Deciding to add your spouse to your business payroll isn’t just a “yes or no” question—it’s a journey through the financial and tax jungle that could impact your pocket and peace of mind. Let’s dive into the nitty-gritty, debunk some myths, and shine a light on what married business moguls need to consider.

Understanding Social Security Benefits

- Here’s a fun fact: Your spouse can tap into Social Security benefits based on your earnings, even if they’ve never worked a day in their life. So, adding them to the payroll just for Social Security might be like buying a ticket to a show they’re already in. 🎟️

The Costs of Payroll Inclusion

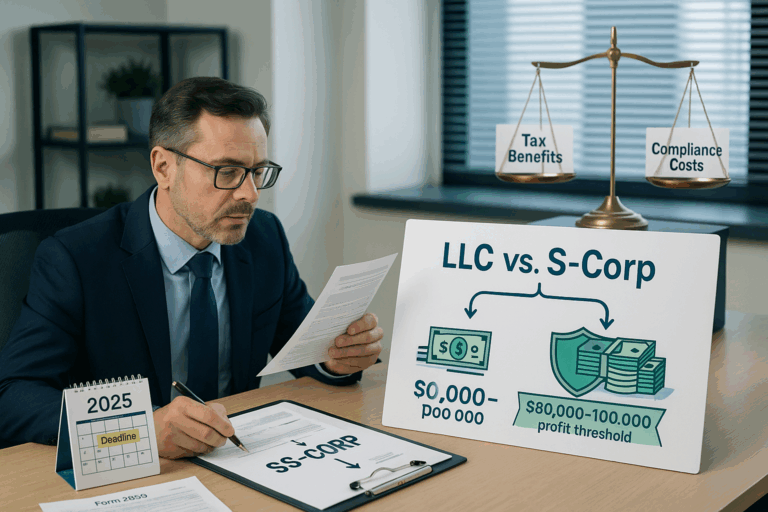

- Bringing your spouse onto the business’s payroll means welcoming FICA, Medicare, and maybe even unemployment taxes into your life. Sometimes, these costs can make you wonder if the juice is worth the squeeze when it comes to shifting income within your household.

Alternative Compensation Strategies

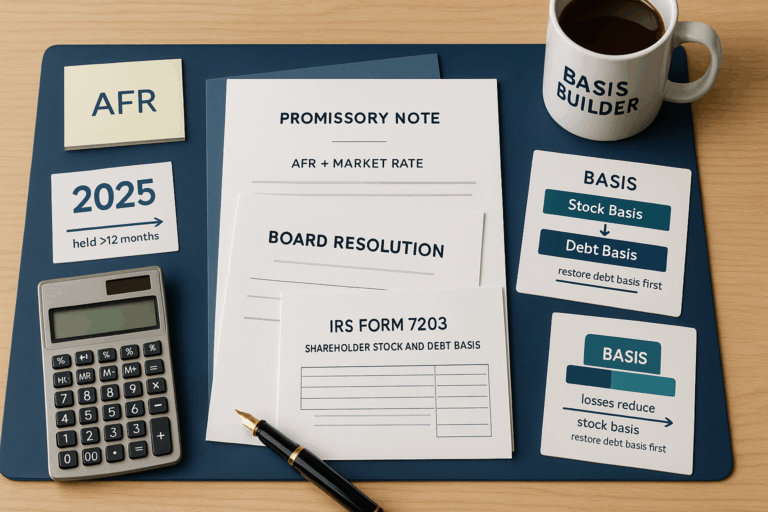

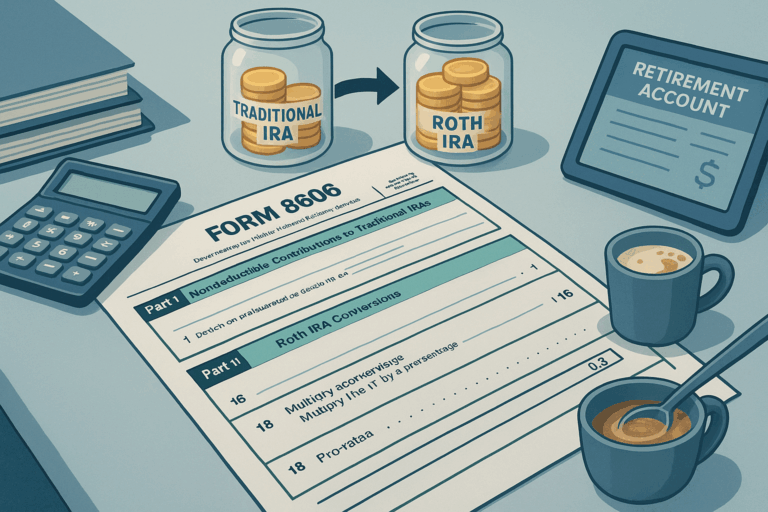

- There are more ways to compensate your spouse without getting tangled in payroll taxes. Think roles on the board of directors or advisors, direct profit draws, or even Roth IRA contributions under the spousal rule. It’s like finding a secret passage that bypasses the tax troll. 🚪

Retirement Planning Opportunities

- If your spouse is on the payroll, you’re looking at a golden ticket to retirement savings city, especially with Solo 401(k) plans. Plus, spreading your investments beyond the business through retirement accounts is like having an emergency parachute—it’s smart to have, just in case. 🪂

Healthcare and Participation Considerations

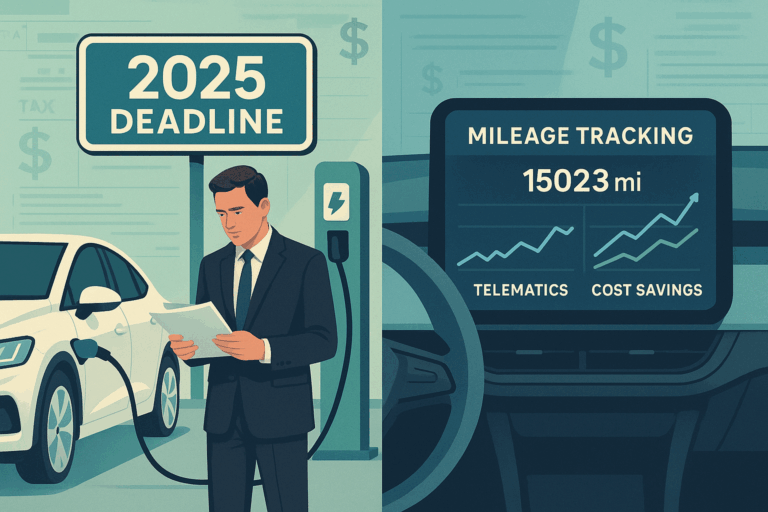

- Sometimes, you might need to add your spouse to the payroll for specific reasons, like Health Reimbursement Arrangements (HRAs) or proving their involvement in the business for tax breaks. These scenarios need a magnifying glass to ensure you’re making the best move. 🔍

Key Takeaways:

- Adding your spouse to payroll is a big decision with lots of costs and not-so-obvious benefits.

- Spouses not working can still enjoy Social Security benefits, so no need to add them just for that.

- Look into non-payroll ways to compensate your spouse—keep it beneficial without the tax headache.

- Payroll can be a gateway to beefing up those retirement savings, making it worth considering for the long haul.

- Diversifying with retirement savings is crucial for keeping your financial health in tip-top shape outside of your business.

Before you jump into any decisions, having a chat with a tax pro can give you the tailored advice you need. Here at Chery CPA PLLC, we’re all about helping you make the smartest moves for your business and family. Let’s make sure you’re set up for success, shall we?

#SmartBusinessDecisions 🧠 #TaxStrategyTips 💰 #MarriedEntrepreneurLife 💍 #RetirementPlanning 🌅 #SeekExpertAdvice 🤝