tax professionals remain cautious about its long-term viability [Source: RG Wealth]. The strategy’s continued availability hinges on several factors. Current IRS guidelines continue to permit after-tax 401(k) contributions and their conversion to Roth accounts, provided the plan allows these features. However, experts warn that Congressional appetite for tax reform, particularly amid rising national debt concerns, could eventually lead to restrictions on perceived “loopholes” in retirement savings [Source: SDOCPA]. Political dynamics will likely play a role in the strategy’s longevity. Tax policy shifts targeting wealth accumulation in tax-advantaged accounts could indirectly impact the viability of Mega Backdoor Roth conversions [Source: Mercer Advisors]. Some analysts suggest that the $46,500 post-elective-deferral limit for after-tax 401(k) contributions could become a specific target for legislative changes in upcoming years. For those considering this strategy, financial advisors recommend a time-sensitive approach—maximizing Mega Backdoor contributions while the opportunity remains available, while simultaneously developing contingency plans should regulations change [Source: Atkinson Wealth Strategies]. Staying

Tax-Savvy Travel: Your Complete Guide to Business Travel Deductions

Dreaming of that perfect getaway but worried about your budget? Here’s a travel hack that’ll make your accountant smile. Believe it or not, your next business trip could be a tax write-off goldmine. But here’s the kicker – you might be leaving money on the table if you’re not maximizing your deductions. Because contrary to popular belief, mixing business with pleasure isn’t just allowed, it’s practically endorsed by the IRS. An Overview of Business Travel Deductions The IRS defines travel expenses as ordinary and necessary costs incurred while traveling away from home for business, profession, or job purposes. These expenses must not be lavish, extravagant, or for personal purposes. To determine if your travel expenses qualify for deductions, consider two key factors: Are these expenses ordinary for businesses in your industry? And are they necessary for your business operations? Deductible Travel Expenses Once you’ve established that your trip meets the IRS criteria, you can deduct a wide range of expenses, including: 1. Transportation costs: This covers air, train, or bus fares, as well as car expenses between your home and business destination.2. Local transportation: Costs for getting to and from the airport and your hotel.3. Accommodation: Hotel expenses for the duration of your business trip.4. Meals: 50% of non-entertainment related meal expenses.5. Communication costs: Internet fees, fax, or printer fees related to business.6. Incidentals: Tips for services, baggage fees, and even dry cleaning or laundry expenses. Non-Deductible Expenses While many travel expenses are deductible, it’s crucial to understand what doesn’t qualify: 1. Family travel costs: Unless your family members are business partners, their expenses are not deductible.2. Extravagant or unreasonable expenses: Stick to what’s ordinary and necessary for your business.3. Personal expenses: Souvenirs, personal shopping, or non-business-related activities are not deductible.4. Home town expenses: Costs incurred in your home city don’t count as travel expenses. Maximizing Your Deductions: Mixing Business with Pleasure The tax code allows for some flexibility in combining business and leisure travel. Here are some strategies to maximize your deductions: 1. Ensure the primary purpose of the trip is business-related.2. Schedule the majority of your travel days for business activities.3. Remember that travel days count as business days.4. If your spouse is a business partner, their travel expenses may also be deductible.5. Consider “sandwiching” vacation days between work days to potentially deduct all lodging expenses. For example, you might fly to a destination on Thursday, work on Friday, enjoy personal time on Saturday, work again on Sunday, and fly back on Monday. In this scenario, all lodging expenses could potentially be deductible. Claiming Travel Expenses on Your Tax Return The method for claiming travel expenses depends on your business structure: 1. Sole proprietors and single-member LLCs: Deduct expenses on Line 24 of Schedule C on your individual tax return.2. Other business entities: Claim deductions on your business tax return under the travel expenses line item. Recordkeeping and Audit Concerns While less than 1% of tax returns are audited annually, it’s crucial to maintain thorough records of all deducted expenses. Keep receipts, itineraries, and business notes to justify your expenses if questioned by the IRS. A simple system, such as making notes on receipts and scanning them into a dedicated folder on your phone, can suffice. Remember, an IRS audit doesn’t necessarily indicate wrongdoing. It simply means the IRS requires additional information or supporting documentation for your claimed deductions. Conclusion Business travel deductions offer a fantastic opportunity to reduce your tax liability while potentially enjoying some leisure time. By understanding what qualifies as a deductible expense, strategically planning your trips, and maintaining proper documentation, you can make the most of these tax benefits. Always consult with a tax professional for personalized advice, especially when dealing with complex scenarios or substantial deductions. Your Next Steps to Tax-Saving Success As you embark on your next business adventure, remember that smart travel isn’t just about finding the best deals—it’s about making every trip work harder for your bottom line. By leveraging these tax-savvy strategies, you’re not just seeing the world; you’re investing in your business’s future. So pack your bags, grab your laptop, and get ready to turn your next business trip into a tax-saving triumph. The world is waiting, and so are the deductions! Ready to Maximize Your Business Travel Deductions? Let’s connect! Find me on LinkedIn for more tax-saving tips and strategies. And if you have any questions or want to explore how these deductions can work for your specific situation, don’t hesitate to reach out. Take Action Today: Schedule your free discovery call: (346) 676-2450 Email us: [email protected] Your next business trip could be your most profitable yet—let’s make it happen together!

File My Own Tax Return or Hire a Pro? (Navigating the Tax Jungle)

In this digital age, where DIY is just a tap away on our screens, it’s super tempting to tackle tax filing on our own. Seems like a smart move to save a few bucks, right? Especially if your financial life isn’t too complex. But, let me tell you, diving into the tax world solo can be more of a wild ride than you bargained for. Here’s why getting a pro on your team could be the MVP move for your wallet. The Accuracy Maze – Sure, tax software has been a game-changer, making us feel like tax wizards. But even wizards can slip up. You’ve got to punch in your info just right and know where all the hidden treasures (or traps) are. One wrong step and boom, you’re in the land of misfiled taxes, which is no fun at all. The Overpayment Trap – Going DIY can lead to accidentally giving Uncle Sam a bigger tip than he deserves. Tax pros, like us at Chery CPA Firm, have the map to navigate through the dense tax laws and spot those hidden deductions and credits you might miss. Trust me, the savings can often dwarf the cost of getting professional help. Audit Shield – While many tax apps throw in an “audit support” feature, it’s like bringing a toy sword to a dragon fight. Having a tax pro by your side drastically lowers your chances of errors that could wave red flags. And if the audit dragon does show up, you’ll want a seasoned knight, not a toy sword, to deal with it. DIY vs. Pro Tax Filing: The Showdown 🥊 Choosing between DIY and hiring a pro really comes down to how tight your organizational game is, how cozy you feel with tax laws, and how complex your financial life is. Feeling like a tax code ninja? DIY might work for you. But if you’re after peace of mind and keeping more cash in your pocket, going pro is the way to go. The Real Price Tag of DIY Tax Returns 💸 Saving on prep fees is sweet until you realize mistakes in DIY returns can hit your wallet hard. Whether it’s paying too much or too little, messing up can lead to penalties that make those initial savings seem like peanuts. The IRS isn’t known for its chill vibe when it comes to errors. At Chery CPA, we’re about strategizing to boost your savings and making sure you’re playing the tax game like a boss. Our expertise comes from years of training and real-world battles with the tax beast, so we know how to keep more of your money where it belongs – with you. If you’re ready to ditch the stress, save time, and maybe even beef up your refund, why not give Chery CPA Firm a shout? Let’s show you how we can make your financial life a breeze and not a battle. Thinking about leveling up your tax game with professional help? Hit up Chery CPA today for a chat, and let’s take the first step towards securing your financial fortress. #TaxWizard 🧙♂️ #AuditShield ⚔️ #OverpaymentTrap 🪤 #DIYvsPro 🥊 #TaxSavings 💰

Slam Dunk Your Taxes: The S-Corp Health Insurance Alley-Oop

Yo, fellow S-Corp ballers! If you’re looking to score big on tax savings, I’ve got the play-by-play on a strategy that’s like hitting a three-pointer at the buzzer. We’re talking about the health insurance “double dip” – a move so smooth, even the IRS gives it a nod. Here’s how you can glide through this strategy and dunk on those tax bills: 1. The Double Dip Swish: Picture this: you’re on the court, and you’ve got a chance to score twice with one shot. That’s what S-Corp owners can do with health insurance premiums – save on income taxes and then again on FICA taxes. Talk about a game-changer! 2. IRS High-Five: This isn’t some sneaky move; it’s straight-up endorsed by the IRS. They’re basically setting you up for an assist, encouraging smart plays with your health insurance costs. 3. W-2 is Your MVP: To make this play, your health insurance premiums need to be part of your W-2 lineup. It’s crucial for making sure your premiums are in the right tax position. 4. FICA Tax Breakaway: By including these premiums in your W-2, you’re breaking away from FICA taxes, which means more savings in your pocket. 5. Steer Clear of Fouls: Missing the mark on how you deduct health insurance premiums can draw the wrong kind of attention from the IRS. Keep it clean to avoid audits. 6. Open to All, But Watch the Playbook: Every S-Corp owner has a shot at this, but there are rules and exceptions to navigate to make sure you’re in bounds. 7. Team Coverage Slam Dunk: This strategy isn’t just for you; it covers your spouse and kids under your plan, multiplying the savings. 8. Benchwarmers: If you’ve got another health insurance play through another employer (like your spouse’s game plan), you might be sitting this one out. 9. Last-Minute Layups: Forgot to include premiums in your payroll? There’s still time for a catch-up adjustment within the tax year, so you don’t miss those savings. 10. Consistent Game Plan: To keep the scoreboard ticking in your favor, include health insurance premiums in each paycheck for accurate W-2 reporting. Key Takeaways:

Why Catching Up with Your CPA Regularly is a Game-Changer for Your Wallet 💼

Hey there, fellow entrepreneurs! If you’re only hitting up your CPA when the tax man comes knocking, you might be missing out on a treasure trove of savings and financial wizardry. Let’s dive into why making your CPA your BFF (at least financially speaking) all year round is a smart move for your business’s wallet. 1. Kicking Off a New Venture or Side Gig Got a brilliant idea brewing? Before you set the world on fire with your startup or side hustle, loop in your CPA. From getting your books straight to snagging every deduction possible, early advice is golden. Avoid the classic no-nos like mixing personal and business funds or overlooking juicy deductions by keeping your CPA in the know. 2. Changes in Your Personal Saga (Marriage, Divorce, or Calling It Quits) Life’s big moments don’t just fill your photo albums; they can shake up your taxes too. Whether you’re tying the knot, signing divorce papers, or just need to update your status, a heads-up to your CPA can unlock some serious tax perks. 3. Plunging into Other Ventures All investments aren’t viewed the same through the tax lens. Dropping some cash into a small business or partnership? That’s going to tweak your tax scene. Keep your CPA on speed dial to navigate these waters smoothly. 4. Expanding Your Family Tree Welcoming a new bundle of joy? Beyond the sleepless nights, there’s some financial sunshine – tax credits! Make sure your CPA knows about your newest family member to cash in on credits like the child tax credit or the dependent care credit. 5. Borrowing Some Dough Whether it’s for personal use or fueling your business dreams, the way you structure a loan can have big tax implications. A chat with your CPA before you sign on the dotted line can save you a headache (and some cash) later on. 6. Diving into Real Estate Whether you’re buying, selling, or investing in real estate, it’s a whole different ballgame tax-wise. Partner with a CPA who knows their way around property deals to make the most of your investment. The Bottom Line: It’s All About Staying Connected 📞 Building a proactive partnership with your CPA can seriously level up your financial game. Regular check-ins mean you’re always ready to pivot, plan, and pocket more savings and growth opportunities. On the hunt for a CPA who’s in it for more than just the annual tax tango? At Chery CPA Firm, we’re all about walking this financial journey with you every step of the way. Hit us up to discover how we can help your business thrive and keep your finances in tip-top shape.