IRS Penalties for Late Payments and Underpayments: A Comprehensive Guide for 2025

The Internal Revenue Service penalties for late payments and underpayments have significant financial implications for taxpayers who fail to meet their obligations in 2025. These penalties serve as incentives for timely tax compliance but can substantially increase tax liabilities when not properly managed. With the standard late payment penalty set at 0.5% per month (capped at 25%), and underpayment interest accruing at 7% annually compounded daily, understanding the nuances of these penalties has become essential for effective financial planning. This article explores the complex structures of IRS penalties, highlighting critical differences between various types of penalties, providing strategies for compliance, and examining special cases where penalties may be reduced or avoided. Whether you’re a business owner, independent contractor, or individual taxpayer, this comprehensive guide will equip you with the knowledge needed to navigate tax regulations effectively and minimize unnecessary financial burdens.

Understanding IRS Late Payment Penalties

Navigating Underpayment Penalties

While late payment penalties apply after tax deadlines pass, underpayment penalties occur when you haven’t paid enough tax throughout the year. The IRS requires taxpayers to pay taxes as income is earned through withholding or quarterly estimated payments. Failing to do so triggers underpayment penalties, which differ significantly from late payment penalties in both calculation and application.

For 2025, underpayment penalties accrue at a 7% annual interest rate compounded daily [Source: IRS]. This seemingly modest rate can accumulate substantially due to daily compounding. For example, a $5,000 underpayment over six months would result in approximately $175 in penalties. The compounding nature means larger underpayments and longer durations create exponentially increasing penalties.

To avoid these penalties, the IRS offers several “safe harbor” provisions. Meeting any one of these requirements exempts you from underpayment penalties:

- Pay at least 90% of your current year’s tax liability through withholding or estimated payments [Source: JSM & Associates]

- Pay 100% of your previous year’s tax liability (110% if your adjusted gross income exceeded $150,000) [Source: H&R Block]

- Owe less than $1,000 in tax after subtracting withholdings and credits [Source: Papaya Global]

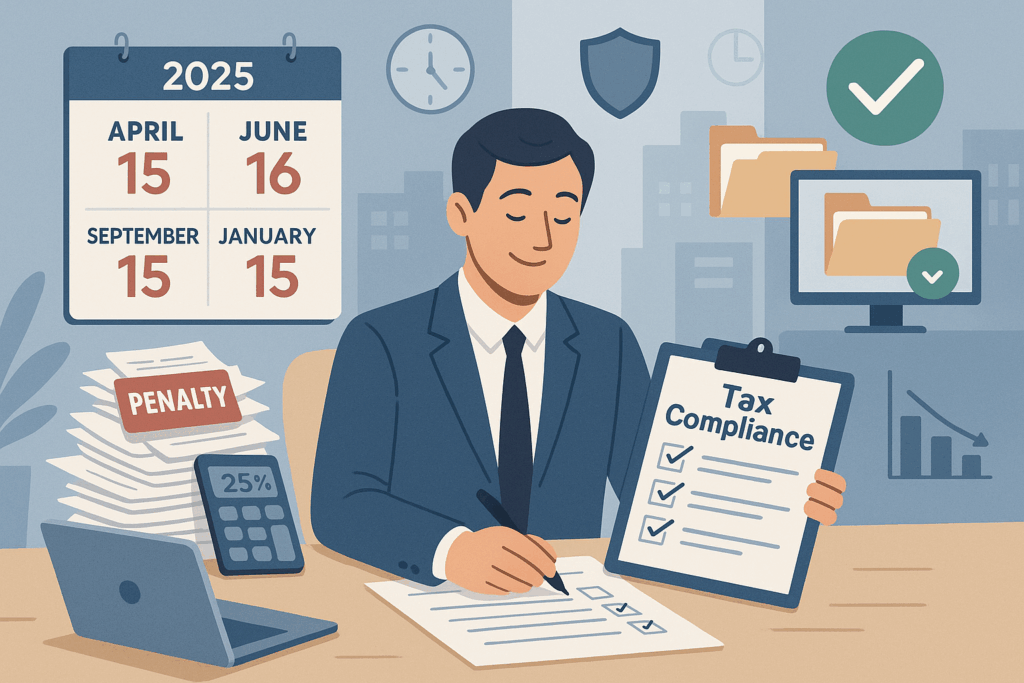

The 2025 quarterly estimated tax payment schedule follows specific deadlines:

- First quarter (January 1-March 31): Due April 15, 2025

- Second quarter (April 1-May 31): Due June 16, 2025

- Third quarter (June 1-August 31): Due September 15, 2025

- Fourth quarter (September 1-December 31): Due January 15, 2026

[Source: Kiplinger]

Missing these deadlines triggers penalties for each quarter’s underpayment, calculated from the due date until the payment date or the following April 15, whichever comes first.

For taxpayers with irregular income patterns, the IRS offers the annualized income installment method. This approach, documented on Form 2210 Schedule AI, allows taxpayers to make uneven quarterly payments based on actual income received in each period [Source: Investopedia]. This method particularly benefits:

- Self-employed individuals with fluctuating income

- Seasonal workers with concentrated earning periods

- Retirees with irregular investment distributions

- Anyone with significant income variability throughout the year

Form 2210 (Underpayment of Estimated Tax) serves as the primary document for calculating these penalties. While the IRS typically computes the penalty automatically, filing Form 2210 allows taxpayers to request waivers or use the annualized income method to potentially reduce penalties [Source: IRS].

Different taxpayer categories require tailored strategies to manage underpayment risks. For W-2 employees with substantial side income, adjusting withholding on their primary job can compensate for tax obligations from secondary earnings. Those earning over $150,000 annually must remember the elevated 110% prior-year threshold for safe harbor protection [Source: JSM & Associates].

Special Cases and Filing Extensions

Filing extensions provide crucial flexibility for taxpayers, but understanding their limitations is essential. When you file Form 4868 before the April 15, 2025 deadline, you gain additional time to file your return (until October 15, 2025) but not additional time to pay taxes owed [Source: Boston 25 News]. This distinction is critical since penalties and interest on unpaid taxes begin accruing from the original due date regardless of extensions.

Three approved methods exist for requesting an extension: using IRS Free File on IRS.gov, making an electronic payment while selecting “extension” as the payment reason (keep your confirmation number), or mailing Form 4868 to the appropriate IRS address [Source: IRS]. To avoid penalties, pay at least 90% of taxes owed by April 15, even when requesting an extension.

Several special circumstances may qualify for automatic penalty relief. Taxpayers affected by federally declared disasters receive automatic extensions for both filing and payment deadlines. For example, those affected by Oklahoma wildfires beginning March 14, 2025, have until November 3, 2025, to file returns and make payments [Source: IRS]. This relief applies automatically to those with an IRS address in the disaster area.

Military personnel serving in combat zones receive significant extensions beyond standard provisions. These taxpayers qualify for an automatic 180-day extension beginning upon leaving the eligible area or hospital discharge [Source: TurboTax]. The calculation becomes even more favorable when adding unused filing days prior to deployment. For example, leaving a combat zone on April 1 (15 days before the deadline) grants a 195-day extension. These extensions also apply to spouses and dependents, even when filing separately.

U.S. taxpayers living abroad automatically receive a two-month extension to June 16, 2025 (pushed from June 15 due to the weekend) [Source: IRS]. If additional time is needed, they can request a secondary extension to October 15, 2025, through Form 4868 or electronic filing methods. However, payment remains due by April 15 to avoid interest and late payment penalties of 0.5% per month.

Extension requirements differ significantly between federal and state taxes. While a federal extension via Form 4868 provides six months to file, state extension processes vary widely [Source: TurboTax]. Some states (like Wisconsin, Alabama, and California) grant automatic extensions without requiring forms, while others (including Maryland and New York) require state-specific extension forms. Always verify your state’s specific requirements, as federal extensions don’t automatically apply to state taxes.

For deceased taxpayers, filing obligations continue. The IRS requires a final individual tax return (Form 1040 or 1040-SR) for the year of death, typically handled by surviving spouses or personal representatives [Source: IRS]. For taxpayers who died in 2024, the filing deadline is April 15, 2025, unless an extension is requested. If a refund is due and the filer isn’t the surviving spouse, Form 1310 must be included to claim the refund legally.

The IRS Fresh Start program offers installment agreements for taxpayers owing up to $50,000, allowing payment plans up to 72 months with reduced documentation requirements [Source: Legacy Tax Resolution Services]. These agreements can prevent further collection notices and reduce the late payment penalty rate from 0.5% to 0.25% monthly. Understanding the IRS notice progression is also important – starting with CP14 (initial balance due), followed by CP501 (first reminder), CP503 (second reminder), and CP504 (final notice threatening levies) [Source: WizTax].

Proper documentation is crucial when dealing with special circumstances. Maintain secure digital copies of all tax documents using cloud storage or encrypted USB drives, with physical originals stored in fireproof containers [Source: IRS]. For disaster-related issues, document assets with photos or videos and know that the IRS Special Services Hotline (866-562-5227) can provide specialized assistance.

By understanding these special cases and filing extension options, taxpayers can navigate complex situations while minimizing penalties. Remember that timely communication with the IRS, proper documentation, and understanding the distinction between filing and payment deadlines are essential strategies for successfully managing these scenarios.

Strategic Planning and Future Considerations

In navigating IRS penalties, proactive strategies prove crucial for minimizing financial risk. Implementing robust recordkeeping systems forms the foundation of tax compliance, with AI-driven accounting tools offering automated transaction categorization and reconciliation capabilities [Source: Tax Resolution Accounting]. Quarterly tax reviews should focus on reconciling all income sources, validating business expense claims, and reviewing partnership basis calculations to preempt IRS scrutiny.

For self-employed individuals, maintaining separate business accounts represents a critical compliance step, clearly distinguishing personal and business finances while simplifying expense tracking and tax reporting [Source: IE Tax Attorney]. High-income earners should leverage tax-loss harvesting opportunities to offset capital gains while exploring Qualified Charitable Distributions to satisfy Required Minimum Distribution (RMD) obligations without increasing taxable income [Source: RCS Planning].

Retirees must carefully navigate RMD requirements by December 31st to avoid the substantial 25% penalty, while considering Roth conversions for creating tax-free legacy assets [Source: RCS Planning]. These targeted strategies address the specific compliance challenges each taxpayer category faces.

The evolving enforcement landscape shows the IRS intensifying audit rates for specific groups, with projections indicating high-income filers (earning over $10M) will see audit rates rise from 11% in 2019 to 16.5% by 2026 [Source: Taxes for Expats]. Enhanced information matching capabilities now leverage third-party reporting from cryptocurrency exchanges and payment processors, enabling real-time verification against tax filings [Source: Oklahoma Tax Relief].

Significant legislative changes loom on the horizon. The One Big Beautiful Bill (OBBB) aims to preserve core Tax Cuts and Jobs Act components while introducing substantial international tax modifications, including raising FDII rates to 33.34%, GILTI to 40%, and BEAT to 10.5% [Source: BIPC]. New cryptocurrency reporting requirements implemented through Form 1099-DA will standardize brokerage reporting for digital assets beginning January 1, 2025, requiring taxpayers to shift to wallet-by-wallet accounting methods for accurately tracking cost basis [Source: Gordon Law].

Technological solutions offer promising avenues for maintaining compliance. AI-powered tax platforms like Sphere now analyze global tax codes to automate calculations across jurisdictions while reducing errors by 40% compared to manual methods [Source: OpenLedger]. The IRS has expanded its Digital Free File program, allowing taxpayers in 25 states to submit federal returns directly through the IRS portal with AI-driven chatbots handling millions of inquiries annually [Source: FileLater].

For effective compliance planning, mark these critical dates: quarterly estimated payments (April 15, June 15, September 15, 2025, and January 15, 2026); filing deadlines for individuals and C corporations (April 15, 2025); and partnership/S corporation returns (March 17, 2025). Extension requests provide additional time—until September 15 for partnerships and S corporations and October 15 for individuals and C corporations [Source: Bench].

Conclusion

Understanding IRS late payment and underpayment penalties is vital for maintaining tax compliance and avoiding significant financial setbacks. The structured nature of these penalties—from the standard 0.5% monthly late payment fee to the 7% annually compounded interest for underpayments—creates a system that progressively increases the burden on non-compliant taxpayers. By implementing proactive strategies such as adhering to safe harbor provisions, utilizing payment installment agreements, properly filing extensions, and maintaining accurate tax records, taxpayers can significantly reduce their exposure to penalties. Additionally, staying informed about legislative changes affecting tax policies ensures adaptation to evolving regulations. While the complexity of tax penalties may seem overwhelming, the guidance provided in this article serves as a roadmap for navigating these challenges. Remember that timely compliance and strategic planning remain the most effective tools for avoiding unnecessary costs and maintaining a healthy relationship with tax authorities in 2025 and beyond.

Sources

- Ambrook – Form 2210-F

- Bench – Federal Tax Prep Calendar

- BIPC – One Big, Beautiful Bill . . . Simplified

- B&S Advisors – Navigating the Complexities of Estimated Tax Payments to Avoid Underpayment Penalties

- Boston 25 News – How To File Tax Extension 2025 Step By Step Instructions

- FileLater – Tax Preparation in 2025: Embracing Tax Technology and AI Innovations

- Gordon Law – Crypto Taxes: How to Report

- HelloBonsai – Tax Underpayment Penalty

- H&R Block – Avoiding Underpayment Tax Penalty

- IE Tax Attorney – Tax Tips for Filing in 2025

- Inkle – IRS Annualized Income Installment Method

- Investopedia – Estimated Tax Deadlines 2016

- Investopedia – Annualized Income Installment Method

- IRS – Business Owners Make Sure Emergency Preparedness Plans Include Financial Records

- IRS – Filing A Final Federal Tax Return For Someone Who Has Died

- IRS – IRS Announces Tax Relief For Taxpayers Impacted By Wildfires And Straight Line Winds In Oklahoma Various Deadlines Postponed To Nov 3

- IRS – IRS Need More Time To File Request An Extension

- IRS – Interest Rates Remain the Same for the Second Quarter of 2025

- IRS Publication 505

- IRS Form 2210

- IRS – Instructions for Form 2210

- IRS – US Taxpayers Living Working Abroad Must File 2024 Tax Return By June 16 Deadline

- JGR Financial – Avoid Underpayment Tax Penalties

- JSM & Associates – Avoiding IRS Underpayment Penalties

- Kiplinger – When Estimated Tax Payments Due

- Legacy Tax Resolution Services – IRS Fresh Start Installment Agreement How To Change IRS Payment Plan How To Apply For Payment Plan With IRS

- Oklahoma Tax Relief – 7 IRS Enforcement Priorities Heading into 2025

- OpenLedger – AI Estimated Tax Filing: A Guide for Taxpayers in 2025

- Papaya Global – Tax Underpayment Penalty

- RCS Planning – Required Minimum Distributions

- SmartAsset – Tax Underpayment Penalty

- Taxes for Expats – Who is Likely to be Targeted for an IRS Audit

- Tax Resolution Accounting – How the IRS is Cracking Down in 2025: What Taxpayers Need to Know

- TurboTax – Guide to IRS Tax Penalties: How to Avoid or Reduce Them

- TurboTax – Tax Return Filing And Payment Extensions For The Military

- TurboTax – How To File For An Extension Of State Taxes

- WizTax – IRS Balance Due Notices